County Commissioners are waking up to the fact that the loss of quality instructional time costs money. On Wednesday, Commissioner Michael Whaley stated in Education Committee, while referencing a World Bank article, that due to COVID, loss of quality instructional time will cost $10 trillion around the world.

But unfortunately, due to the local Memphis investigative news and public measurement blackout, Commissioners have no idea how much it costs when the idiots from Memphis Tomorrow botch the workforce development system.

First, lets reference the World Bank article. The article states:

Without remedial action when students start returning to school, a new World Bank report estimates a loss of $10 trillion dollars in earnings over time for this generation of students, and countries will be driven off-track to achieving their Learning Poverty goals.

Now, to locally contextualize $10 trillion, lets equate the cost to Shelby County, using its population of 950K and world population of 7.8B. Based on the article, the credible cost estimate to Memphis/Shelby will be $1.2B in wages and $36M in lost Memphis/Shelby tax revenue over a generation of 20 years. At the same time, using highly conservative estimates, the cost of the local disconnected workforce development is more that 5 times more !

Analysis

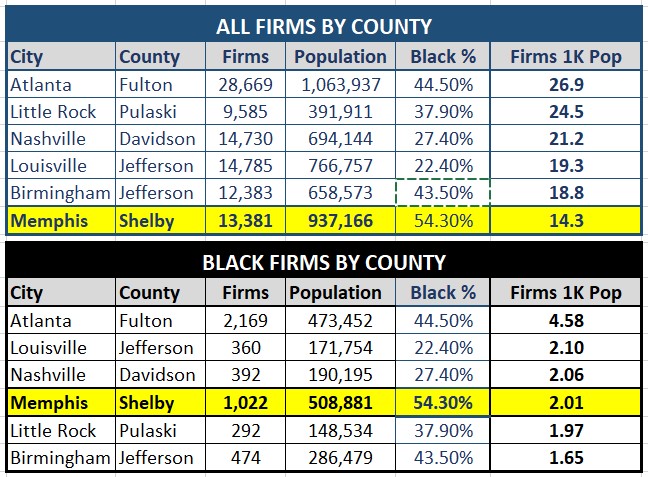

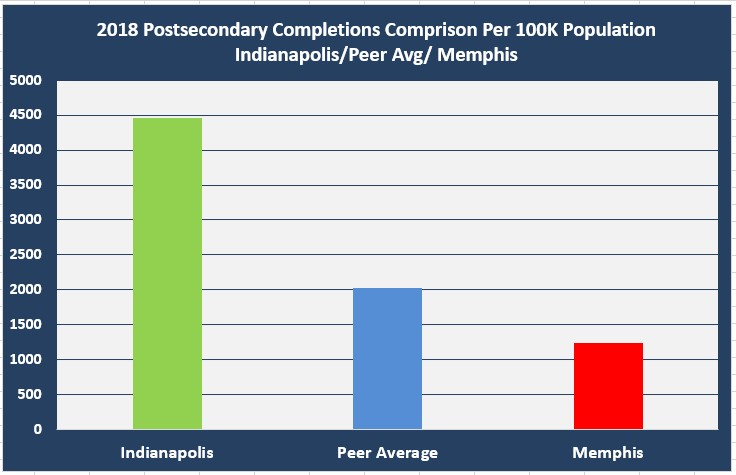

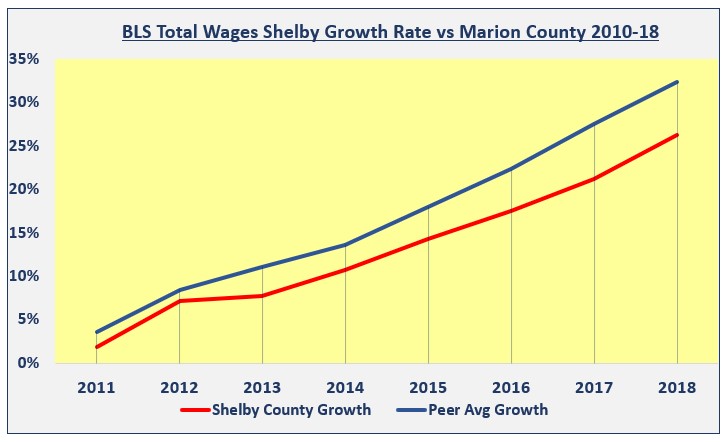

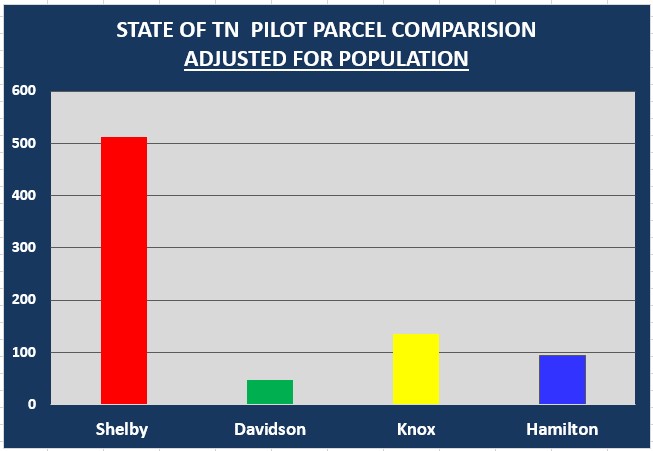

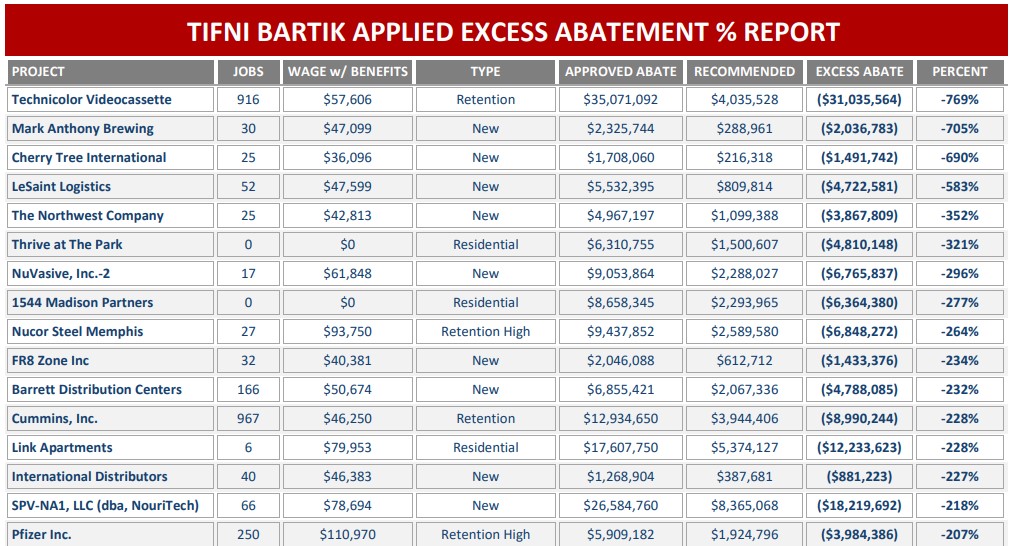

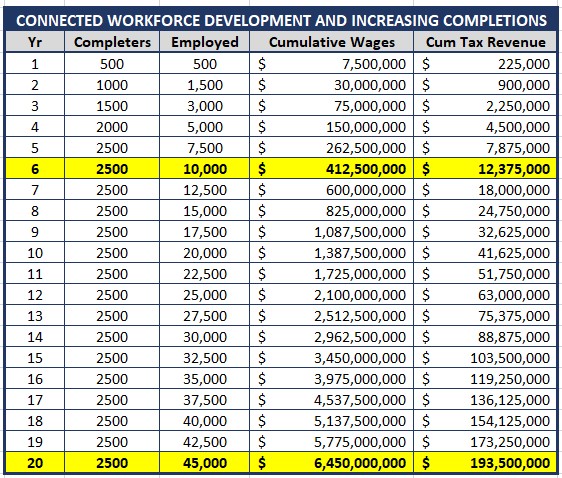

One can blow up the numbers to say what they want. Given that, the following is a highly conservative analysis. First lets state a few facts. When adjusted for population and using pre-COVID data, Shelby County’s post secondary completions trail the average of their peers by about 6k per year and local annual employment gains trail by approximately .5% or 2,500 filled jobs resulting in a 20,000 filled job deficit since 2010.

This analysis uses a connected workforce development system to conservatively increase post-secondary completions, to fill the employment gap by 2,500. The analysis is conservative because, after the employment gain of 2,500 is achieved in year 5, it is held constant over the generational term.

In this model, completions are increased by 500 per year with accompanying annual wage increases of $15k that comes with a completion. Over 20 years, annual wages cumulatively increase by $6.6B and local tax revenue by $194M due to a connected workforce development system. Based on the World Bank article, COVID costs are $1.2B in wages with tax revenue losses of $36M or 5x less than that of a disconnected workforce development system.

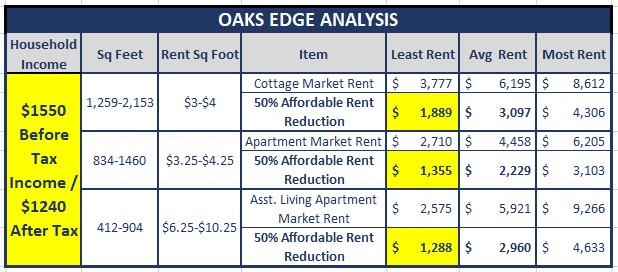

See conservative analysis below:

Currently, Shelby County is in year 6 of a sabotaged workforce development system with disconnected conditions persisting. The current annual cost of that disconnect, highlighted above and independent of COVID, is 10,000 filled jobs, $413M in deficient wages and $12M in deficient local tax revenues from a disconnected workforce development system.

With no multipliers used, this is a conservative analysis and the modeled results, when converged with Bureau of Labor and Statistics data, are credible. In year 6, the modeled results show a disconnected workforce development system accounting for 50% or a deficit of 10,000 filled jobs against a 20,000 filled jobs deficit since 2010 when compared to the peer growth average.

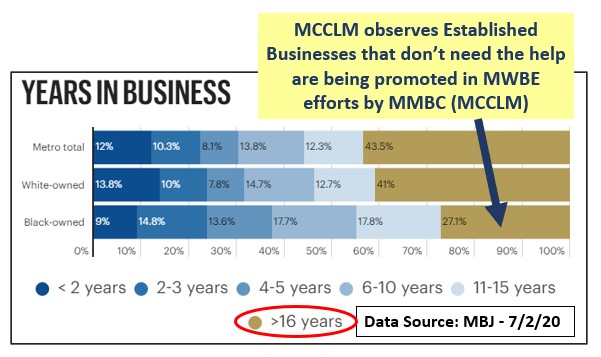

The remaining 10,000 filled job deficit can easily be accounted for based on a culturally unsupported and stifled small business sector. The local economic development challenge is rooted in workforce and small business.

Conclusion

COVID was/is out of everyone’s control. But the botched workforce development system, was and is an expensive and costly self-inflicted wound by the elitist Memphis Tomorrow idiots….