EDGE Retention PILOT Program (A Memphis Tomorrow Bi-Product)

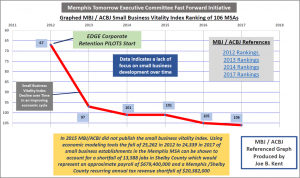

EDGE and its job retention/expansion Payment-In-Lieu-Of-Taxes (PILOT) program is part of the largely taxpayer funded Memphis Tomorrow Executive Committee Fast Forward initiative. Overall, when accompanied with below peer average economic growth and based on quantitative analysis when considering the economic impact of capital investment, the retention component of the retention/expansion PILOT program, over time, appears to have served as a community disinvestment program. This disinvestment comes at the expense of Memphis/Shelby County small business development, the business community and the community as a whole. The graph to the right can be enlarged by clicking the image which shows declining small business vitality since the EDGE retention PILOT program started.

be enlarged by clicking the image which shows declining small business vitality since the EDGE retention PILOT program started.

This blog calls into question incomplete and bogus accounting used to justify excessive tax abatements against the existing tax base for retaining existing jobs. These tax abatements administered by the Economic Development Growth Engine (EDGE) are called retention PILOTs and differ from new job expansion PILOTs. A different projection accounting methodology is needed each for both retention and expansion PILOTs. Some retention PILOTs include new jobs along with abatements for retaining existing jobs. A retention PILOT, in this blog, is defined as any PILOT that contains more existing jobs than new jobs and applies a different accounting methodology for accounting for retention PILOTs and jobs that already exist in the community versus new job expansion PILOTs.

Although, at the same time, a study from the Economic Institute proves that economic multipliers should not be used in projecting tax revenue for warehousing jobs, new job expansion PILOTs are not questioned in the below evaluation. If the Economic Institute study were applied and economic multipliers were not used in this Amazon new job expansion PILOT, EDGE projected revenue would drop from $37M to $19M. This would result in a net taxpayer benefit of $4M as opposed to the $22M projected by EDGE. The recent Economic Institute study in effect, calls into question the economic modeling used by EDGE as it was developed in the 1970s.

As far as overall tax incentive policy, this blog recommends an end to retention and residential PILOTs and tax increment financing (TIFs) in non blighted areas while recommending responsible PILOTs for industry recruitment, large local expansions and TIFs for truly blighted areas and not blighted areas as defined by census tracts alone. Additionally, a new EDGE Board is needed with a financial incentive structure aligned to customer taxpayer interests and not corporate/real estate interests.

EDGE Retention PILOT Program Evaluated

The problem with EDGE retention PILOT accounting carried out by the EDGE Board over a period of 8 years is that the accounting is incomplete and bogus resulting in a projected $600M gain from abating $250M in taxes against the existing Memphis/Shelby tax base. Common sense says that abating taxes against the existing tax base is a tax loser and when using complete projection accounting estimated Memphis/Shelby tax losses range from $95M to $120M which results in approximately $800M in EDGE projected tax revenue overstatements. The projected tax revenue overstatements were used to justify corporate socialism as found in excessive tax abatements.

The EDGE Board assumes in their projection accounting, a 100% chance of Memphis/Shelby company operational departure while not accounting for the benefit of the remaining workforce upon company departure or opportunity costs that result from forgone community investments due to retention tax abatements. Assuming a corporate profit motive, companies are less likely to choose the more expensive and disruptive option of operational relocation and a remaining workforce will continue to be part of the tax base upon any operational relocation. To fully project tax revenue from retention PILOTs, these variables must be accounted for while also accounting for lost community benefit that come as a result of retention tax abatements.

Since this blog originally questioned retention PILOT accounting, The Beacon Center of Tennessee has also published a study (pdf page 8) that calls into question EDGE retention PILOT accounting. In the study, Beacon, a Nashville based advocacy organization, makes it’s case using a sampling and not all EDGE retention PILOTs. The Beacon model derives total projected retention PILOT tax revenue from the retention tax abatement by considering (New Job Tax Revenue with Economic Multipliers Applied)+(Construction Tax Revenue)+(Property Taxes Paid during PILOT term). The below table extends the Beacon model beyond a sampling to include all retention PILOTs.

The MCCLM method contained in this blog uses a different probability methodology to derive projected tax revenue and is as follows (EDGE Projected Tax Revenue) – (Probable retained revenue without retention PILOT but with abatement provided for new jobs Only)- (Economic impact of remaining workforce should a company depart with 50% workforce impact to tax base upon company departure) – (Economic impact if retention component of the abatement were invested in the community).

The MCCLM probability model, assumes a for profit motive of private concerns and considering this applies a probability of retention given the much greater cost of disruptive operational relocation when compared to maintaining local operations. Its much more expensive to move than it is to maintain operations even if a tax abatement is offered in an alternative location. And as far as the cross border threat, much of the tax revenue would be retained and not lost if a company decides to relocate to Northern Mississippi or Eastern Arkansas.

A recent change was made to the MCCLM retention PILOT accounting modeling that accounts for 50% of abated tax revenue that would not be available from improved property investments for 40% of the departing companies while assuming a 60% retention rate without the availability of a retention PILOT. Additionally, a weighting feature was added to account for personnel and capital investments that directly benefit the Memphis community. This accounts for opportunity costs from forgone community investments that come as a result of corporate socialism found in the practice of excessive retention PILOTs.

The MCCLM method assumes a 60% retention rate without an abatement for existing jobs, 2.0 economic multiplier for investing in jobs that directly serve the community and 50% of the retention abtaement for capital expenditures that result in financial asset value and economic impact like a MATA bus or a community center. Keep in mind, EDGE uses economic multipliers in their economic modeling that range from 1.5 to 3.5 for jobs that serve global or national interests.

The spreadsheet for this work can be accessed here and the user can change the assumptions in the orange, green and purple boxes. The main point of this blog is to provide a quantitative contextual analysis to public-private partnerships that involve taxpayer funding. All to often, for example, tax abatement discussions devolve into all or none without a quantitative context. Please forward any questions to jkent@pathtrek.net.

The findings of, in a sense, the collaboratively competing models in Beacon and MCCLM can be found in the tabs of this spreadsheet, the table below and summarized in the following points confirming incomplete bogus accounting for the EDGE retention PILOT program. Keep in mind the generous 60% retention rate actually works in EDGE’s favor in the MCCLM modeling as compared to the 98% research based retention rate inferred in the recent Beacon Center of Tennessee Daily Memphian opinion piece. In the article, Ron Shultis says, “While defenders would say that those jobs would not have been retained had the abatement not been given, the research does not back that up. Instead, research shows these incentives make a difference in as few as 2% of instances”. See below:

EDGE Claims a $664M gain from retention PILOTs

MCCLM effectively confirms common sense that abating taxes against the existing tax base is a direct tax loss in a $120M loss resulting in a $784M EDGE projected revenue overstatement from retention PILOTs. This analysis also assumes the extension of a tax abatement for new jobs only as contained in retention PILOTs.

The Beacon methodology finds a $95M loss resulting in a $759 EDGE projected revenue overstatement

Adjusting EDGE revenue accordingly, the MCCLM method finds that the entire EDGE PILOT program, to include expansion PILOTs, is operating at a $765k projected taxpayer loss and the Beacon method finds $43 gain. EDGE claims a $802M gain as contained in the entirely Bogus EDGE Scorecard.

MCCLM Individual EDGE Retention PILOTs Evaluated w/ PILOT Profiles

The below work, which may be useful to some, was conducted before changes were made in the modeling and accounts for each of the PILOTs being accounted for individually.

The above MCCLM applies a single probability against all EDGE retention PILOTs through to the present. The below methodology applies a probability based on the type of capital investment and disruption to the business in the form of capital investment groups through the end of 2017.

Grades throughout this site are not a grading of companies but are grades for the retention / expansion PILOTS as supported by Memphis local economic development policy. Just below are assigned summary grades and costs of the EDGE retention/expansion PILOT program using an individual PILOT evaluation model with a grading system:

- Retention/Expansion PILOT Program Grade: F

- Community Ecosystem of Tomorrow Vision Grade: F

- Overall Business Community Benefit Grade: F

- Memphis/Shelby County Estimated Taxpayer Loss: $267.6M

- Memphis/Shelby County Estimated Annual Taxpayer Loss: $18.8M

- EDGE Overstated Total New Tax Revenue Generated: $885M

EDGE Retention PILOT Capital Investment Category Summaries and Grades

Grades for individual company profiles may differ from that of the capital investment category grade below. To access individual category and company profiles, click the hyperlinks below for the associated capital investment category. Within the company profiles a more complete and responsible accounting methodology is employed in addition to the EDGE economic modeling to more effectively estimate Memphis/Shelby County taxpayer impact of the retention/expansion PILOT program. The formula for those calculations is disclosed within the category pages with 19 company retention/expansion profiles provided. Current EDGE economic impact modeling for “total new tax revenue generated” effectively makes the following assumptions: 1) 100% of the 19 retention/expansion companies and their associated direct and indirect jobs will leave Memphis/Shelby County without a tax abatement for existing jobs directly employed by company PILOT beneficiary and 2) that there is not a forgone economic impact / tax revenue loss if retention tax abatement proceeds were otherwise invested directly into jobs/resources such as public safety, education and public transit that directly serve the community ecosystem. The profiles exclude expansion PILOTS which are locally needed for new job creation and industry recruitment. The below analysis will show that some of the retention/expansion PILOTS have merit while none of them generate the new tax revenue as reported by EDGE. See below MCCL authored capital investment categories for EDGE retention / expansion PILOTS:

NOTICE: CRITICAL FEEDBACK, QUESTIONS OR SUGGESTED CORRECTIONS IS WANTED AND NEEDED VIA EMAIL OR COMMENT

Existing Facility and Consolidation in Shelby County Capital Investment – Grade A+

- Company: Evergreen (1)

- Taxpayer Gain: $400k

- Annual Taxpayer Gain: $26k

- Overstated EDGE revenue generated: $6M

Existing Facility Capital Investment – Grade F

- Companies: AB Mauri, FedEx, Pfizer, Solae, Turner Holidings, Valero and WM Barr (7)

- Taxpayer Loss: $110.5M

- Annual Taxpayer Loss: $8.2M

- Overstated EDGE revenue generated: $200M

Existing and Additional Facility Capital Investment – Grade F

- Companies: Cummins, Hollywood Feed and Nike (3)

- Taxpayer Loss: $110.4M

- Annual Taxpayer Loss: $7.35M

- Overstated EDGE revenue generated: $213M

Local Facility Relocation Capital Investment – Grade C

- Companies: Bryce, Sedgwick and T&B (3)

- Taxpayer Gain: $2.45M

- Annual Taxpayer Gain: $145k

- Overstated EDGE revenue generated: $125M

New and Existing Facility Capital Investment – Grade F

- Company: International Paper (1)

- Taxpayer Loss: $59.5M

- Annual Taxpayer Loss: $4M

- Overstated EDGE revenue generated: $230M

New Facility and Consolidation from West Memphis – Grade D

- Companies: Coca Cola and TAG (2)

- Taxpayer Loss: $9.6M

- Annual Taxpayer Loss: $766k

- Overstated EDGE revenue generated: $40M

New Facility Capital Investment – Grade B

- Companies: ServiceMaster and Wright (2)

- Taxpayer Gain: $19.5M

- Annual Taxpayer Gain: $1.3M

- Overstated EDGE revenue generated: $71M