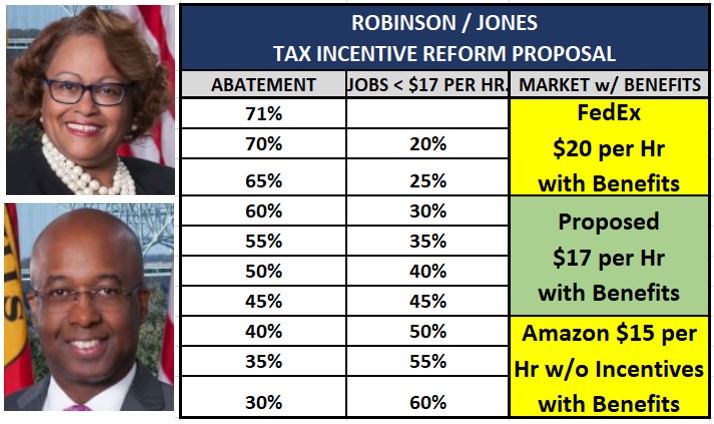

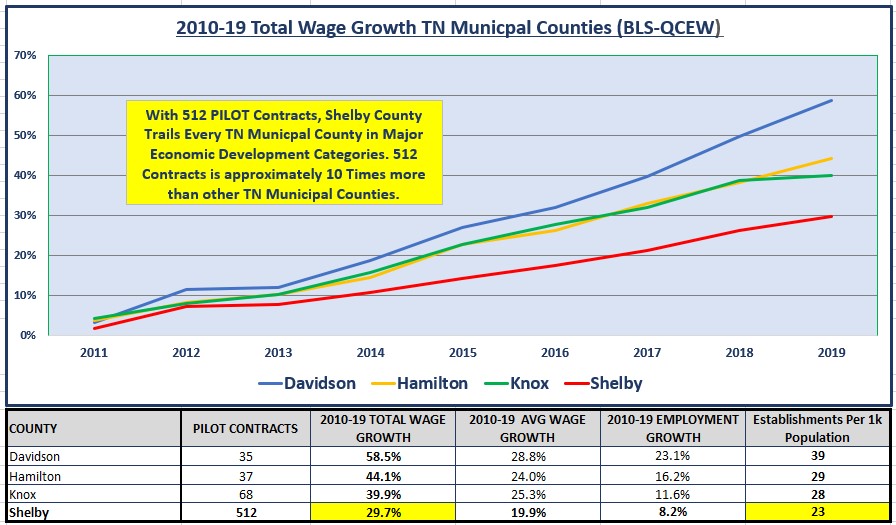

The winners are Patrice Robinson, Martavius Jones and performance of local government. Robinson/Jones should feel confident about their job tax incentive reform proposal made at yesterday’s Joint City Council / County Commission session. See table above.

Here’s why they should feel confident. The market is set. FedEx is paying $20 per hour w/ benefits and Amazon, without tax incentives after a $200M capital investment, is paying $15 per hour w/ benefits. In present day Memphis, the market does not get any more clear than that, with a sweet spot at $17 per hr.

Through tax incentive reform, Robinson/Jones demonstrated a savvy intuition to strike the right community balance between market forces and public needs, that support increasing tax revenues and wages with a $17 per hour with benefits target. Away from eliminating incentives and futuristic modeling that has historically paved the way for excessive incentives, the proposal is brilliant in its simplicity, balance and alignment with community needs and market conditions.

The Robison/Jones proposal supports property tax abatements starting at 71% declining to 30% based on the percentage of jobs paying at least $17 per hour with benefits. The proposal needs more work, as eluded to by Councilor Rhonda Logan. Such work likely includes resolving PILOT term lengths and provisions that check any abatement of already existing property taxes in PILOT awards. Abating existing taxes brings significant opportunity costs, that should require trade off analysis by local legislative bodies.

Richard Smith of FedEx gave a thoughtful video presentation, calling for more oversight, transparency and accountability, aligned with a published economic development plan, while not “giving away the store” with excessive incentives. Smith seemed, in many ways, hungry for public leadership. Its a public economic development plan that is needed, which has always been the public sector’s job to author.

To that extent, local government staffs, on their own, put together two legislative packages, rich with useful information highlighting excessive tax incentives when compared with other municipalities, references to independent research, tax incentive approval process maps and an eroding EDGE approval process. Local government should gleam with confidence and know they got this !

Over the years, the Greater Memphis Chamber has been unable to author a public economic development plan, which can be explained by the fact that the private sector, not the public is the Chamber’s customer. On the other hand, it would seem that the Chamber would see it in their interest to bring public incentives in line with market conditions. After all, while being a significant consumer of both local public services and and tax incentives, even FedEx, would likely be hard pressed to understand publicly incenting jobs much less than their very own $20 per hour.

Ultimately, the data compiled by local government staffs reveal a need for tax incentive reform to reverse an eroding job incentive approval process, while not giving away the store.

Erosion and Process

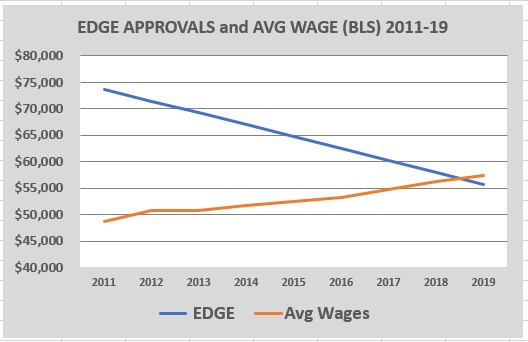

Page 10 of the legislative package, assembled by local government staffs, revealed significant erosion in the EDGE job tax incentive approval process, with average wages declining, over time, for approved PILOTs. The table, on page 10, is entitled “Countywide Average Wages vs PILOT Projects”. Informed by the table, the chart above graphs, in blue, EDGE’s average wage PILOT approvals over time, with actual countywide average wages, informed by BLS, appearing in orange.

Erosion is shown with the EDGE average wage approvals declining and in fact, descending below actual average county wages. As far as historic approval process, Councilman Jones remarked that legislative bodies did better than the independent EDGE Board that started in 2011. Jones is correct.

Further details in the legislative packet document other municipalities requiring local legislative approval. With this possibility looming of a possible return to local legislative approval, Councilman Worth Morgan prioritized speed in the process as preferable, while for the most part, defending the status quo. Morgan also remarked that only gains occur with PILOTs, but the fact is that taxpayer losses do occur, when abating existing property taxes, which often results in significant opportunity costs.

Commissioner Whaley asserted changes must be made in light of local economic development outcomes and Commissioner Sawyer stressed the need for legislative action, the need for community engagement and involvement in the educational system by PILOT recipients.

Folks seem to like, what is an unreliable measure, the benefit cost ratio. It it is to be used, it should be correctly calculated, while not calculating in already existing property taxes, when figuring project revenue, as that artificially inflates both the benefit cost ratio and overall project revenue.

Conclusion

The winners are Robinson, Jones and local government. All should be confident. They nailed it while having all community stakeholders and taxpayers in mind…..