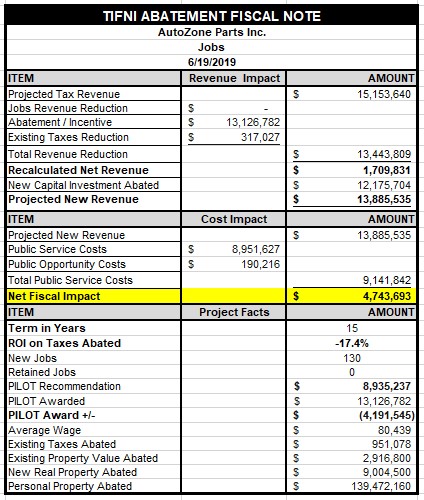

Away from the hype of artificial intelligence, TIFNI stands to redefine economic development in Memphis through a reintroduction of human intelligence and measurement. The tax incentive fiscal note impact (TIFNI) platform promises to effectively measure public economic development investments with the customer taxpayer in mind.

For years, the Memphis economic development system has operated on artificial intelligence of the type that projects massive taxpayer windfalls on the back of excessive tax incentives. All the while, the UofM has stood beside the author of such artificial intelligence and partner, the Economic Development Growth Engine (EDGE), while scooping up incentives for themselves as excessive incentives explode for the benefit of the small few in local corporate/real estate interests.

EDGE was born out of the corporate elitist FedEx/Memphis Tomorrow complex, a hold over from the Fonzie/Crump era rigged system days. As a result of a rigged system, lacking human intelligence and system measurement, the primary drivers of any local economy, in small business and workforce development have been dismissed. The former has led to declining small business vitality, a disconnected workforce development system and increasing poverty rates in Memphis all of which TIFNI proposes to correct through smarter economic development investments.

TIFNI Economic Development Measurement and Check on Elitism

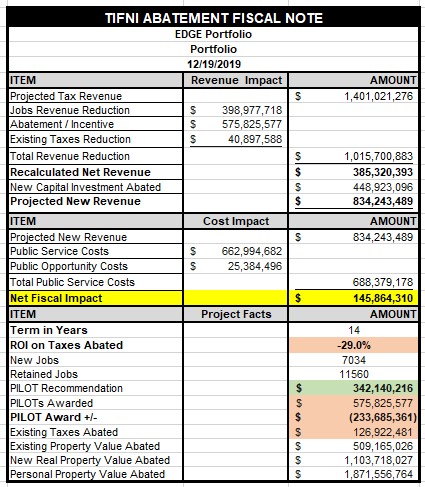

The locally owned small business (LOSB) TIFNI solution provides a fiscal note for every tax abatement. With TIFNI, economic development investments are measured based on the benefit to the customer taxpayer using reliable economic and fiscal impact analysis.

Further, TIFNI analyzes economic investments while considering opportunity costs that would otherwise make the community less attractive for economic investment if community investments are forgone. As a result of the implementation of the publicly administered TIFNI platform:

Taxpayers will know the return on investment (ROI) of economic development investments

Policymakers will understand economic development modeling to project future tax revenue

Policymakers will understand and apply the assumptions used in economic development modeling to project future tax revenue

Taxpayers will better understand the effectiveness of public-private initiatives with access to a measurement platform

TIFNI can be obstructed from implementation but can’t be beat. Unfortunately, the hack elitist may very well attempt to obstruct TIFNI and reliable measurement of the public-private complex. They have been obstructing common sense measurement for years. In many ways, it seems that the UofM is becoming the bureaucratic center of the rigged Fonzie/Crump era elitist complex. The Memphis elitist have consistently revealed they know how to rig the system but not how to competitively evolve the ecosystem.

The UofM and Obstruction of Ecosystem Evolution

First, lets give credit to the UofM for improving athletics, managing student cost increases and a solid public student university product. But what the UofM is not is a community economic development thought leader.

I have tried on multiple occasions to deal with the UofM and their partners. Its been a closed system for me as a local UofM graduate. Once was with Ted Townsend in the Summer of 2018 regarding solutions for stalled workforce development efforts and nothing happened. At the time, local workforce development efforts were 4 years behind schedule. The UofM meeting was followed by a Summer meeting in 2019 with Epicenter on the same subject. Nothing happened as small business was dismissed and more work was then shipped out of town to Burning Glass located in Boston. As a result, while being 5 years behind on connected workforce development, there still is no published labor market information to guide connected workforce development efforts.

Problem in Memphis, there is no sense of urgency while the elitist dismiss local small business and the taxpayer. Just this week, in an article in the Daily Memphian, regarding a learning grant received by the UofM, Dr. Vasile Rus said “In 10 years, it’s possible that we could have an institute here that would be helping Shelby County Schools and beyond”. Given the local needs, 10 years ??? No sense of urgency ! Why even say that ? Sounds like a page out of the Memphis Tomorrow playbook promising a better tomorrow.

On another occassion, I met with Marc Perrusquia who is over the new UofM “investigative” journalism department on the topic of economic development measurement. Perrusquia seemed to want to do a story on my work but it never materialized. Instead, the UofM terminated Shelby County peer economic development measurement with their Memphis Economy project during the City of Memphis election season. That to me was stunning, just to stop measurement for no reason. And then the rosy UofM/Paragon economic outlook study using a select survey group appeared later this year.

The economic challenge in Memphis is small business and workforce development. But the elitist partnership bureaucracies erected by the UofM end up starving out small business which sets small business up to have their ideas ripped off. There just is not a spirit of increasing transactional velocity in Memphis with LOSBs when good ideas arise that address community challenges. Instead, there is a new bureacracy that says all the right things while obstructing small business through bureaucracy.

Besides, it seems, based on press accounts, UMRF/Epicenter goals are more around growing small businesses into corporations as opposed to just building out a vibrant small business economy. The rigged Fonzie/Crump era culture is why Memphis only has 22 business establishments per 1,000 population leaving Memphis at the bottom of its peer group. Rigged systems don’t grow.

And then you try to meet with the likes of Allie Prescott, Dr. Rudd, David Waddell or Leslie Smith, they won’t meet with taxpayers with concerns or questions, even though they are publicly funded.

Conclusion

TIFNI checks an elitist establishment with reliable measurement. Public officials need to reject runaway elitism with fundamental measurement while recognizing the taxpayer as the customer in publicly funded economic development work. And policymakers need to know that there are public universities throughout the country that attract funding by just being independent thought leaders and not kowtowing to an elitist establishment.

But based on their track history, policymakers can’t rely on the UofM as an independent thought leader in community economic development matters. Nor can they rely on the UofM to have a sense of urgency in expediting innovation for community betterment.

At the same time, all is not lost. The UofM is steadily improving on the athletic front while keeping student costs down and producing a solid public university student product. But expeditious innovation for community betterment is probably not going to originate from the UofM……