TRUE STORY: The Greater Memphis Chamber does not have goals for or anyone tasked with overseeing small business growth. The former was uncovered in the Greater Memphis Chamber’s testimony before the Shelby County Commission’s Economic Vitality workgroup on Thursday. Isn’t small business what Chambers are all about ???

This is especially concerning as the Chamber has 32 employees with none of them tasked with the work of small business growth which is where most economic growth originates. This occurs while local small business vitality has plummeted for the last 5 years. And further, The Chamber lacks an articulated alignment protocol for workforce development, a policy position on funding public transit and a coherent economic development plan to support local growth after 1 year of planning.

What is known, is that the Chamber supports robust and largely unchecked economic development incentives for corporate/real estate interests and government funding for local pet nonprofits. At the same time, it was refreshing to hear, from Chamber testimony, demand concerns for local small business. After all, such demand to increase small business receipts is going to come mostly from the private and not the public sector.

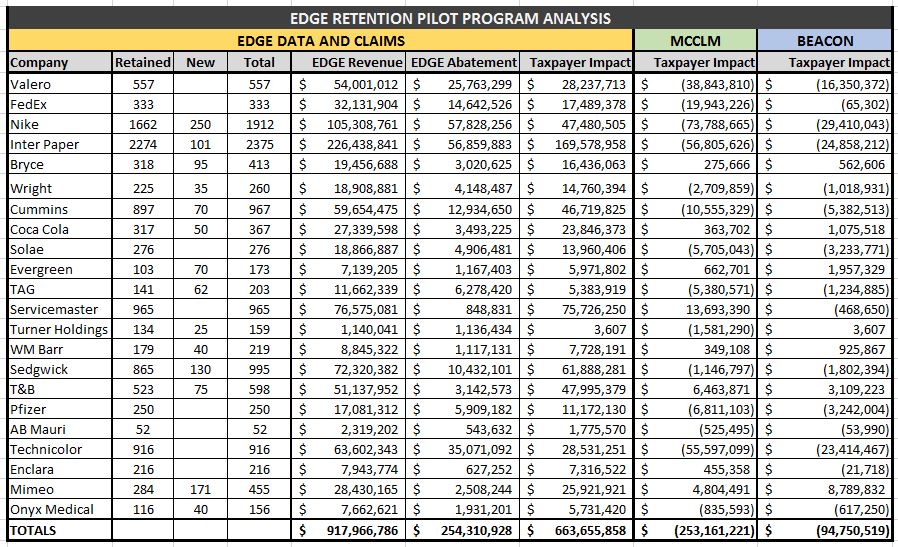

Further, testimony by Shelby County Equal Opportunity Compliance (EOC) officials revealed concerns over corporate/real estate incentives as small business gets left behind. Incentive reform is needed to curtail excessive incentive awards that undermine public resources which support small business as the few at the top prosper.

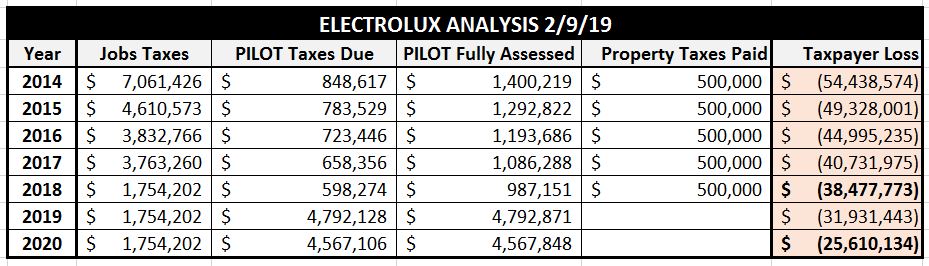

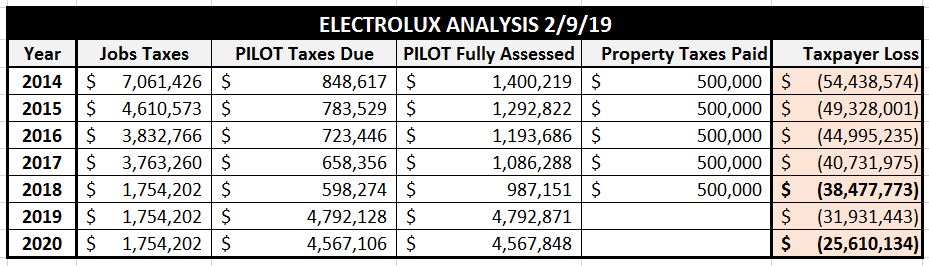

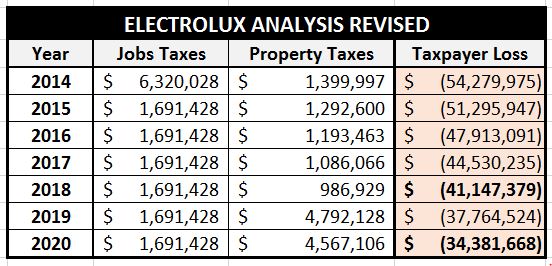

While responsible economic development incentives should continue for industry recruitment and large local expansions such as JNJ, incentive reform should end retention Payment-in-lieu of taxes (PILOTs), residential PILOTs and reserve Tax Increment Financing (TIFs) for truly blighted areas while not relying on census tracts to define such areas.

The Planning Juggernaut

For whatever reason, the Memphis economic development complex never seems to get started with the work of true economic development. With a whole host of initiatives and event pageantry going on at any given time, it seems local economic developers are constantly engaged in seeking funding for or planning the next big thing as opposed to engaging the work of economic development.

For example instead of engaging in the economic development activity of promoting ACT WorkKeys for workforce development or a sustained call to action for increasing small business transactions by the private sector, the Chamber is immersed in planning a “workforce summit” for the Fall and a “Memphis First” campaign to support small business. It’s a Planning Juggernaut.

MRYE – Memphis Raise Your Expectations saw this coming and proposed thoughtful research based solutions to local legislators to kickstart the work of economic development. But, that went nowhere as local legislators seem to only schedule and listen to the same parade of organizations and players as the closed system starves out small business and a community in need.

Small Business Importance

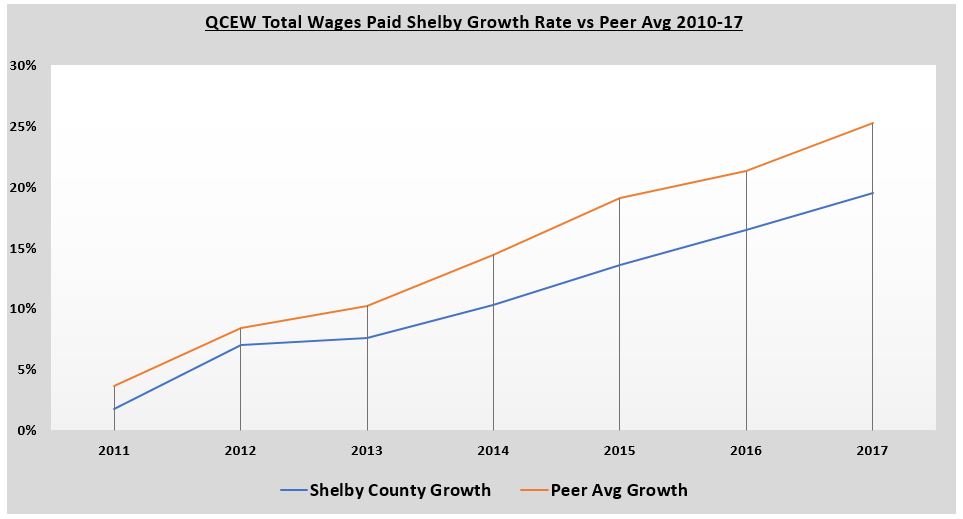

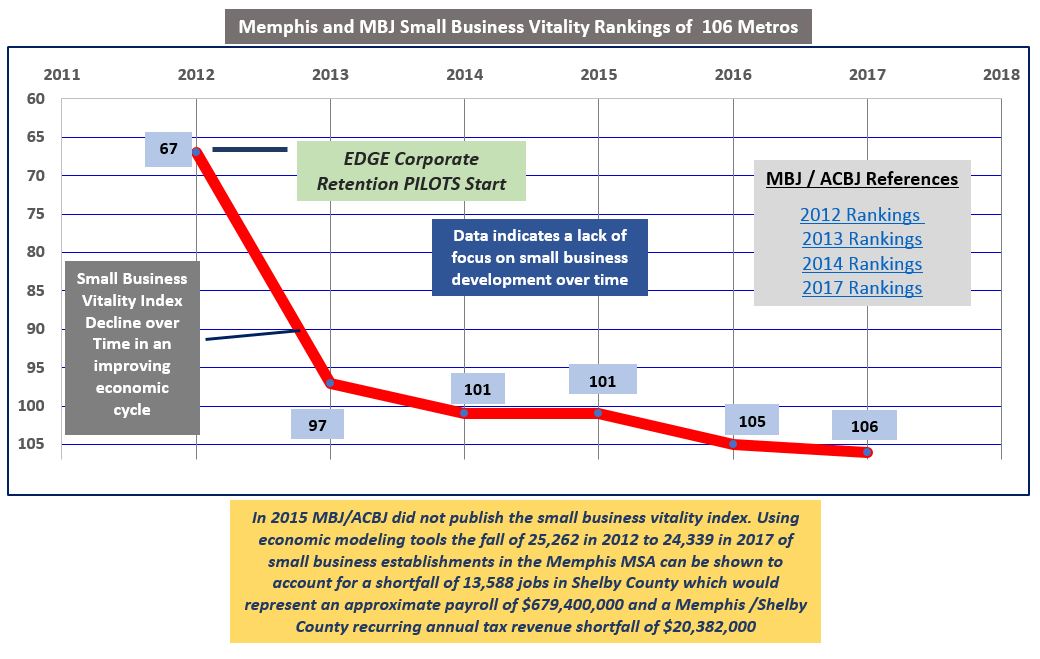

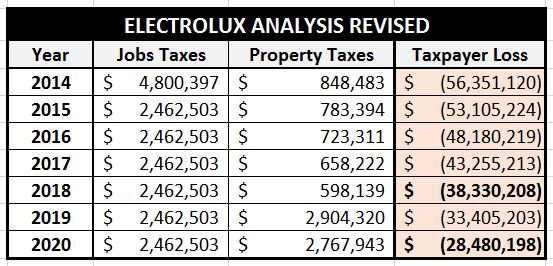

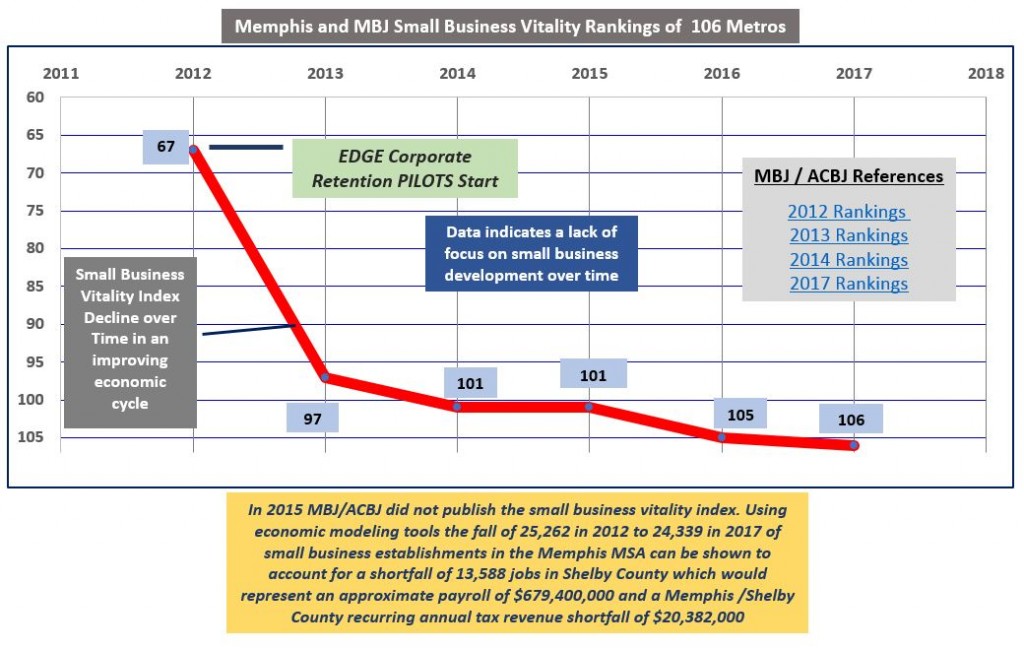

The reason small business is so important is because a large percentage of deficient wage growth can be attributed to falling Memphis small business vitality. Almost 50% of below peer average wage growth comes from falling small business vitality which results in an estimated 14K fewer jobs, $700K in lost annual wages and $20M in Memphis/Shelby recurring annual tax revenue shortfalls since 2011. See the chart below:

The fall in small business vitality corresponds with the initiation of the retention PILOT program which supports corporate/real estate interests and wealth transfers away from a community in need. Couple the former with social obstruction of a closed Memphis Tomorrow business culture and botched workforce development efforts and an ecosystem decline by design framework results.

The fall in small business vitality corresponds with the initiation of the retention PILOT program which supports corporate/real estate interests and wealth transfers away from a community in need. Couple the former with social obstruction of a closed Memphis Tomorrow business culture and botched workforce development efforts and an ecosystem decline by design framework results.

The only way to reverse Memphis economic development trends is for Memphis Royalty to engage those very people and entities that they have shut out for years through economic development policy and social obstruction. That will require Memphis Royalty to seek out small businesses to engage and nurture with transactions.

Most of the local small business initiatives focus on supply side business planning assistance, incubators for business funding support and not a demand side call to action for increasing local small business receipts. This demand side omission is a strategic miss.

Small Business Call to Action – Steps

As the Memphis planning juggernaut continues, below are some simple steps that Memphis Royalty and the private sector can take to increase small business receipts by getting started today:

Chamber email/social media local small business support call to action

Companies should prepare their personnel for the need to support local small business which will require new vendor training and may be challenging

Companies should develop procurement goals for increased local small business support

Review vendor lists for remote vendors and replace them with one of these local vendors found in this spreadsheet that contains Memphis City and Shelby County government locally owned small businesses and MWBEs. This step was mentioned in Chamber testimony as part of future campaign plans but needs to start right away.

Research the availability of funding support perhaps with Workforce Investment Network that might help underwrite vendor transition and training costs to help local small business stay competitive

Reversing Memphis small business vitality requires challenging and intentional action by Memphis Royalty and local private sector concerns. It’s the only pathway.

Conclusion

Restoring Memphis economic vitality will be heavy lift. It starts with a sense of urgency away from planning, pageantry and listening to the same people. Unfortunately, current economic development thinking involves getting the very same people together bi-monthly, that have been fostering the decline of Memphis economic vitality. This won’t work with efforts burdened with the same thinking and closed culture that has strangled local economic growth.

Legislators can help by bringing needed transparency to a closed system, reforming incentives, practicing engaged oversight and demanding results while asking Memphis Tomorrow for $1.5 billion in upfront philanthropic contributions to bring Memphis up to speed with it peers. Without such leadership, Memphis can expect, more of the same…….