I CAN HELP YOU MBJ WITH YOUR MEMES

ECONOMICS AND CONSOLIDATION ?

TAXPAYER JUSTICE: DMC Benchmarked

Without taxpayer justice, forget about social justice, fiscal conservatism, workforce as a priority or moving Memphis forward. All of the former is a scam without taxpayer justice occurring in a city where mere taxpayer advocacy is politically incorrect.

Inspired by flat property tax revenues, Ted Evanoff’s article on Tom Intrator, and the local rise of 30 yr abatement terms for urban renewal, this blog benchmarks $11.5M in annual Memphis/Shelby taxpayer shortfalls from Downtown Memphis Commission / Center City Revenue Finance Corporation abatements. The benchmarking is versus Kansas City MO’s similar 353 and Land Clearance Redevelopment Authority (LCRA) programs. The programs are offered by the Kansas City Economic Development Corporation (KCEDC).

The Downtown Memphis Commission (DMC) is administered by Jennifer Oswalt and Bobbi Gillis chairs the abating board within the DMC entitled Center City Revenue Finance Corporation (CCRFC). Thus far, this blog has focused its attention on excessive job incentives administered by the Economic Development Growth Engine (EDGE). This is primarily due to the fact that under Oswalt and Gillis, DMC abatement data is much harder to access, effectively making the data much less transparent than EDGE.

At the same time, urban renewal real estate investment incentives require a different evaluation methodology than EDGE’s job incentives. To that extent, for this evaluation, Kansas City, MO was chosen for a benchmarking analysis based on its many similarities to Memphis. Kansas City is a border, river and barbeque town that like Memphis and unlike Nashville is not a boomtown. For the benchmarking analysis, two KCEDC urban renewal programs were reviewed for benchmarking.

The Benchmarking

The KCEDC 353 program appears to be a Kansas City municipal government only abatement program while the LCRA program can abate taxes for multiple taxing authorities within Kansas City MO’s Jackson County. Based on a cursory review of past KCEDC agendas, the LCRA seems to be the most popular program used in Kansas City for urban renewal which is possibly due to its broader abating authority.

To that extent, here are each of the program benefits:

353 Program – Up to 75% abatement for 10 years and 37.5% for an additional 15 years for new capital investment (25 yrs)

LCRA – Up to 100% abatement on new capital investment for 10 years

Given LCRA popularity, KCEDC’s LCRA program is used for this benchmarking analysis with the maximum allowed abatement imposed on DMC approved PILOTs as found in the 2018 Shelby County Trustee Report. The 99 year Riverbluff Cooperative was removed from this survey as it appears the PILOT was designed to reflect a residential property assessment.

The analysis took all DMC abatement properties, applied the current day Memphis/Shelby tax rates for the life of the PILOT to derive an overall difference for the entire abatement term of DMC managed projects vs KCEDC LCRA program. The overall difference is a Memphis/Shelby $299M accumulated taxpayer shortfall due to excessive DMC abatements that date back to 1981 well before the time of Oswalt and Gillis.

Historic tax rates were not applied, which perhaps provides a discount mechanism of sorts, to convert amounts into current day accumulated tax revenue shortfall amounts. But don’t get wrapped up in exact historical amounts, as the evaluation is about a comparison of program terms while the historic abatement numbers bring life to the evaluation.

The overall evaluation is then translated into percentage, which shows abatements for DMC managed urban renewal is 56% in excess and resulting in $11.5M in annual Memphis/Shelby taxpayer shortfalls.

The primary excess driver costing Memphis/Shelby taxpayers is the lengthy abatement term of the DMC program. An example would be Auto Zone with a 40 yr PILOT that dates back well before Oswalt and Gillis showed up which current day taxpayers are still carrying around on their back and will be until 2033. This occurs as Auto Zone gets a new 15 yr 75% EDGE PILOT. On the other hand, while PILOT terms under the management of DMC have fallen over recent years, terms have never come close to averaging 10 yrs or less as is the case with the KCEDC program.

And, as of late, under Oswalt and Gillis, those PILOT terms have begun to climb again while abating 75% or more in taxes. Examples include Intrator’s 30 yr 75% PILOT, Loew’s 30 year and FedEx 22 yr 100% PILOT on new capital investment.

It just seems there is never any negotiation with these PILOTs while being excessive in an already nationally low business cost environment. It would seem the longer term PILOTs should have been something more like KCEDC 353 program of 75% for the first 10 years and 37.5% for additional years and up to 15 years (25 yr PILOT), with of course a 100% 10 yr abatement program as the other program option.

But, in a rigged system without oversight, the elitists under a fiscally liberal mantra, have carjacked the taxpayer while programming in flat tax revenues with high property tax rates for years to come on the back of a Memphis community in need. So unfortunate….

Conclusion

Without taxpayer justice, social justice, fiscal conservatism, workforce development as a priority or moving Memphis forward will only serve as a pageantry scam.

In this blog, $11M in annual Memphis/Shelby taxpayer shortfalls have been identified from DMC managed projects and $300M for the life of their projects. From this and previous blogs, add $11M for DMC, $25M for EDGE and $54M for deficient total wage growth since 2010 and one arrives at $90M in deficient annual Memphis/Shelby taxpayer shortfalls. And that does not include excessive TIFs or municipal PILOTs.

And this question should summarize the overall problem. Per the Shelby County Trustee PILOT report and excluding the Riverbluff Cooperative, there has been $824M in development since 1981 under the DMC program with the County now getting annual tax revenue credit for $123M in new capital investment. If there were no DMC PILOTs, wouldn’t there have been much more than $123M in development since 1981 in the Downtown Memphis area?

And the $824M in abated but realized new Downtown capital investment under DMC management makes me wonder where the $15-19B in new capital investment figure even comes from…..

PREMEDIATED CONSPIRACY

This blog contains new measurement insights with questions that might be asked in a typical political discourse where an anti-taxpayer conspiracy was not at play. There is no social justice or fiscal conservatism with the persistence of runaway elitism that supports $90M in recurring annual tax incentives.

Furthering local decline, there is an ongoing, elitist and premeditated conspiracy occurring in Memphis and Shelby County. Amidst new budget concerns, that have been in the pipeline for some time, the elitist conspiracy is being carried out by a vast and diverse public-private complex on the back of a Memphis community in need.

It’s premeditated because the public-private complex thrives without measurement, legislative oversight or course correction when public funding initiatives fail to achieve desired results and while the same people are rewarded. A conspiracy only takes 7 votes in local legislative bodies. But with regard to the County Commission, the conspiracy is unanimous.

Abating boards, such as the Economic Development Growth Engine (EDGE), routinely appear before legislative bodies where data supported concerns of bogus projection accounting, excessive incentives or botched workforce development efforts are never confronted or investigated while the same people are sustained when achieveing deficient results. All of this occurring, while corporate/real estate interests, for the small few, thrive on the back of a Memphis community in need.

As an example, the same person, Al Bright was recently reappointed to Chair the EDGE Board for another 8 years with a unanimous vote and without any questioning ! Bright, a corporate attorney, could hold no jockstraps in defending the deficient results of the EDGE Board while the reappointment insults taxpayers on so many levels.

Local legislators, in effect, disregard checks and balances found in rotating board appointments while rewarding Bright with a 16 yr overall term with the reappointment. Then, taxpayers are further insulted with the messaging that there is no one else capable in all of Shelby County in Chairing the EDGE Board. And investigative questions by legislative bodies or the press are never posed.

Below are some questions with new data insights that would typically be posed, on the record, in a non-conspiratorial legislative environment (with some rhetorical spin).

How Much Is being abated and spent on economic development Countywide ?

Nobody knows the answer to this question. First, because the question is never posed by legislators and secondly because there are no published reports that reveal the answer. Taxpayers can get a gauge of local incentives excessiveness by reviewing the 2019 State of TN Comptroller Report.

The report reveals that Shelby County has 512 parcels under PILOT contract, Davidson 35, Knox 68 and Hamilton 38. Review of this report, should lead one to conclude that the use of tax incentives are excessive in Shelby County. This reality thwarts tax revenue growth.

Another report that can be used is the 2018 Shelby County Trustee Report. The above analysis assumes City/County participation in abatements and makes calculations for City taxes if City taxes are not broken out in the report, on page 6, as is the case with Arlington and Millington. If this assumption is incorrect, please let me know and I will correct the above analysis.

Based on the former assumption, almost $90M in taxes are being abated across all of Shelby County per year. And that $90M does not include TIFs and local government grants. There is not a known report for TIFs and grants. Nor is there a report that forecasts PILOT revenue and abatements going forward. So the total for all incentives for all of Shelby County appears to be well north of $90M per year and will be for some time to come.

With respect to the Shelby County budget, its safe to conclude there is $25M+ excess in tax incentives per year based on previous benchmarking done by this blog. But no one seems to know the total amount of local incentives countywide as the conspiracy prevents discussions and comprehensive consolidated reporting on the matter while such reporting should relate PILOT recipients to their landlord. The previously proposed local small business tax incentive fiscal note impact (TIFNI) platform solution would have provided consolidated reporting and a tool for right sizing abatements. But that solution was kneecapped by the conspiracy.

The closed Memphis elitist system and conspiracy hates problem solving, taxpayer advocacy and local small business solutions that will help move Memphis forward. That is one reason why Memphis has a struggling small business sector and slow economic growth.

And also, current questions for the City of Memphis regarding their 2018 PILOT Report involve the absence of a Valero PILOT payment and low tax rate based on their reported capital investment and the absence of the 2013 Nike PILOT appearing in the report.

Can Anyone Hold a Jockstrap ?

No. Nobody can hold any jockstraps on defending the FedEx/Memphis Tomorrow public-private complex that is down in all categories. It now appears former County Chief Financial Officer, Chris McLean, came in saw what was left over from the Luttrell Administration and fought through one budget year. Then McLean, picked up, booked and got the hell out.

In addition to the excessive corporrate/real estate incentives, the collective conspiracy botched the workforce development system while stifling the small business sector resulting in deficient total wage growth leading to $27.5M in annually recurring Shelby County Tax revenue shortfalls.

Conclusion – Its a Revenue Problem

While there are always ways to reduce spending, the primary Shelby County Budget challenge stems from excessive abatements and slow total wage growth that lead to tax revenue shortfalls. The total Shelby County revenue shortfall from excessive abatements and slow total wage growth is approximately $52.5M per year.

But the conspiracy does not allow for investigations or discussions regarding revenue shortfalls from deficient economic and workforce development initiatives. So taxpayers can look forward to service cuts or significant increases in taxes/fees occurring on the back of a Memphis community in need. There is no social justice or fiscal conservatism in the face of runaway elitism…..

BUDGET & PACK OF LIES: Social Justice and Fiscal Consevatism

With structural budget problems, local social justice and fiscal conservative government efficiency efforts are a pack of lies in the face of runaway elitism. On balance, such efforts in Memphis are merely symbolic while serving as camouflage for runaway elitism. There is no social justice or fiscal conservatism in the face of runaway elitism.

The creation of the fiscally liberal Economic Development Growth Engine (EDGE) was sold on the basis of government efficiency and fiscal conservatism. And Black History Month was capped off last week with the unanimous reappointment of Al Bright as EDGE Board Chair.

EDGE was born out of the FedEx/Memphis Tomorrow complex that is down in all categories over 20 years while their initiatives use taxpayer money. And as EDGE Chair, Bright has marshalled 8 years of runaway elitism on the back of a majority black community in need. During the last 8 years, excessive corporate/real estate incentives have roared for the benefit of the small few, while small business has struggled and the workforce development system has been systematically botched using taxpayer funds.

Getting the tax rate right will help but it won’t make up $85M. The data suggests, the chief challenge is confronting a rigged elitist system where there is no legislative division. Productive division, rhetoric and political blame is needed in the system to check runaway elitism. In legislatures outside of Memphis, one will hear productive rhetoric within debate such as “corporate welfare”, “elitist giveaway” and “elitism”. But not in Memphis.

Local legislators will not even consider the data, discuss the existence of excessive tax incentives or the perils of an unchecked FedEx/Memphis Tomorrow public-private complex that has resulted in competitive ecosystem decline over the last 20 years. Fred Smith and Pitt Hyde are celebrated as “visionaries” when the truth is they are not even “revisionists” over the last 20 years which would be exercised through course correction within the public-private complex.

The above mutes taxpayer advocacy while labeling data supported taxpayer outrage as name calling within a rigged system. In the current environment, introducing legislation that appropriately blames the FedEx/Memphis Tomorrow complex for 20 years of deficient results would be a productive oversight check of the public-private complex. After all, the taxpayer in a Memphis community in need, takes the blame everyday while over $1B in deficient community investments can be accounted for under the unchecked FedEx/Memphis Tomorrow complex.

Structural Budget Issues and No Oversight

Based on testimony from County Chief Financial Officer, Mathilde Crosby, Shelby County has structural budget issues or not enough projected revenue in relationship to projected spending. This problem has been brewing for a while. Legislators questioned Crosby on an increase in assessment appeals and tax collections. But they did not address the structural revenue issues that pertain to economic development where legislative oversight has not occurred over the public-private complex.

The fact is in Shelby County, a lack of legislative oversight enables deficient public-private corporate community leadership. The former enables deficient economic development results and that begets deficient revenue with growing expenditures to support growth. All occurring in a closed system, while rewarding the same people for deficient results.

Given the Shelby County Trustees Report $51M in PILOTs and previous benchmarking done here, $25M per year can be shown to be excessive. Couple that that with deficient below peer average total wage growth, that equates to $27M per year in deficient Shelby County tax revenues and the total is $52M. That $52M is approximately 6.5% in property tax revenue or a 26 cents property tax increase. $27M in total wage growth deficiency can be attributed to a botched workforce development system and a culturally stifled small business sector as corporate elitism thrives.

The structural budget issue is predictable and has been brewing for a while in the economic development complex. But the FedEx/Memphis Tomorrow system operates unchecked while taxpayer advocacy is muted and ecosystem decline is normalized while the small few prosper.

Conclusion

Its unfortunate that local legislative bodies so readily dismisses data driven dissent, the local citizenry, community activism and its own small business sector.

In a recent crowd sourcing project, regarding the reappointment of Al Bright, participants that included locally known leaders were polled on how they would label such reappointments of the same people while abandoning checks and balances found in rotating board appointments. The following rhetorical terms were returned in the poll: “runaway elitism”, “racist elitism”, “assholism” and “institutional oppression”.

While small savings and improvements in revenue collection can be found, deficient corporate community leadership and runaway elitism that feeds on a Memphis community in need is the chief structural budget culprit.

Meanwhile, mere citizen taxpayer advocacy in the local discourse and in the face of runaway elitism is dismissed and not engaged while being seen as “inappropriate”. That is what they do here. The elitists carjack and rip people off and when folks publicly complain, they are labeled “inappropriate”.

Maybe that is a good bit of the problem…..

Racism or Elitism ?

POLICY: Carjack The Taxpayer

BLINDFOLDED: Workforce Development

Local workforce development practitioners are being asked to be productive effectively blindfolded and without data. Since October, I have attended 4 workforce development meetings, led by highly competent professionals and facilitators, that I know would not choose to convene a large number of professionals on multiple occasions without any data. In fact, such gatherings without data, results in diminished productivity while costing taxpayers.

In the pipeline, since October after 5 years without data and the persistence of disconnected workforce development efforts, the community awaits a report from Burning Glass. Burning Glass is a company out of Boston who does labor market analysis. Labor market analysis is endless and never perfect, while in most environments, at least some form of summary data is provided to local professionals so they can be productive in their work while awaiting final report production. But not in Memphis.

To that extent, routinely it is said by practitioners in these meetings, that go back well beyond October that “we meet all the time and nothing happens”. It’s true. Disconnected workforce development efforts have persisted for 5 years in Memphis costing taxpayers an estimated and now recurring $15M per year. Additionally, fundamental questions and themes commonly emerge from such meetings with no specific answers while wasting valuable time and taxpayer money. Some of these questions are below.

What’s The Goal and How do We Measure it (Data Requirement) ?

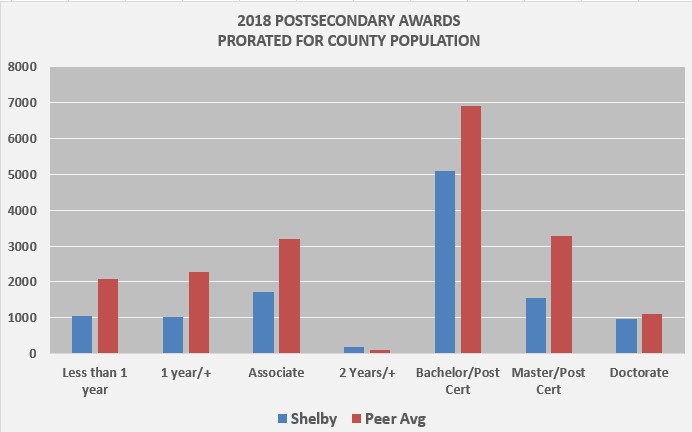

Concerns of showing up on time and drug use, which are voiced throughout the country, are often voiced as obstructions to employment. But, in many ways, those areas reside outside of the control of the education sector. At the same time, increasing post-secondary completion rates resides within the control of the education sector while targeting grades 8 thru adult. The fact is, when compared to its peer counties and based on its population, Shelby County needs to increase post-secondary completion rates by 6,000 per year across all award levels.

Sample Goal: Increase post-secondary completions across all award levels by 1,500 per year with an increased focus on 1 and 2 year awards over the next 4 years.

What about career planning, awareness and soft skill development ?

This is a data, curriculum and marketing requirement. In order to increase the post secondary completion rates, career planning and navigation must be implemented in the standards based academic curriculum for all students starting in middle school and continuing in high school. This curriculum work is not limited to career and technical education participants but is for ALL students so that enrollments and completion rates will increase for in demand post-secondary career pathways.

In this way, through curriculum integration, its not additional content for educators to deliver but just part of the academic curriculum where the discrete in demand soft skills, as identified by data, are integrated into the academic curriculum experience.

This curricular experience alerts students and parents to in demand career opportunities that align to students interests, preferences and skills while educators address academic standards and promote State of Tennessee measured Early Post-Secondary Opportunities (EPSOs)

Sample Goal: Develop initial standards based curriculum templates that promotes EPSOs by the end 0f 2019-20 school year for initial implementation in 2020-21 with supporting professional development occurring in the Summer of 2020

What about professional development for educators ?

Because most educators career paths consist of them going to school, college and going to school to work, they lack confidence in discussing career content that resides outside of academia. To that extent, professional development and standards based academic content is needed to help them increase their confidence. There are programs to support this need such as this Pennsylvania Teacher in the Workplace Program.

At the same time, Memphis is fortunate to have the Junior Achievement (JA) Biz Town facility that is designed to model the local economy through scenario based learning. This facility, typically used for student learning, would be excellent for educator professional development to expedite educator career content professional development at scale while boosting the revenues and visibility of Memphis JA. This JA experience would of course coincide with other professional development opportunities.

Sample Goal: Design educator professional development that leverages JA Biz Town for Summer 2020 delivery

What about Funding and Wraparound services ?

Locally, wraparound services have come to mean all of those services that financially complement the traditional education experience in areas like public transit, child care and funding for books in for example what is found with the Southwest Community College Foundation. Wraparound services is largely a funding requirement to boost and improve existing programming for increasing post-secondary completion rates. Additionally, greater funding is needed for workforce development within the context of overall economic development.

Sample Goal: Equipped with an economic development business case, publicly advocate for increased public-private funding for workforce development, in legislative Chambers on a regular basis, while requesting specific amounts of funding.

Conclusion

At least some recognized summary form of labor market data is needed to facilitate productive workforce development planning and goal setting efforts. Without it, taxpayers time and money is being wasted…

I

BECOME AN EXPERT ON EXCESSIVE INCENTIVES IN MEMPHIS

Using research, anyone can become an expert in proving excessive corporate/real estate incentives exist in Memphis and Shelby County. These 3 below documents provide support for the existence of a minimum of $300M+ in excessive incentives. The former results in $25 to $35M in annual Memphis/Shelby tax revenue shortfalls due to excessive incentive policy. This represents $25-35M per year not going to true economic development like public transit, workforce and small business development. See below:

Tennessee Comptroller 2018 PILOT Report – One only has to count in the PILOT report the number of parcels under PILOT contract in each of the municipalities in the State of Tennessee. If one does that, it will be revealed that Shelby County has 431, Davidson 25, Knox 52 and Hamilton 38 parcels under PILOT contract. Benchmarking against the greatest holder in Knox County at 52 parcels under PILOT and prorating based on Shelby County’s greater population by 2x the existence of 104 parcels under PILOT contract could be defended for Memphis/Shelby. The excess from this evaluation results in a 327 parel PILOT excess when compared to Knox County and greater when compared to Nashville/Davidson County.

Making Sense of Incentives – Dr. Timothy Bartik’s research, primarily on state tax incentives programs, provides a methodology for evaluating local job incentives programs. If one applies Bartik’s research, as modeled in his research, they will multiply EDGE Scorecard claimed revenues by 12.5%. As of 2/23/20. EDGE claimed revenues are $1,426,974,324. This will translate into the following evaluation: $1,426,974,374 x .125 = $178,371,796 in adjusted revenue. Next one takes adjusted revenues and subtracts $592,846,121 in abatements to arrive at net tax revenue in the following evaluation: $178,371,796 – $592,846,121 = $(414,474,325) in projected taxpayer losses. This equates to approximately $35M per year in defiicient Memphis/Shelby tax revenues due to excessive incentives.

Benchmarking Research – The following benchmarking research conducted by this blog reveals a $320M excess in EDGE awarded incentives. Using data as of the end of 2018 from EDGE, The Indianapolis Business Journal, Nashville.gov and The Bureau of Labor and Statistics, Memphis/Shelby incentives are benchmarked against two municipal peers in Indianapolis and Nashville. Additionally, macroeconomic data regarding small business vitality and gross domestic product is also contained which reveals tax incentive policy has not worked for the overall Memphis/Shelby economy. $320M equates to approximately $25M in deficient Memphis/Shelby taxpayer revenue shortfalls dues to excessive incentives.

The above can be used as research based tool in making the business case to redirect economic funding more toward true economic development in workforce, transit and small business. After all, workforce and small business are the chief economic growth drivers of local economies.