SHAM PROCESS: No to Chamber $300K for Workforce

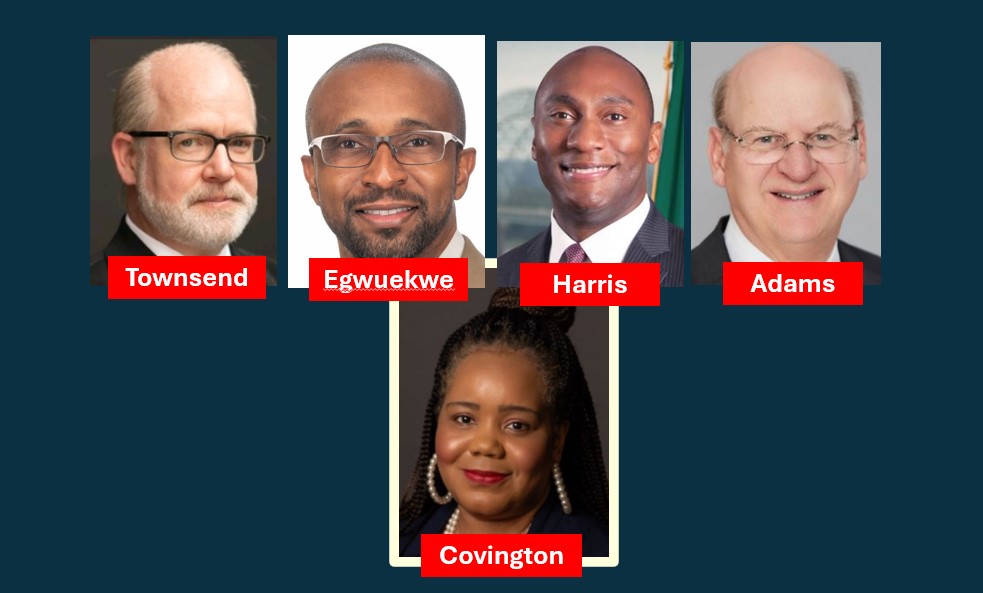

Public workforce development is not working under the Greater Memphis Chamber’s fiscal agent administration. In a sham process, Amber Covington was terminated as Executive Director of the Greater Memphis Workforce Development Board (GMWDB).

A sham because, per Daily Memphian reporting, only 6 board members voted for termination, 2 against, with 4 abstaining. But per the GMWDB website, there are 24 board members! Did GMWDB even have a quorum for their sham meeting? And it seems it would take a majority of the body or 13 votes for a termination decision of this magnitude.

Meka Egwuekwe GMWDB Board Chair voted for termination after Mayor Lee Harris had asked for Covington’s resignation. But why was Covington asked to resign and then terminated? And why did Mayor Lee Harris assign responsibility to the Greater Memphis Chamber for distributing federal Workforce Investment Opportunity Act (WIOA) dollars? After all, the Chamber is a business association not a workforce development organization.

Perhaps Mayor Harris made the Chamber assignment because the County Commission workforce development committee hardly meets, and the Commission is not in the business of overseeing the public’s matters. Regardless, it was a bad Mayoral assignment because the Chamber has been close to multiple workforce disasters to include WIN, GMACW, Upskill 901 and Workforce Mid-South.

Chamber CEO, Ted Townsend called the partnership with the County “unparalleled.” Right, no one else is doing it because Chambers are not equipped to be workforce development agencies. And is anyone at all asking about the Chamber’s Accelerated Skills Center announced almost a year ago? Is the Center anywhere close to being opened on schedule?

CHAMBER WANTS $300K

Meanwhile, the Chamber is asking for $300K from the County to support their beleaguered workforce development efforts. Representing the Harris Administration in County Commission Budget Committee, Dominique McKinney said the Administration was supporting the $300K appropriation to “deepen” the public’s partnership with the Chamber. But why with sham processes, other workforce failures and doesn’t WIOA funds include administrative support costs? No way should the County Commission approve $300K for the Chamber.

But back to Covington. per Covington’s LinkedIn profile, both the Chamber and GMWDB had sufficient information about Covington before she was approved as the permanent Executive Director for GMWDB. Throughout Covington’s tenure as Executive Director of GMWDB, she maintained a Chamber email address as the primary contact for the GMWDB.

Covington had worked as the Chamber’s Director of Workforce Development for 1 yr and 5 months. Then the GWWDB Board appointed her as their interim Executive Director for 6 months and then approved her as permanent Executive Director to only terminate her in a sham process 7 months later?

Something is not adding up, with Covington accompanied by her attorney not allowed a public hearing, after the board met privately before the termination vote. What a sham! There are real process problems here if not outright bullying.

NEXT

The Chamber has now appointed Sandra Howell to be interim Executive Director of the GMWDB. But Howell was deeply involved with the failed UpSkill901 initiative. That is not against Howell as much against the Chamber itself, having been so close over the years to multiple workforce development failures.

Attorney Ben Adams is slated to become the next Chair of the GMWDB, while saying the workforce regulatory environment is fuzzy. That doesn’t sound hopeful. Adams also serves on Greater Memphis Chamber’s Board of Directors Executive Committee. Again, another bad sign.

REJECT $300K APPROPRIATION!

The County Commission should reject approving $300K for the Chamber even if it means sending the money back to the federal government. This is one “partnership” that should not be deepened but immediately ended.

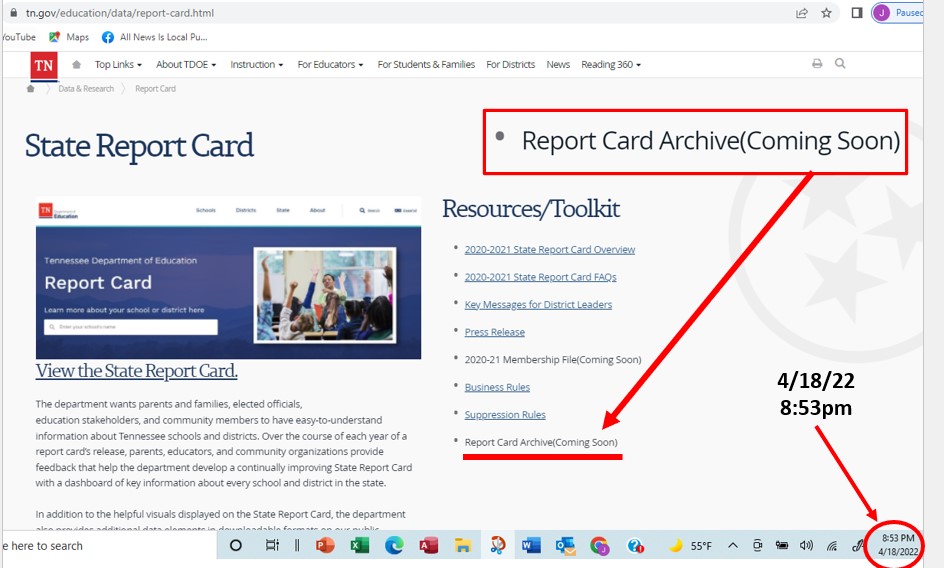

TN Report Card Archive

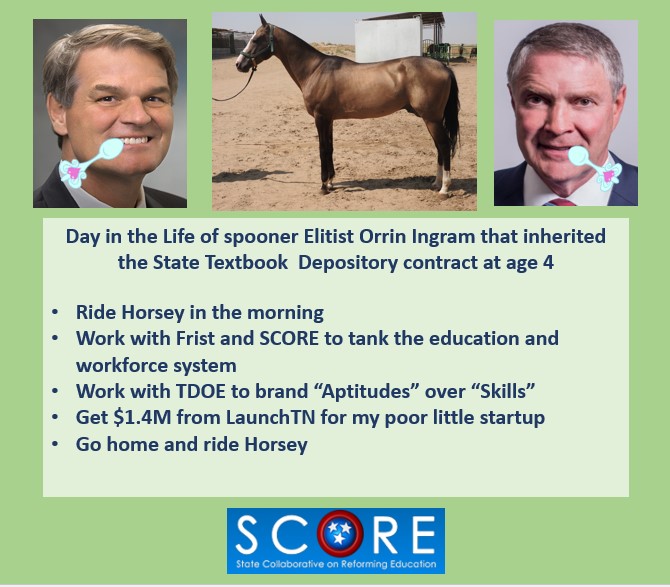

INGRAM: Day in the Life

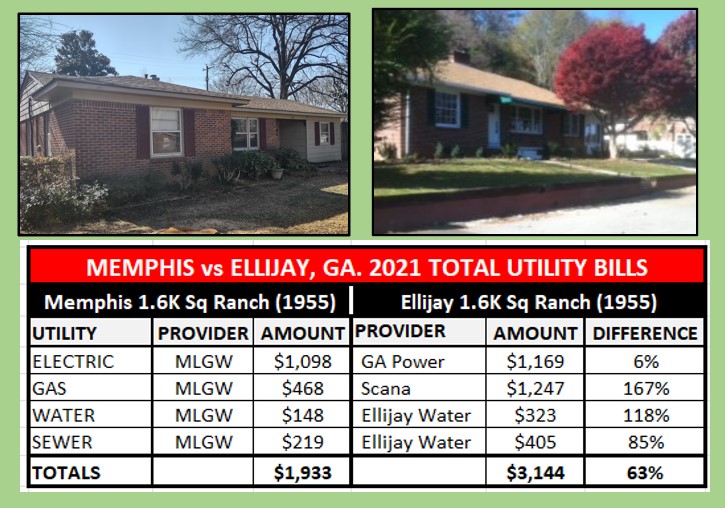

UTILITY BILL COMPARISON

FORD: Don’t Get The Memphis Benefit

With all of the Greater Memphis Chamber celebration, one would think that the Ford plant was locating in Shelby County. But it’s not. The Ford plant will be located 50 minutes away in Stanton, Haywood Couty, TN.

Meanwhile, discussions are beginning to occur about light rail from Memphis to Stanton to facilitate workforce transportation. But wouldn’t such light rail just be a temporary need? Won’t those Memphis workers just move closer to Stanton once they sustain higher incomes for a time?

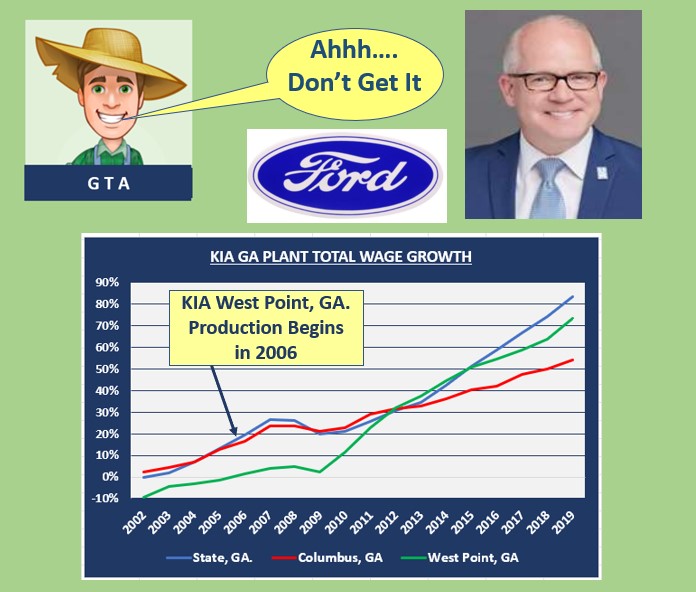

At this point, based on the above logic, I just don’t get the benefit of the Ford plant for the City of Memphis. So, I looked into it further based on a similar plant deployment with Kia in West Point, Troup County, GA and near the larger population center of Columbus, Muscogee County, GA.

Kia opened in 2006 in West Point, GA and employs approximately 2,700. Ford will employ 6,000 drawing from a larger population base in Shelby County than what exists in this particular Georgia region. Given the population of the TN and GA regions, a proportional similarity exists between respective projected occupational demands and regional populations in both TN and GA.

To that extent, the following observations can be made from the BLS sourced data chart above regarding the Kia economic impact on County total wage growth. In this example, West Point’s Troup County is Haywood County, Columbus’ Muscogee County is Shelby County and Georgia is Tennessee. See below:

In 2006, when Kia production started, West Point, GA’s’ Troup County (Green) emerged from negative total wage growth when benchmarked against 2001 total wages.

In 2006, the population center of the region in Columbus GA’s Muscogee County (Orange) growth accelerated briefly only to fall off at the beginning of the great recession along with the State of Georgia (Blue) and Troup County, GA (Green).

In 2009, when visibility began to clear from the great recession, Muscogee County’s percentatge total wage growth exceed the State of GA, while Troup County’s percentage total wage growth exceeded both the State and Muscogee County. In this way, Troup County’s percentage growth overperformance is expected and unsurprising given the new Kia plant location in Troup County.

In 2012, Troup County’s total wage growth sustained exceeding the percentage wage growth of Muscogee County from 2012-19, while decelerating below the State of GA in 2015 but remaining competitive with the State through 2019

In the end, Columbus GA’s Muscogee County and the population center for the remotely located Kia plant, was not competitive with GA statewide percentage total wage growth. Could this be the future of Memphis and Shelby County with the Ford plant deployment in remotely located Haywood County ?

Here is the question. Is there a Memphis/Shelby County economic development plan at all ? An economic development plan is needed to help insure that Shelby County has competitive percentage total wage growth with that of the State of Tennessee.

Given this need, a Ford plant in Haywood County does not appear to be the answer. The answer is a local economic development plan that emphasizes Memphis and Shelby County small business and workforce development…..

North Mississippi ED Monster

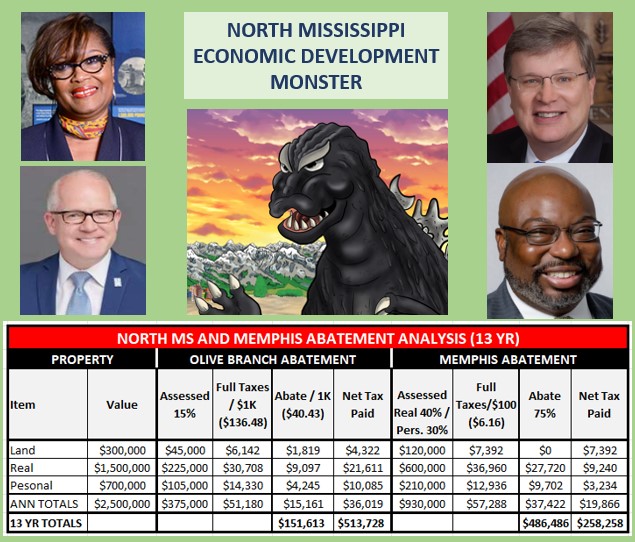

Sparked by this Daily Memphian article, this blog digs into North Mississippi tax incentives, using only the information on the Desoto County Economic Development webpage.

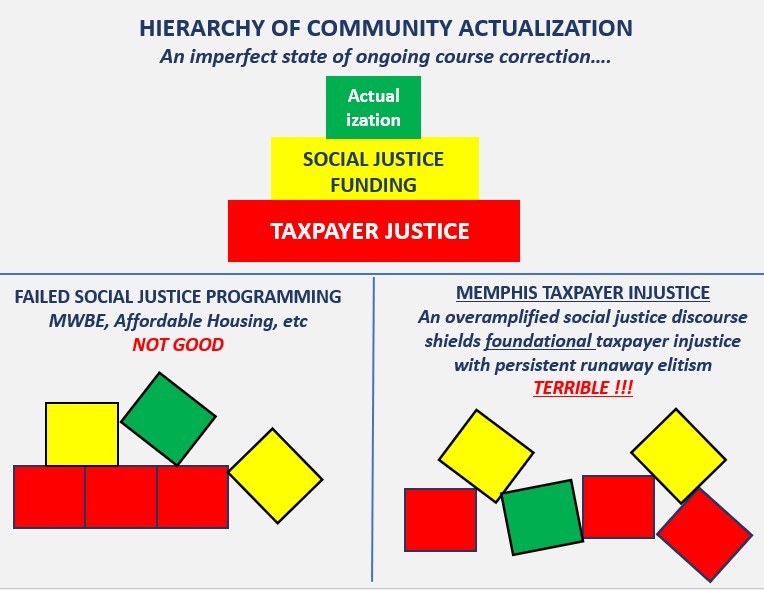

So much has been made of the economic development monster, to the South, in Northern Mississippi. At the same time, several existing local companies have leveraged that scary monster, to garner local tax abatements, also known as a retention payment in lieu of taxes (PILOT).

Retention PILOTs and abating existing real property taxes for low wage jobs is where the excess resides in local job PILOTs. At any rate, the following analysis has been conducted to help inform the local conversation around job PILOTs.

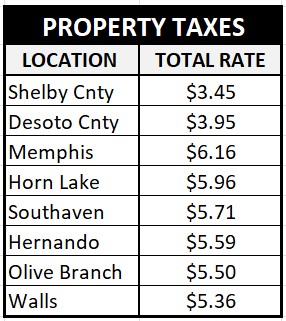

Since taxes are calculated differently in Mississippi than in Tennessee, this analysis standardizes on a grouping of commercial property values taken from this Desoto County Economic Development webpage and pertaining to Olive Branch, MS. The analysis also standardizes on a 13 yr abatement term, as that is the approximate average term for EDGE job PILOTs, when dollar weighted.

As shown in the table above, those property values are $300K in land, $1.5M in a building (real property) and $700K in personal property such as machinery. Using the aforementioned property values, while referencing information found on the Desoto County webpage regarding tax abatements, the above table analysis reveals the following observations:

Over 13 years, Memphis/Shelby County abates $486K, while the new recruited corporation pays $258K in local commercial property taxes.

Over 13 years, Olive Branch/Desoto abates $151K, while the corporation pays $514K in local commercial property taxes.

Memphis/Shelby can provide the same tax liability, as Northern Mississippi abated projects, for new corporate recruitment, by abating 63% for 10 yrs and not 75%. Mississippi limits local tax abatements to 10 yrs.

For retention PILOTs, Memphis/Shelby could have provided existing local corporations, with approximately the same tax liability as Northern Mississippi on unabated projects, with an estimated 25% tax abatement, while also helping corporations avoid relocation costs. Using the numbers above, 10% would have accomplished the previously mentioned goal, but it is assumed that the property tax differential was greater in the past than now. Within job PILOTs, retention PILOTs and abating existing property taxes for low wage jobs is where the incentive excess locally resides.

Corporations with significant personal property investments, may have lower tax liabilities in Tennessee, as Mississippi assesses personal property at approximately 33% more. Please see the personal property full taxes column in the table above.

While it is not part of this analysis, if not exempted, Mississippi taxes finished goods inventory. This puts upward pressure on commercial tax liabilities in Mississippi. Manufacturers appear to have less flexibility, as there appears to be fewer tax exemptions for raw material inventory.

As one can see, there are some structural local tax advantages to operating in Memphis vs Northern Mississippi.

Conclusion

While Mississippi calculates property taxes differently, the above tax rates were converted to Tennessee commercial tax rates based on the commercial property values used above. In this way an apples to apples comparison can occur.

All that to say, more than anything, companies are going to locate where they can find an available site and a community that meets their needs. Tax abatements are just a small portion of the overall decision, which provides no reason to undermine the tax base with excessive tax abatements.

After all, even Mississippi excludes education taxes as well as localities excluding other taxes from their economic development programming…..

NOTE: Only local economic development funded programming was part of this analysis. State economic development programming, that includes income tax rebates in MS., was not part of this analysis. In my opinion, our Tennessee economic developers in Nashville, view no income tax vs income tax rebates to corporations as a net benefit to Tennessee. At worst, I believe it is a wash.