“Repeat after me: Workforce Development is Economic Development” is an article that just appeared in the Daily Herald Business Ledger of suburban Chicago. Authored by Jim Morgan, Vice President of the The Management Association, the article stresses workforce development as paramount in fueling economic growth.

The upper Midwest is especially challenged with an aging population and lack of diversity which threaten area growth. These are challenges not pressing in Memphis with a diverse youthful population as a key economic development asset IF developed.

In the article, Morgan mentions a discussion, five years ago, with a manufacturing CEO that stated, “Talent is my pacing item. Talent, or more accurately the lack of talent, is determining how much product we deliver, how many shifts we employ, and how fast we grow. It is not capital expenditures, financing, transportation, or rules and regulations. It is people.”

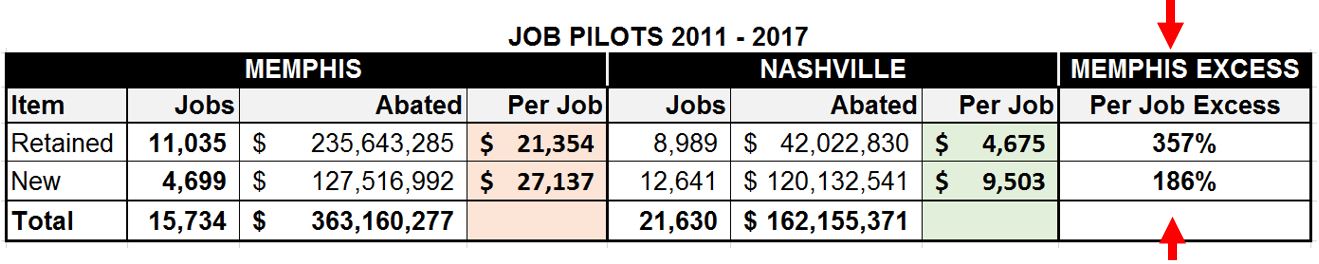

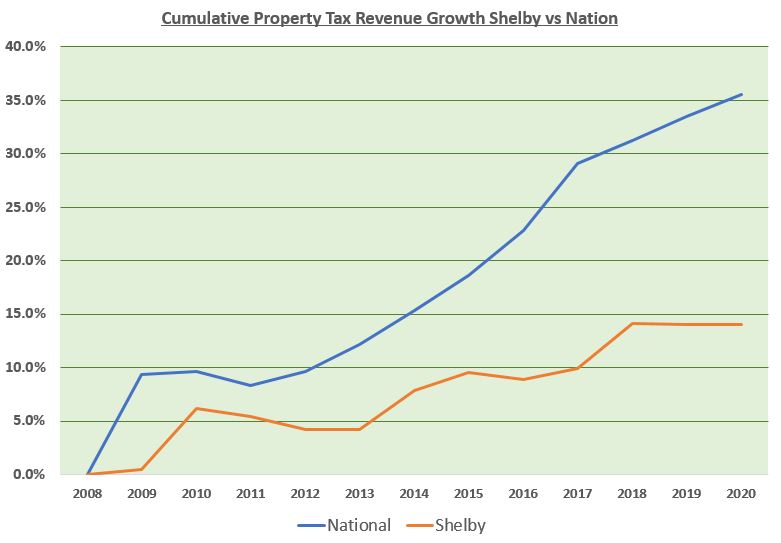

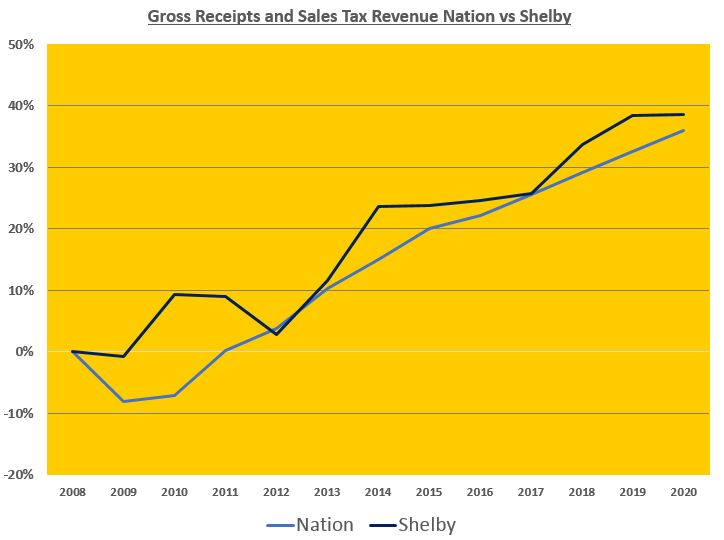

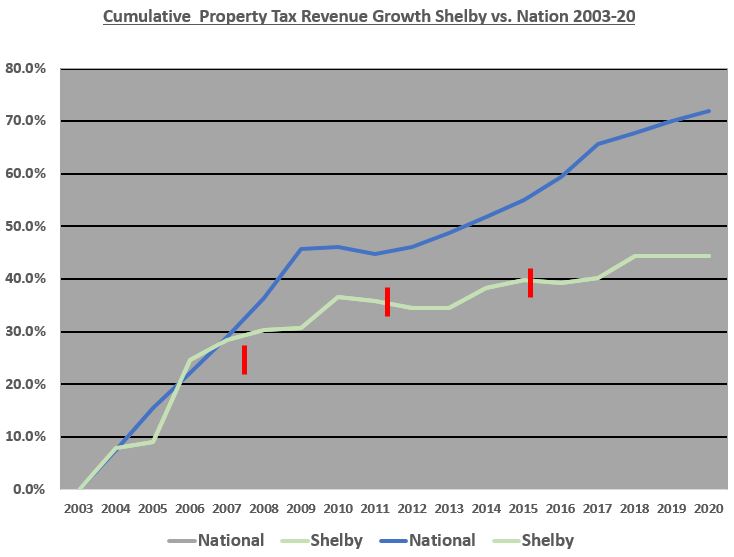

Meanwhile, over the past five years in Memphis, local “Visionaries” went on a bender incenting capital investment in an already low operating cost environment. It resulted in an implementation of corporate socialism that unleashed a brand of fiscal liberalism occurring under the the labels of “government efficiency”, “economic development” and “a better tomorrow for all”.

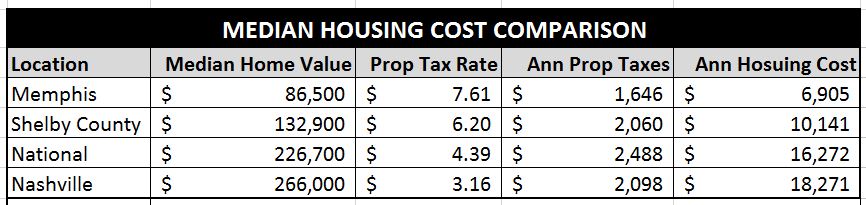

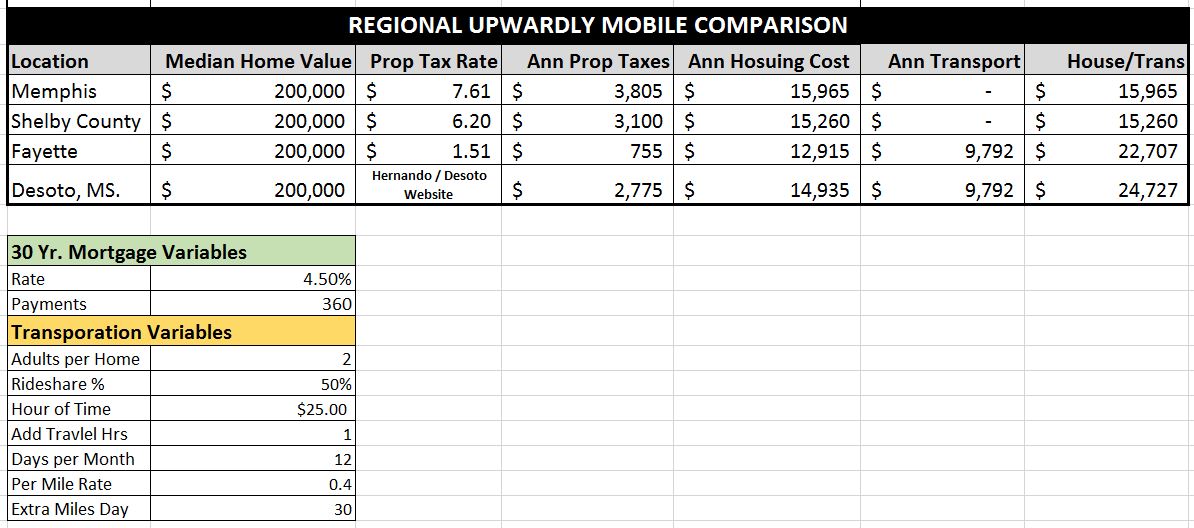

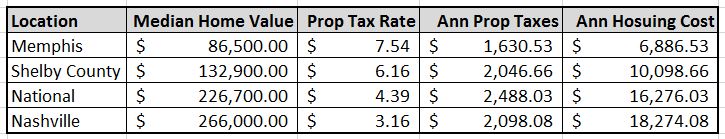

But, operating costs, which includes a high property tax rate, never was the problem. Memphis “visionary” efforts prioritized corporate/real estate development as economic development leaving the key drivers of any local economy in small business and workforce development behind while fending for themselves in a “free market” economy. Such a policy environment has gone only to serve a small few while not serving the overall business community.

Hopefully, priorities and the policy environment are changing under new Chamber leadership and the establishment of The Shelby Regional Economic Development Alliance. Morgan goes on in the article to mention several tactics that employers can use in helping to improve workforce development which, in part, includes: 1) educating students of career opportunities in the region and 2) developing programs to improve education and educating at-risk populations.

Common Language is Fundamental (Data and Assessment)

Common language development is the bedrock of improving workforce development through improved communication and educational programming. Common language enables employer customers of the workforce development system to effectively communicate their workforce development needs with the education/workforce development system within an academic setting. Academic settings are rich with regulatory and academic language often making it difficult for non-academic practitioners to effectively communicate their workforce development needs.

To that extent, common language supports are needed to bridge the language barrier to address workforce needs starting in the academic curriculum while proceeding through the career/vocational and degree programming landscape. Common language supports start with discrete skill employer demand data that gets everyone on the same page regarding in demand skills. This would most cost effectively and expeditiously commence with a publication of authoritative public data. Once the public data is reviewed, any concerns, would inform the targeting and administration of more expensive and laborious data collection through local surveys which may not be necessary with the publication of reputable and authoritative public data.

Next, two forms of assessment would be identified in standardized and diagnostic assessment to further support common language implementation. Standardized assessment would include basic skills (reading, math, and etc.) assessments profiled against occupational requirements to determine student foundational skill readiness and industry certification assessments (which is currently happening) to determine specific vocation readiness for employers. Diagnostic assessments such as interest and workplace preference profiles help guide student career pathway exploration and planning work while alerting employers of a candidate’s personal preference and interest alignment with available career development opportunities and job openings.

Examples of basic skills standardized assessments include ACT WorkKeys, recently written about by Ted Evanoff in the Commercial Appeal. A lesser known basic skills assessment, but similar, is the National Work Readiness Credential (NWRC). All of the above goes to support the deployment of common language that gets everyone on the same page while facilitating effective stakeholder communication to inform workforce and economic development implementation.

Implementation

The current career pathways and regulatory environment offers several avenues for employer collaboration and involvement within the academic and vocational curriculum. “Career pathways”, broadly speaking, is just another term for curriculum and more technically is a hierarchy of learning experiences and programming linked to sixteen career clusters which, in part, include careers in agriculture, information technology, construction and transportation, distribution and logistics.

These available implementation avenues should be fully leveraged as they align with the standards based regulatory environment in which educators and the workforce development system must operate. The lack of common language and not leveraging standards based regulatory avenues is the reason that business-education initiatives often fall flat while instead evolving into one off events such as career fairs or Manufacturing Day. These events can be highly impactful provided they have a relevant path back into daily instructional practice for reinforcement in a sequenced career pathways curriculum and supported with parental involvement.

Transition planning provides an avenue for employer involvement into the curriculum. Transition planning is regulated and required by law to provide special needs students a plan to transition into postsecondary life. Morgan mentioned the need for improving education and educating at-risk populations. Transition planning, in part, includes foundational skill development and career pathways planning. Transitional planning for special needs students and career planning in the standards aligned general education curriculum for all students provides an avenue for employers to collaborate in regionally relevant career pathways curriculum development while engaging and alerting students of career pathways opportunities in career/technical education, degree programming, apprenticeships and jobs. This collaborative activity and curriculum implementation helps boost postsecondary completion rates for in demand careers.

The Tennessee Department of Education’s (TDOE) Early Postsecondary Opportunities (EPSO) program offers another opportunity for employer engagement. According to the TDOE website, “Early postsecondary opportunities (EPSOs) include a course and/or exam that give students a chance to obtain postsecondary credit while still in high school. Courses (whether stand-alone or in conjunction with an exam for postsecondary credit) must be aligned to postsecondary standards.” Further the website also states that EPSO measures are factored into district accountability measures and allow students to:

- earn postsecondary credits while in high school.

- become familiar with postsecondary rigor and expectations.

- develop confidence and skills for success in postsecondary learning.

- make informed postsecondary and career decisions.

- decrease the time and cost of completing a certificate or degree.

EPSOs provide an avenue for employers to collaborate in curriculum development for specific in demand occupations while being aligned to educator accountability requirements. EPSO’s provide a win-win opportunity for employers and educators.

Distribution, Promotion and Measurement

With employer involvement, the deployment of a standards aligned career pathways curriculum can most cost effectively be delivered through the Internet while being supported with coaching and onsite personnel. Web technology supports the distribution of employer demand data, some assessments and standards aligned career exploration and planning modules to support student career development and employer engagement. Talent pipeline development results can be aggregated, while maintaining student privacy and displayed to the community to help drive economic development work that relies on talent pipeline development.

Social media platforms can provide further opportunity for the promotion of in demand skills, career pathways and career opportunities. All of this goes to support a paradigm shift to workforce development is economic development.

While the educational system was discussed in depth, the above programming scales to serve a variety of learning environments to include re-entry, dislocated worker, drug court, adult ed and etc.

Conclusion

Needed but squashed vitality that questions the “visionaries” on excesses has resulted in an underserved business community. Vitality is needed to fuel growth for any economy as it serves as a mechanism to course correct deficiencies. But many in Memphis, to include, the highly educated, elected officials and community at large accept these excesses as normal or know questioning the excesses of the “visionaries” results in hardship, so it does not occur. At the same time, this missing vitality explains, in large part, why Memphis has not grown while leaving the primary drivers of any local economy in workforce and small business development behind in the dust.

As parts of the Nation struggle with a lack of diversity and an aging population, a youthful diverse population is likely the differentiating asset to drive improved economic development outcomes. Getting there will require a shift away from corporate/real estate development to workforce development as being the key driver to economic development all while benefitting the entire Memphis business community.

Other Published Workforce Development Articles

- JustMy Memphis – Workforce: Elephant in the Room (11/5/18

- Smart City – GMMDC: Smarter Path to Economic Development-8/15/18

- Smart City – Beyond PILOTs – Thinking BIG and National Leadership – 5/30/18

- MDN – Retention PILOTs – Thinking BIG and National Leadership (4/25/18)

- Memphis Business Journal Workforce Solution Editorial – (5/26/17)