SHELTER IN PLACE: Been Going on a Long Time / No Verdict

No verdict is the result. The lack of a verdict on the elitist PILOT Extension Fund (PEF) sham is the product of a “Shelter in Place” discourse that has been in place for a long time in Memphis. Its a discourse that keeps the Memphis public ignorant, as sheltered Memphians believe, Memphis would be nothing without FedEx. This belief is complete bullshit and product of a blaring FedEx public relations machine, that is accommodated by the local “Shelter in Place” media.

The fact is that Blackjack is a civic idiot and FedEx would be nothing without Memphis. Meanwhile, real estate partnerships of Puke Hyde and others, are the beneficiary of potentially illegal taxpayer funded loans for private parking garages. The lacking public verdict is how the Shelter in Place discourse protects the elitists, while keeping Memphians ignorant.

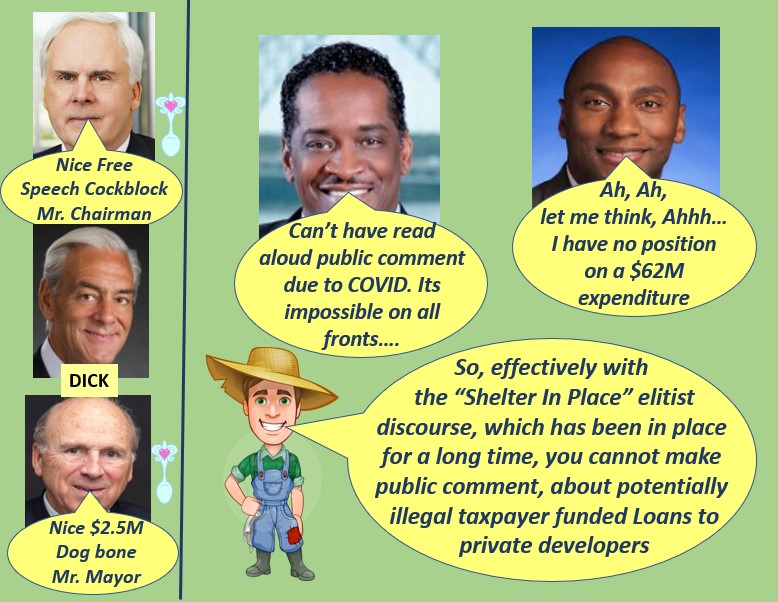

Commission Chairman Eddie Jones, who has expressed concern over PILOTs and such, recently forwarded the Shelter in Place existence by disallowing read aloud public comment in Shelby County Commission proceedings. This comes after Mayor Harris, stunningly has no position on the $62M public PEF measure, as due diligence on the matter, was overtly cockblocked by the County Commission.

The reason that due diligence was cockblocked is that the social justice elitists would have been publicly revealed ripping off a majority Black community in need. After all, they rip off small business, rip off educational opportunity and rip off the taxpayer as a matter of elitist process, all the time, in a majority Black community in need, under the guise of public relations tools like the National Civil Rights Museum.

The Capitol Insurgency vs Social Justice Elitism

The only advantage to the Nation’s Capitol event, involving a band of insane rednecks, is that everyone saw it. At the same time, the undermining of the local democracy by the social justice elitists, is much harder to see, as it has been systemically occurring for 20 years, while using such elitist public relations tools as the National Civil Rights Museum (NCRM). Puke Hyde is the Chair of the NCRM Executive Committee.

The Memphis Business Journal recently publicized the elitist public relations work of the NCRM featuring Dick Shadyac, Chairman of Memphis Tomorrow, on corporate social responsibility. Dick focused on the need of measurement in corporate social responsibility, just as his very own Memphis Tomorrow cockblocks and rips off my family, small business and community repeatedly, as I have, for years now, professionally proposed public measurement solutions of the Memphis Tomorrow public private complex. Memphis Tomorrow hates innovation coming from local small business, which is historically culturally evident in the decimation of the Memphis music business and small business sector.

For that matter, Dick is also a civic idiot for even being associated with and Board Chairman of Memphis Tomorrow. His remarks come, just as the sham $62M DMC PEF for public parking was being considered. Its a fund that currently shows an estimated $28M public debt.

If Memphis Tomorrow were serious about corporate social responsibility, they would have opposed the sham. But Memphis Tomorrow is an elitism sham into itself, while failing to measure the last 2014 FOCUS Economic Development plan, that came as a product of the Memphis Tomorrow Fast Forward initiative.

The only justice comes with Blackjack and Puke, on their hands and knees, puking up $1.5B in public chambers, and then leaving the stage. Both are civic idiots. Dick might want to join them. That’s not rhetoric. Their idiocy is a data supported fact…..

DMC / DMA PRIVATE GARAGE LOANS

PUBLIC PARKING BOONDOGGLE: Plentiful / $62M More of the Same

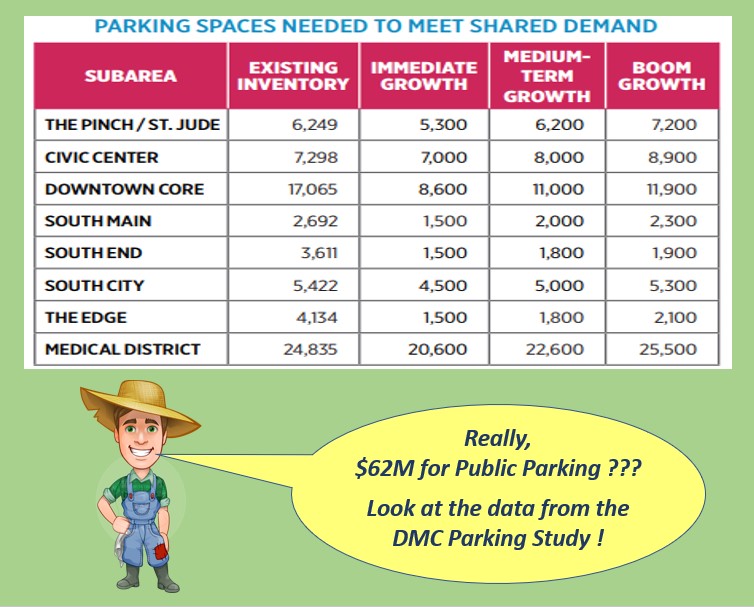

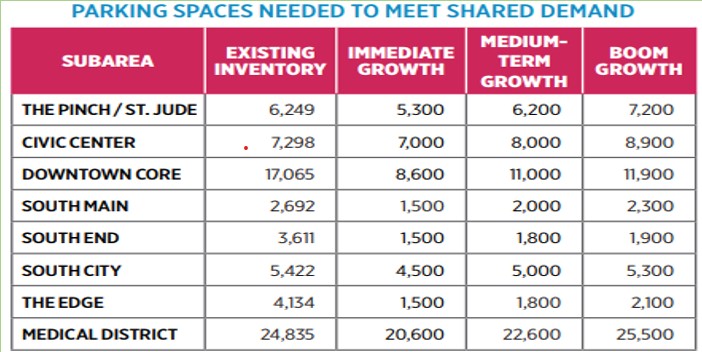

There is just not an immediate need for more Downtown public parking. The table above was sourced from the Downtown Memphis Parking Study. From the table, one can see the existing inventory, in each part of Downtown and the projected peak demand, based on three scenarios. There is an excess supply of parking availability.

The $62M public parking request appears to be more of the same and developer driven by Carlisle’s One Beale project. Secondarily, the request is driven by a potentially exciting and transformative Brooks Museum project. The current One Beale project has already been the recipient of approximately $41M in tax incentives and public loan awards to include the following: 1) an approximate $1M grant, 2) $10M garage / PILOT Extension Fund garage loan and 3) approximate $30M tax abatement over 20 yrs. Incentives for the yet approved Hyatt expansion, could drive tax incentives and public loans to has high as $140M.

A public expenditure of $10M, for the Brooks Art Museum project, can be deduced, by reviewing the DMC County Commission Public Parking presentation delivered on December 2, 2020. This deduction is concluded by adding up the cost of the public parking projects, that are disclosed in the presentation. These public parking projects total $52M.

The cost of the Brooks Art Museum is the only project of the five with undisclosed cost, for a total $62M request, making the cost of the non-public parking Brooks museum project $10M. The non-parking Brooks Museum project reduces public parking availability by 400 spaces in the Downtown Core.

The exciting part, is the mention of a $100M investment, presumably, an exciting art collection for the Brooks Art museum project. While the Brooks Museum project has significant merit, the $42M Mobility Center appears to be another developer driven public benefit, for a developer, that may be the recipient of up to $140M in local public incentives and loans. The $42M Mobility Center, planned just across the street from the One Beale project, would just pile public more benefits on to the Carlisle development.

Observations

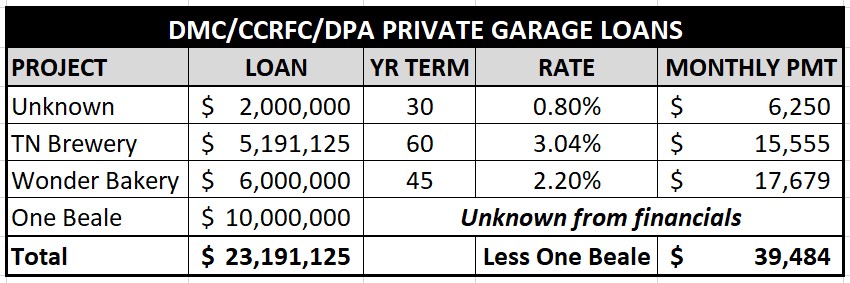

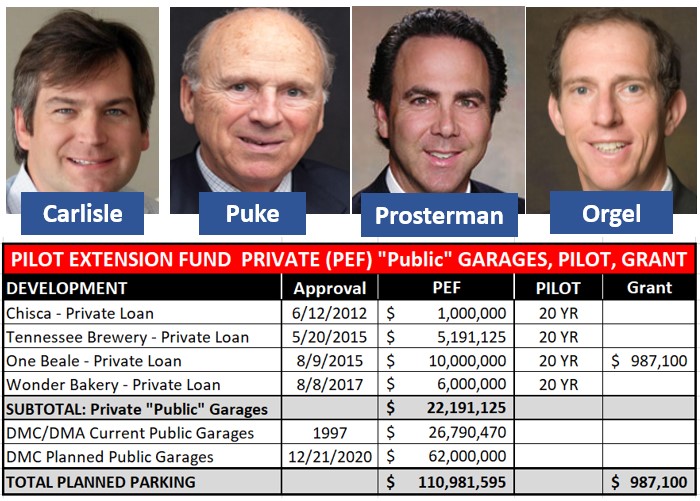

The PILOT Extension Fund, from which these projects are scheduled to be funded, would have $22M more in the fund, if long term garage loans were not provided to private developers. Wonder Bakery development received a $6M-45 year loan, Tennessee Brewery a $5.1M 60 year loan, One Beale a $10M loan with the term length unknown and CHISCA a $1M loan in 2014. Most of these are private garages that also receive the benefit of tax abatements.

At any rate, here are some other observations from the Downtown Parking Study:

“In most subareas, even in the Boom Growth scenario, there is no net increase in parking supply required to accommodate anticipated growth. However, since much of the existing supply is provided in less-than-optimal facilities (either they are in facilities with poor conditions, they are themselves located on future development sites, and/or they are in private facilities that cannot be used to support nearby growth without shared parking agreements) there may be the need for “replacement parking” development. (pg. 47)”

Observation: This appears to be a preparatory planning accommodation for the planned Brooks Museum parking reduction. But even with a 400 space reduction, the Downtown Core still has adequate parking based on the numbers in the above table.

“However, parking use patterns are concentrated unevenly, and all subareas still feature a considerable number of unoccupied spaces even during the midday peak. At almost any location and any time of the day, a highly-used parking facility is only a few blocks away from underutilized parking. (pg. 7)”

Observation: Walking and walkability is stressed in the report. So walking a few blocks should not be a driver for a $62M request.

“At peak occupancy (Weekdays 11am-1pm), all Downtown spaces are only one-third full, meaning there are still approximately 45,000 unused spaces across the entire study area. Most of these unused spaces are in restricted off-street facilities. Off-street publicly accessible and DPA garages average 66% occupancy.(pg. 8)”

Observation: Plenty of public parking

Page 100 of the report stresses ways in which to reduce traffic and parking demand to include ridesharing. How is ridesharing behavior going to be incented, with convenient and affordable parking options due to more than sufficient supply ?

Conclusion

There’s plenty of public parking. The $62M request is more of the same, in a boondoggle and excessive corporate/real estate developer publicly funded benefits…..

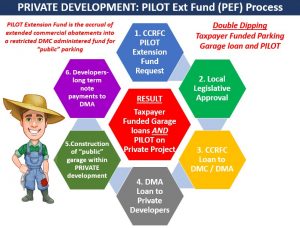

DOUBLE DIP: PILOT Extension Fund

“Double dipping” is the finding, as research into the PILOT Extension Fund (PEF) continues. Local developers in Carlisle (One Beale), Puke, Prosterman (Wonder Bakery) and Orgel (Brewery) have leveraged the PEF for long term loans to finance construction on private “public” parking garages, while then getting 20 year 80%+ property tax abatements, on the overall development, that includes tax abatements on the parking garage !

Also, just an aside on an unrelated matter, Prosterman is the beneficiary of $2M in TnInvestco state funds, for a startup called Hapten Sciences, that has only resulted in 2 employees over 10 yrs.

Anyway, approved loans for private “public” parking garages total $22M. And the term lengths of these taxpayer funded private loans are like 45 years. A low interest long term loan, using taxpayer money from abatements + another 80% abatement for the finished project = A DOUBLE DIP !! (See above table with data sourced from the DMC Database).

Further, based on a review of the DMC financials, its unclear if loans are being repaid to the Downtown Mobility Authority (DMA). And Carlisle got a garage loan, a 20 yr abatement and a $1m grant for One Beale. This does not include the new 30 yr PILOT for the Grand Hyatt or the benefit of the planned $42M mobility center across the street from the One Beale development.

The PEF is a restricted public parking fund, funded with extended corporate/real estate tax abatements. And its also true that, over the years, Downtown Memphis Commission CEOs, have asserted a false belief, that this abatement money is NOT the taxpayer’s money, but the DMCs money, based on an Attorney General’s opinion issued in 1997. The actual legality of the fund remains an open question.

Wonder why no local traditional or non-traditional publications have questioned the $62M PILOT Extension Fund expenditure? Its strange that no one is asking what would $62M do for affordable housing or public transit? Or why there is a parking plan and no economic development plan? At the same time, with no formal working definition of “economic development”, it’s clear local “visionaries” have defined economic development as corporate, real estate AND now parking development.

PEF Private “Public” Parking Garage Loan Process

Basically, these loans are publicly funded loans, for parking garage construction for private developments, that allow public parking, whether or not there is demand for public parking in the area. Here clickable graphic and the PEF loan process:

parking, whether or not there is demand for public parking in the area. Here clickable graphic and the PEF loan process:

- DMC Center City Revenue Finance Corporation (CCRFC) approves a PEF request and seeks local legislative approval.

- Once legislative approval occurs, the CCRFC arranges financing and provides funds to the Downtown Mobility Authority (DMA) for administration and distribution

- DMA loans the funds to private developer

- Private developer builds and manages the “public” garage on their private development

- Developer repays DMA loan over 45 years or so

- Developer benefits from Double Dip of taxpayer funded low interest loans and 20 yr 80% property tax abatement on the garage and their private development.

Now, after the above, the DMC is going to spend anther $62M on public parking, when in 2019, DMC’s DMA only generated $2M in revenue, before expenses, on 5,500 public parking spaces. At a conservative $10 per day, that is only a 10% occupancy rate. During COVID, DMA 2020 revenue was off $400K, down to $1.6M.

But based on the 2019 analysis, a bunch of folks are not paying for parking or there are a bunch of empty spaces, which negates the need for additional public parking. So much for any funding focus on needed public transit, affordable housing or education. All total, the PEF plan is to finance $111M in public parking.

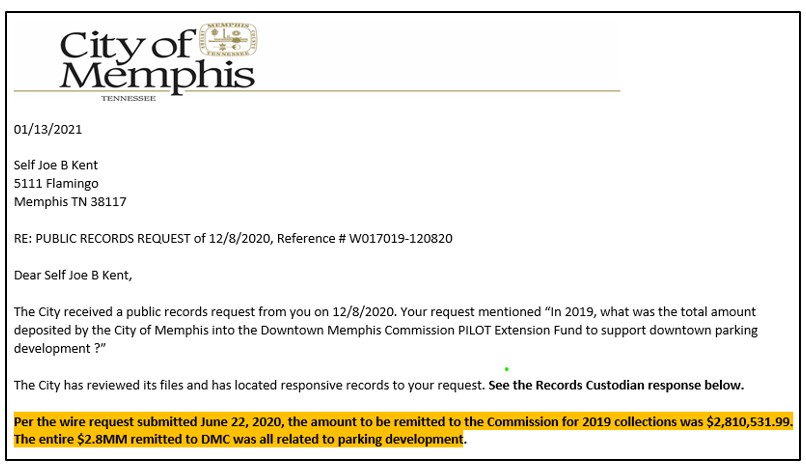

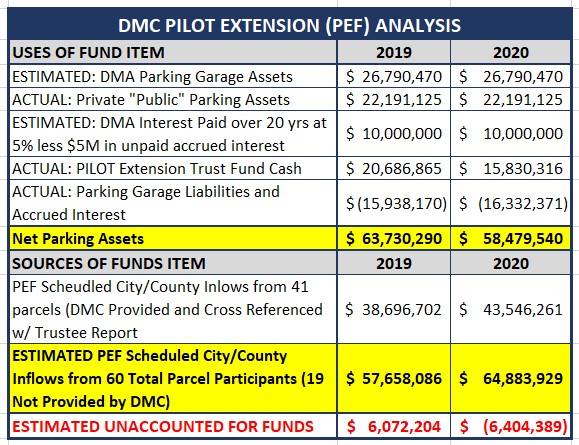

PEF Analysis Update

As new information on the PEF is obtained, the above table is updated. For example, we do not know how much money has flowed into the PEF over time. The above estimates are based on public testimony and DMC public information requests that are cross referenced with the County Trustee Report. For example, as of today 12/30, based on a public information request to the City of Memphis on 12/8/20, the City has no idea how much was contributed to the PEF in 2019, much less over the last 20 years.

To that extent, the new information discerned, from the DMC financial statement and website, were the private “public” garage assets, that provided the information to adjust the unaccounted funds down by $22M, resulting in an estimated $6M surplus in 2019 and $5.6M deficit in 2020.

PEF Open Due Diligence Questions

Besides the outrageous Double Dipping and $62M priority put on downtown parking, at a huge cost to everything else, these open due diligence questions remain:

- Legal authority of the PEF ?

- Historic contributions to the PEF ?

- Valid lease agreements to support future fund inflows and corresponding debt service ?

Maybe we will find out the above…..

COMMISSION COCKBLOCK: County Due Diligence on $62M

At their last meeting (1:27:30) , The Shelby County Commission overtly COCKBLOCKED due diligence on a $62M public funding allocation, for downtown parking, to then adopt the measure in a 11-2 vote. The Commission had previously scheduled due diligence, to be conducted by County officials Chief Financial Officer Mathilde Crosby, Trustee Regina Newman and Assessor Melvin Burgess. Due diligence findings were to be presented at the January 6, 2021 Commission Economic Development Committee meeting.

Alarmingly, this COCKBLOCK, effectively obstructs County officials from doing their jobs, while such concerns go wholly unreported by the local press. This non-reporting highlights the rigged Memphis system and institutional failure of the press that keeps the public in the dark, on matters of elitist led taxpayer injustice.

The former is just an extension of the archaic and elitist Crump era culture, of days gone by, forwarded by idiots Blackjack Fred Smith and Puke Pitt Hyde. It’s commonplace for the elitists, through local legislative bodies, to dismiss the public at large. But this is a new low, with the Commission dismissing its own officials, as County officials make the public appeal to Commissioners, to allow them to do their jobs in supporting the public good.

Commissioner Mark Billingsley, who previously championed due diligence on this “important decision” matter, strangely reversed his position to champion immediate December 21, reconsideration of the $62M PILOT/Parking Extension Fund matter, without scheduled due diligence. The scheduled outstanding due diligence concerned: 1) legal authority of the PILOT Extension Fund (PEF), 2) Binding lease agreements to support $62M PEF for public parking and 3) historic PEF activity over the last 20 yrs.

While leaving the above outstanding due diligence unaddressed, Billingsley justified his position favoring the $62M request, based on having received a letter from AutoZone CEO, Bill Rhodes. And Commissioner Brandon Morrison favored the $62M measure, in honor of the work of Jennifer Oswalt, who is departing the Downtown Memphis Commission.

Billingsley further asserted that the corporate beneficiaries of publicly incented downtown parking in AutoZone and FedEx, cannot be taken for granted, as they can leave Shelby County anytime. Billingsley seemed ignorant to the fact that both downtown projects for FedEx and AutoZone have already received excessive local incentives, that total an estimated $64M. And that is $64M in local incentives, prior to any consideration of additional local incentives for downtown parking, all while not including $12.3M in state incentives for these corporate downtown developments.

Analysis – Parking Plan but No Economic Development Plan

Anyone find it weird that there is a Memphis downtown parking plan but no economic development plan ? Its because elitists, like Puke, have proven they don’t know what “economic development” is. Prior to COVID, when parking demand was higher, I never had a problem finding a parking place downtown. In fact, the DMC County Commission parking presentation documents this as fact, with the admission of available parking in both photographs (Orpheum Lot) and in written testimony (Front Street garage). So, there is no parking crisis, as was asserted by some County Commissioners at their December 21, 2020 meeting.

Enabled by a lack of governmental oversight and an non-investigative press, Memphians live in a bubble. Remember, the elitist Poplar TIF was approved, based in part, to relieve traffic congestion. Has anyone advocating for this stuff ever been to Nashville, Atlanta or Washington DC ? Trust me. There is no downtown parking crisis or East Poplar traffic congestion problem. Both of the former illusions come from an unchecked elitist narrative, designed to exploit, through taxpayer injustice, a majority Black Memphis community in need.

Further, review of the DMC parking presentation reveals clues to the the drivers behind downtown parking reconfiguration. Both of those drivers point to Puke’s pet projects in the Brooks Art Museum and the Riverfront. This $62M for the downtown “parking crisis” is actually more money for already previously funded projects, in the Riverfront and additional corporate incentives for downtown parking, to accommodate for the reduction in parking, for the Brooks Art Museum project. And then there there is also the Carlisle One Beale project beneficiary.

The $62M measure includes immediate access to $16M in funds that have piled up, over a number of years, largely out of public view, at the Downtown Memphis Commission. The mystery surrounding the existence of the fund, is a product of historically failed governmental oversight, that has persisted for years, in not reviewing annual industrial development board (IDB) financial reports. Besides DMC, funds seemed to have also piled up at other IDBs, such as EDGE, where EDGE has $22M in unrestricted cash assets.

When Blackjack was pursuing his FedEx Downtown incentive package, he recognized all of the public funds piling on IDB balance sheets and went after them getting $2M from EDGE and $1M from DMC’s Center City Development Corporation. Mayor Strickland has said, that local incentive awards do not include cash grants. But that is not the case for local companies, like FedEx, moving across town.

At any rate, in the end, there are too many open questions, related to the PEF, for this matter to be over. The public deserves answers.

Unfinished Business and Good News

With so much unfinished business regarding the PEF, local legislative bodies owe the public answers. The due diligence scheduled for January 6, 2021, on the PEF, should occur in Commission Economic Development committee as scheduled. If not that committee, some other committee.

Originally, the PEF matter was rightly referred back to Commission committee, because there was no available public documentation to support a quantitatively informed discussion around a $62M public funding request. But when Commissioners reconsidered the matter, on December 21, 2020, the dollar amounts discussed, were pulled out of thin air and based on nothing.

The fact is, there was never any hurry for the County Commission to approve the $62M public parking measure. In fact, Commissioner Tami Sawyer exposed this by asking Jennifer Oswalt, what the hurry was on the Union Row consideration when the project has yet to start 2 years after being approved. What the hurry was on this $62M parking project, involved local elitists wanting to control the agenda and narrative, while getting immediate access to $16M (based on Oswalt testimony), in DMC cash assets, without needed due diligence.

Due diligence of the PEF will likely reveal significant problems, and perhaps, even fund insolvency, based on the fund’s historical performance liabilities to the public. And that’s not to mention, to begin with, the implementation of the fund may never have been legal.

The good news is that, Chairman Eddie Jones and Commissioner Tami Sawyer voted against the $62M PEF, with support from County officials Crosby, Burgess and Newman. Lets hope, these public stewards, demand answers regarding the PEF, on January 6, 2021 and beyond…..

DMC PARKING EXTENSION FUND: Where Did $40M Go ?

NOTICE: With clarifying information, this blog can be modified for the benefit of informed community discussion with revised assumptions. This table has been corrected, since its original publication, in favor of the fund, by adding $10M in estimated interest payments, for use of funds, over 20 yrs. This lessens the amount in estimated unaccounted funds.

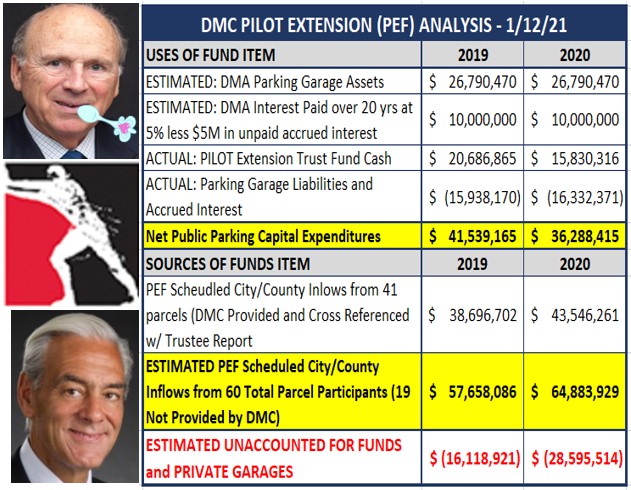

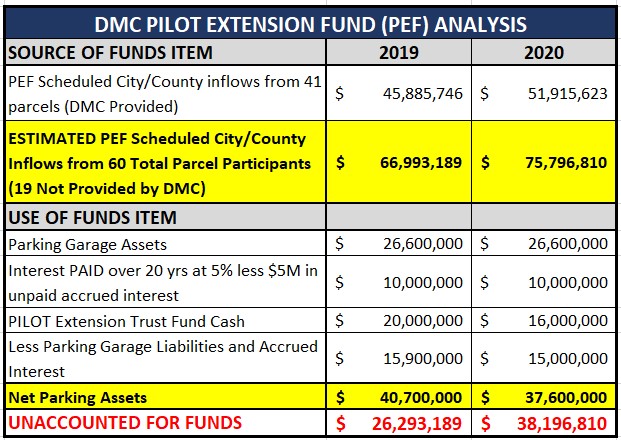

Based on an analysis of the 2019 Downtown Memphis Commission (DMC) audited financials and information obtained via a public information request to the DMC, the DMC PIL Extension Fund (PEF) appears to be $26-38M short.

The DMC staff was helpful in providing information related to the PEF. DMC provided information to include PILOT parcel, project name, PILOT begin date, original term, extension date, extension term and PILOT end date. That information was cross referenced with the 2019 Shelby County Trustee PILOT report to derive total historical “scheduled” contributions to the PEF in City and County taxes.

The DMC provided parcels currently contributing to the PEF, but did not provide 19 parcels that had participated in the fund since 1997, that have since returned to the tax rolls. Methodologies for this analysis will be defined below. But first, what is the PILOT Extension Fund and the questions surrounding it?

Parking Extension Fund (PEF)

The Parking Extension Fund (PEF) was birthed in 1997 based on a State Attorney General’s opinion regarding local government’s authority in approving the extension of payment in lieu of taxes (PILOT) for community betterment. PILOTs are reduced commercial property taxes designed to encourage increased commercial investment.

Based on recent on the record County Commission testimony (see item 27 at 2:09:45 in video), the PEF would extend commercial PILOTs, with the abated portion being dedicated to a restricted DMC administered fund, known today as the PEF, to support the development of downtown parking. The availability of public parking assets would, in theory, encourage commercial investment.

Public knowledge of the PEF, is sparse with many local legislators learning about the fund, which has existed since the late 1990s, for the first time in December 2020. This learning comes as the DMC attempts to get legislative approval for a $62M downtown public parking project. Given the sparse knowledge base having inherited the PEF years ago, both appointed and elected officials are raising questions.

Questions by Rock Star Public Servants

Leading questioning and facilitating discussion regarding the PEF before the County Commission, were Shelby County Chief Financial Officer Mathilde Crosby and County Trustee Regina Newman. Both are highly skilled rock star professionals, with collectively, needed financial and legal backgrounds to facilitate PEF inquiry for the public good.

Primary areas of questioning and discussion by Crosby and Newman concerned: 1) legal authority for the existence of the fund as properly authorized by local government, 2) the availability of contractual lease agreements to support the revenue requirements of the PEF and 3) how much has historically been contributed to the fund. All of these questions remain open with the Shelby County Commission, led by Chairman Eddie Jones, smartly deferring action on the $62M PEF request and referring the matter back to the January 6, 2021 Economic Development Committee.

Based on public testimony, public information requests and 2019 DMC financials, this blog is concerned with helping to facilitate the discussion around historic contributions to the fund and corresponding downtown public parking assets.

$25-40M Estimated PEF Deficit and Methodology

As stated earlier, the deficit for the PEF is estimated, based on this analysis, to be between $26-$38M. Further, in contradiction to public testimony, PILOT extensions have occurred robustly in the 2010s, with some extensions, preapproved to take effect after 2020. But what about the deficit and how was this estimated deficit derived ?

SOURCE OF FUNDS

Estimated PEF Total Scheduled Inflows from 60 Total Parcels – DMC’s Jennifer Oswalt testified before Commission, that there were at one point, 60 abated parcels contributing to the fund. DMC provided 41 parcels via public information request. Those 41 parcels were then cross referenced with the 2019 Trustee Report to derive, from the DMC provided extension dates, historic contribution amounts to the fund.

Then, the County amounts were multiplied by 1.79 to derive a City/County total amount. And finally, to account for the missing 19 parcels, that had participated in the fund in the past, the total City/County amount for 2019 and 2020 was multiplied by 1.49. From the late 1990s, as of 2019, the total estimated amount of scheduled contributions is $66,993,189 and $75,796,810 for 2020.

USE OF FUNDS

Parking Garage Assets – Using the 2019 DMC financials, page 28 states $29.4M in buildings, with the DMC office building, per the Assessor website, having an appraised value of $2.8M. That results in a net of $26.6M, which in this analysis, is assigned to parking garage assets.

PILOT Extension Trust Fund Cash – For the PILOT Trust Fund, page 18 of the 2019 DMC financials states $20M and per Oswalt public testimony $16M for 2020.

Interest Paid – Estimates interest paid over 20 years, using a 5% interest rate, on $26.6M in parking garage assets.

Parking Garage Liabilities – Page 30 of 2019 DMC Financials, $15.9M in debt and accrued interest. From that, the 2020 estimate is $15M.

Net Parking Assets – Calculation of (Parking Garage Assets + Interest Paid +PEF Cash) – (Parking Garage Liabilities)

Unaccounted for Funds – Calculation of (Estimated Total Scheduled PEF Inflows) – (Net Parking Assets) arriving at -26M for 2019 and -$38M for 2020.

Conclusion

As information emerges, there will probably be additional blogs on the PEF. Please send comments, feedback and concerns to me at jkent@pathtrek.net.

COCKBLOCK !!! : Shelby County Commission

Operating in the image of Boss Crump and elitist spooners Blackjack and Pitiful, the Shelby County Commission COCKBLOCKED the public out of attending and participating in Commission proceedings today. Through public comment in Commission proceedings, I am currently trying to verify the corporate contribution, if any, of corporate parking fees for the corporate use of public parking garages, outside of public funds as contained in the DMC PILOT Extension Fund. There is some good news at the end of this blog, involving Trustee Regina Newman and Chief Mathilde Crosby.

At any rate, in fairness and in my attempt to have the DMC prepared for my public questioning, on Friday night, I sent DMC’s Jennifer Oswalt my questions on the PILOT Extension Fund which involved a Monday Commission $62M consideration. Some of the questions were addressed in my recent blog.

On Saturday, I saw a County Commission press release disallowing public attendance at the County Commission proceedings posted on Commissioner Mick Wright’s page. Following that, I awaited its promotion in the local media. But that did not occur. Nor were there any notices disallowing the public on the County Commission Agenda. like the previous meeting notice that accommodated public attendance, The agenda states: “The meeting will be held at 160 N. Main Street, First Floor, in Chambers as well as online using GoToWebinar. ”

So, thinking Wright’s Facebook post may have been mistaken, given the lack of press publication and a published agenda that had accommodated public attendance for some time, I emailed Shelby County Commission Chief Administrator Quran Folsom for clarification on Sunday night. Folsom did not respond to my email.

Next, I called the Shelby County Commission at 11:23 AM on Monday in advance of the 3pm Commission meeting. I asked the polite Commission attendant if they were allowing public attendance at the Commission meeting and she said yes they are. I said, are you sure ? She said, let me check and came back and said yes, public attendance is allowed. So down to the Commission meeting I went.

At Commission

I entered the Shelby County Building and went through COVID protocol, where I received the above clearance bracelet. Then I went through security and headed to Chambers. Both health and security personnel, admitted me as a public participant as they always have and did not say anything about the public not being allowed.

As I approached the Chamber doors, a Shelby County Deputy said, that the public was not allowed. I said, I called ahead and he said, that I was not allowed in Chambers due to COVID. So having been admitted into the building, I went and took a seat near the restrooms in the chamber lobby. Soon after, it seemed a SWAT Team of Deputies approached me saying that I was not allowed in the building after having been admitted.

So I left the building, where I ran into Katherine Burgess of the Commercial Appeal who inquired about my experience. Burgess, seemed somewhat baffled and was later allowed in County Commission, as a member of the press. We both exchanged notes and pleasantries, then went on about our business.

Upon getting into my car, I wanted to make public comment, so I referred back to Commissioner Wright’s Facebook post, got the number 901-222-1234 and called it at 2:57pm to log my public comment. The call went to a voice mail which was full. So my comment was not logged.

Following that, upon returning home, I logged into the Commission meeting. The Commission had just finished introducing the new Budget Director and around 3:47pm, Commission Chairman Eddie Jones announced the public comment procedure, which had an already past submission deadline of 3pm. The public comment procedures had 3 options, web, email and phone submission with the phone number of 901-222-1234 that I called at 2:57pm. So I called it again and the voice mail box was still full.

The COVID Commission public comment procedure is a disservice and does not accommodate verbally reading public comments into the record or allowing the public to voice their concern from a remote location, at the time a measure is being considered. This procedure provides no assurance that the pubic is heard and especially at the most critical time, when the measure is being considered. No doubt, its a Commission Cockblock, of the type, of an archaic and rigged elitist system, of Crump days gone by.

After all, from experience, I know about the elitist Memphis cockblocks all to well. And they are cockblocks for all !

Good News

Trustee Regina Newman and Chief Financial Officer Mathilde Crosby exerted leadership testimony to get the Commission to refer the $62M PILOT extension fund (PEF) back to committee. It should never have been on the agenda without a PEF program description, audited DMC financials, business plan and supporting documentation.

As the rigged local press covers social justice symbolism, we are going to have some time to dig into this to find out about the runaway corporate elitism and taxpayer injustice, that has been systemically occurring, on the back of a majority Black community in need.

I already have proven, in Commission Chambers, a $5M EDGE overstatement of net property tax impact of the UofM supported Poplar Plaza PILOT. And then there is the needed testimony of MB Ventures, Innova and Epicenter with respect to state provided startup funding.

The elitists are idiots and that fact should be the resulting lesson for the public at large. Knowing this, is a path forward, while moving out of the Elitist Crump era stone age of the past…..

ELISTIST PRESS and PILOT EXTENSION FUND: Over Resourced Social Justice Investigation Scam

Does anyone find all of the historical social justice investigation of almost 100 years ago a bit much ? After all, such investigation occurs, as present day taxpayer injustice, on the back of a Memphis majority Black community in need, goes entirely uninvestigated by the local Memphis press.

At best, given trends and events, current social justice historical press investigation is an over resourced effort. At worst, its an active elitist conspiracy, to distract the public away from what is most important in addressing social justice, and that is taxpayer justice.

There are numerous examples. But take for example the recent exhaustive investigation of almost 100 years ago, of the late Clifford Davis, only to provide a rationale for renaming the Federal building. The over resourced effort was the work of the joke Daily Memphian / University of Memphis (UofM) Institute of Public Service Reporting’s “investigative” partnership.

Meanwhile, the UofM Board of Trustees gets press for rolling out civil rights logos and renaming buildings for late social justice activists. Stunningly, the former comes on the heels of the UofM supporting the excessive $15M Poplar Plaza tax incentive, that used press unreported bogus EDGE financial justification, while losing taxpayers, in a majority Black community in need, $2M in existing taxes.

And its no surprise, with no investigation of the elitist Memphis Tomorrow complex, that no one really knows what the Downtown Memphis Commission (DMC) PILOT Extension Fund really is, as a $62M consideration comes down the pike. To find out, this would only involve, merely, a 30 year historical investigation. But such investigation fails to occur.

With that said and sparse available public documentation, this blog is going to take a shot at investigating the DMC PILOT Extension Fund (PEF) and figuring it out.

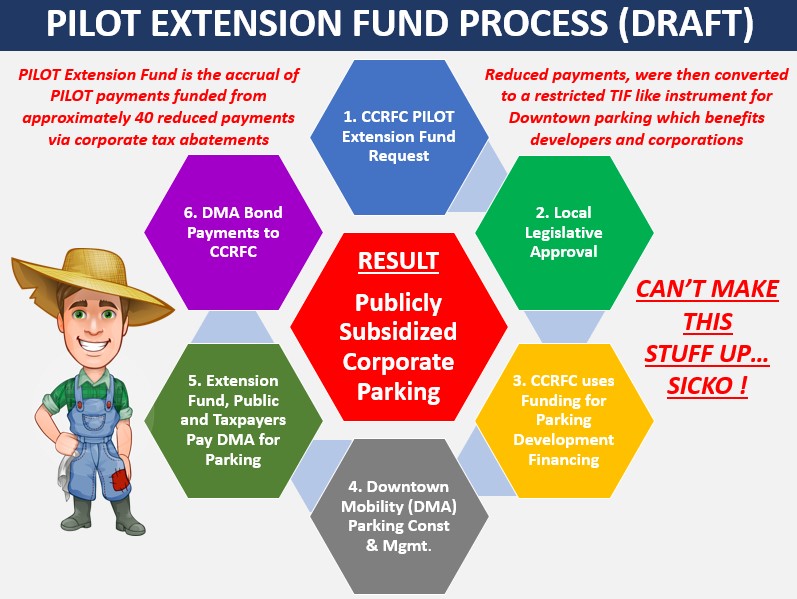

PILOT Extension Fund Draft Explanation

First, with little authoritative technical documentation, this is a draft of the DMC PILOT Extension Fund (PEF) process. The above was constructed based on helpful information obtained, via email, from the DMC. This process may be edited once more documentation is obtained from the DMC and/or local governmental bodies.

Given the fact, that a $62M PEF funding measure is set to be voted on by the County Commission on Monday, this blog felt it imperative to get, at least a process draft published, in an attempt to have an informed consideration of the $62M measure. This because, like me, it appears several Commissioners lack basic PEF understanding.

Based on a preliminary review, the PEF was established approximately 30 years ago to fund downtown public parking and economic development. It appears corporations and developers stand to greatly benefit from this public parking subsidy.

40 PILOTs were extended in the late 1990s and FedEx joined just recently, to fund the PEF, while corporate PILOT beneficiaries enjoy, on average, extended term 85% real property tax abatements. Additionally, it appears the approximate 15% PILOT payment was used to create, yet another incentive, through a restricted TIF like fund for public parking development.

Based on limited technical documentation, this is how the PEF process is suspected to work. The reduced PILOT payments accrue into a restricted fund. Then the following happens: DMC Center City Revenue Finance Corporation (CCRFC) requests legislative approval for fund use 2) Legislative consideration and approval 3) CCRFC uses funds to arrange loan financing for DMC Downtown Mobility Authority (DMA), 4) DMA constructs and manages parking garages, 5) PEF, Public and Taxpayers pay DMA for parking 6) DMA makes bond payments to CCRFC.

Assuming this process is correct, these are questions for DMC regarding the Commission’s consideration of the $62M PEF measure:

Assuming a $47M loan based on a $15M current PEF balance (DMC Testimony), if borrowed today, total payments would be $80M over 40 years with a 3% interest rate. Using Trustee documentation and the 41 PILOT payments and term lengths, the PEF will generate an estimated $16M over the next 25 years. That represents a deficit of $64M. Perhaps those figures are not correct, so to the DMC:

- Based on the 41 PILOTS in the Extension Fund, how much funding are those PILOTs expected to generate for the PILOT extension fund until the PILOTs expire?

- Is all of the future revenue from the PILOT Extension Fund dedicated to this $62M project or are there other liabilities ?

- The PILOT Extension Funds are public funds. Excluding any funding from the PILOT extension fund, how much are companies that are part of the PILOT extension fund, projected to pay in annual parking fees?

- What are the public’s annual projected revenues from public parking less DMC administration costs?

- What is the expected average loan term for borrowed funds to support parking garage development?

- How many public parking spaces does AutoZone currently have and what do they annually pay for them excluding PEF public funds?

- Will there be any further parking PILOTs granted as was done with Indigo Ag?

- Can I please get a copy of the document that was approved by the State Attorney General that facilitated the creation of the PILOT Extension Fund?

That’s all…..

GOOD NEWS: Whitehaven Economic Development

Exciting news for the Whitehaven community! As the new Interim Executive Director of the Whitehaven Economic Redevelopment Corporation, Michael O. Harris is already out of the gate with a small business grant program. Harris identifies as a data driven fiscal conservative, who wants to maximize return on investment for the residents of Whitehaven by expanding opportunity through small, medium and large business expansion in the area.

Given Harris’ current work as Director of Corporate and Government relations with Junior Achievement, which encourages entrepreneurship through youth development, getting out of the gate with a focus on small business is a natural for Harris. But, with a vision to increase opportunity for the area, Harris knows that small business alone will not get the job done.

Beyond small business, Harris will leverage his platform with the Greater Memphis Chamber to recruit medium and large enterprises to Whitehaven. This will be done while networking with the Rotary Club of Whitehaven Memphis-South, where Harris serves as President, to build even a stronger community framework for economic and workforce development to serve Whitehaven area businesses and residents.

Harris is committed to bringing his Rotary roots of “service above self” into this role as a servant leader. His desire is to work “inclusively, and honestly with the residents, businesses, churches and agencies of the community for the overall revitalization efforts of the Whitehaven Community.” Displaying his collaborative spirit, Harris has already partnered with Pearl Walker, President of the I Love Whitehaven Neighborhood and Business Association.

It’s just the beginning, but Harris is out of the gate supporting small business with tangible results. Next, under Harris for Whitehaven, is continued support for small business while building a pipeline of medium and large business to locate and grow the Whitehaven community for years to come.