The Greater Memphis Chamber convened a meaningful stakeholder conversation with their UpSkill901 workforce development summit but no connecting workforce development plan emerged from the event. Convening such events takes significant effort, as the Chamber seemed restrained by forces beyond their control, to not have a plan available to them following some 5 years of locally disconnected workforce development efforts. Given those restraints, the Chamber pressed ahead while facilitating efforts to help ignite connected planning and an ongoing conversation around workforce development as economic development.

In the lunch session, Beverly Robertson stated that a plan would be forthcoming from session work and Richard Smith in the closing session buttoned up the conference touting workforce development as the #1 economic development priority, the area’s youthful population advantage as an economic development asset and the need to continue the collaborative workforce development conversation.

The Chamber made the event productive by starting out with a data presentation regarding the forthcoming automation disruption and panel discussions. Breakout sessions followed, smartly segmented into target audiences, where workforce development practitioners shared best practices and challenges in facilitated sessions. Obstructive silos emerged as a chief challenge throughout the day. Adding credibility to the voiced concern, workforce development practitioner, Kyla Guyette, Executive Director for Workforce Investment Network (WIN), in the lunch session, remarked after having worked throughout the country, that the local siloed landscape was especially challenging in Memphis unlike anything she had ever experienced.

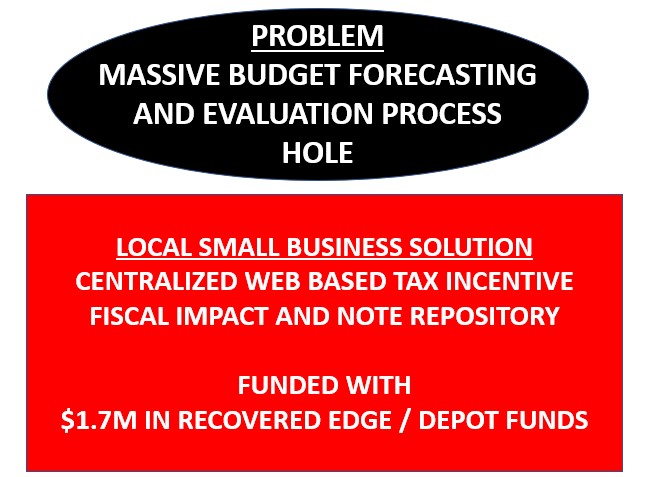

Further, the need for a centralized technology based workforce development portal emerged as a primary tool need to reduce silos, better align resources, communication, partners and efforts. MemphisWorks, currently in use locally, was mentioned favorably as a potential centralizing technology portal in the morning breakout session while YouScience, an assessment platform being locally piloted, was mentioned in the afternoon session. At this point, there does not appear to be a shortage of choices of available technology.

Beyond the cost of the intellectual property, the primary cost with centralized technology is properly aligning it to funding, learning and employer demand requirements to achieve implementation and optimal use while maintaining and updating content with the support of ongoing professional development and marketing. Potentially housing student records may also emerge as a requirement. While a centralized student instructional delivery portal would be ideal, at the same time, a portal may be more scaled down, while not facilitating student instructional delivery, but providing regional labor market information, professional development, best practice sharing and progress monitoring of local workforce development efforts.

As far as curriculum content, the need for “soft skill” development emerged as a primary need in breakout sessions. Panelist remarks in the afternoon session stated that employers are better positioned to teach tactical job skills while soft skills are far more challenging for employers, thereby leaning on the workforce development system for developing soft skill competency. Specific soft skills were not specifically defined nor was quantified employer demand data of soft skills or basic foundational skills offered in the morning session.

Next Time Summit, Connecting the Dots, Common Language and Plan

Typically, with the added benefit of a plan, events such as UpSkill90l start with a morning content kick off session. The morning session is followed by an application of the content in breakout sessions. Lunch sessions typically reinforce morning content with a break from meeting content with music or lighthearted comedy. The afternoon sessions focus on implementation opportunities of applied content from the morning sessions with established feedback loops for post event support or optional onsite coaching for implementation progress monitoring.

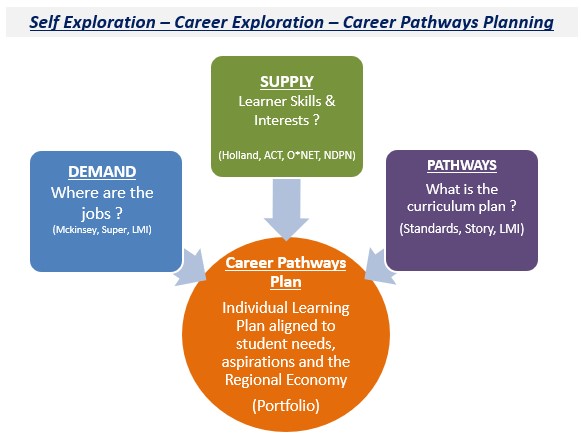

The fundamenatals of a connected workforce development and the deployment of career pathways consists of “common language” development with 1) a unifying measurable definition for “career readiness” applicable to diverse target audiences 2) employer demand data, 3) occupationally aligned assessments, preferably universally recognized to support economic development efforts, 4) career pathways curriculum alignment and planning, 5) professional development and typically 6) centralized technology to reduce costs.

In this way “soft skills” and basic foundational skills would be discretely defined based on employer demand data to inform curriculum development and planning efforts in conjunction with technical skills data to inform and define program offering. Typically, the former is supported with a flexible and open research based plan to support more tactical proprietary tools and to defend and support connected workforce development efforts within the standards based regulatory environment.

Conclusion

Given absence of a connected plan restraints, the Greater Memphis Chamber pressed ahead and was successful in convening workforce development practitioners while starting the vital workforce development as economic development conversation. The upcoming career fair will only further local workforce development efforts while providing opportunities for the continued conversation and hopefully moving toward implementing a connected workforce development plan.