Local elected officials often use sound bites to preserve the backwards Memphis economic development complex of the 1940s. These sound bites, without quantitative context, while true in isolation, don’t tell the complete story.

In City Council on Tuesday, Councilman Berlin Boyd said that the public doesn’t understand PILOTs and that the Council should be careful in their discussions on PILOTs while stating that most PILOTs provide a net financial benefit to taxpayers. And Commissioner Brandon Morrison, on Wednesday in Commission Committee said, that Memphis has the highest property tax rate in the State which might dissuade business investment. Both above statements are true but without needed quantitative context these sound bites result in an incomplete story from which taxpayers can make informed evaluations.

Further, Councilman Martavius Jones, in City Council raised concerns about relatively flat tax revenue growth and depreciation on personal property assets that receive the benefit of tax incentives. Jones thought it would be helpful to have the County Trustee appear before the Council Economic Development Committee. This may help some but not much as the Trustee effectively bills and collects the reduced tax payment as part of the payment in lieu of [full] taxes (PILOT) while publishing an annual report.

And finally, it would seem that a check on excessive PILOTs would most appropriately occur in Jones’ Budget Committee to take up PILOT reform and future restraint on budget busting excessive PILOTs.

Analysis – More Complete Story PILOTs

The question that should arise with relatively flat local tax revenues in times of economic expansion is:

“Are Memphis/Shelby taxpayers paying excessively for economic growth through tax abatements?”

And the answer is absolutely in $200-$400M in excess depending on how local PILOTs are benchmarked! The most egregious form of this excessiveness comes when real property taxes are abated on existing property in addition to new capital investment while providing 75% tax abatements for all for 10-15 years. It would also seem, abating taxes on existing real property would undermine the Pre-K funding formula.

But back to Boyd’s remarks, much of the public does not understand PILOTs to include legislators and perhaps even those on abating boards. A couple of reasons for the confusion is 1) the bogus EDGE projection accounting showing huge projected gains while local property tax revenues are relatively flat and 2) the 75% abatement amount for corporate/real estate interests naturally raises concerns where taxpayers don’t participate at least as much as corporate interests in tax revenue growth from economic development activity.

Further, local Memphis/Shelby taxpayers live in a relative bubble where there is no plan or defined measurement for economic development. To that extent, the below bullet points can document the excessiveness of the Memphis/Shelby economic development complex where abating boards are incented to represent corporate/real estate interests over the taxpayer through fee revenue based on the overall size of job incentive PILOTs:

3 corporate PILOTs in Nike, IP and FedEx Downtown totaled $148M exceed all of Indianapolis’s incentives that totaled $135M for 110 projects.

5 corporate PILOTs in Nike, IP, FedEx Downtown, Technicolor and Valero totaling $208M exceed all of Nashville’s PILOTs at $200M for 25 projects

90 Memphis projects at $500M+ exceeds by 50% both Indianapolis and Nashville PILOTs at $335M for 135 projects

A macroeconomic analysis, which reviews total employed job throughput using Bureau of Labor and Statistics Quarterly Census of Employment Wages, shows that Memphis paid $14.5K per job while Indianapolis and Nashville both paid $2.5K per job.

The above is a full-blown Memphis/Shelby ecosystem nightmare brought to taxpayers by the FedEx/Memphis Tomorrow corporate community leadership complex. It can’t be defended on the political right or left as it is just Neanderthalishly STUPID in excess and hurts the entire community.

With historically twice the property tax rate of Nashville with $200M in job incentives, given the above analysis, had Memphis/Shelby had 50% total wage growth since 2010 like Nashville, the $500M in job tax incentives could be defended . But Memphis/Shelby had below average total wage growth for the period at 26% while Indianapolis had about average total wage growth at 32% and $135M in total tax incentives.

Next as far as Jones concerns over depreciation on abated personal property taxes, corporate interests enjoy a greater abatement in early years when personal property is more fully valued. For a 10 year abatement the personal property assets are annually appraised at an average value of 42% and for 15 years 35%. By the end the abatement term, when abated personal property returns to the tax rolls, the original property would be valued at 20% of its original value.

Overall, of EDGE’s capital investment figures, approximately $3.4B has been invested in real property, $1.6B in personal property while $450M in existing real property, which is most concerning, has received the benefit of tax abatements.

In short and on balance, given the above excesses and with a botched from the top workforce development system, Memphis/Shelby has not been engaged in the work of economic development. Instead, the bully hack FedEx/Memphis Tomorrow economic development complex has been engaged in feeding on a community in need while subsidizing corporations and real estate developers under hack “trickle down” better tomorrow theory. The above activity significantly undermines true economic development in safer streets, small business and workforce development.

The solution to correcting the above excesses is right sizing abatements using the following formula that most in the general public would understand. That formula is 50% of new capital investment provided current job levels are maintained while abating 1% of total wages for new jobs only. EDGE term and investment minimums would remain in effect. Applying the above formula to historic abatements would have reduced overall job incentives by $200M since 2010 while right sizing abatements on a per job basis making Memphis abatements twice as much as Nashville.

This proposed reform generously surrenders the benefit of the nationally low- cost business environment of Memphis while recognizing the high Memphis tax rate argument. Another argument that has been surrendered vs Nashville and Indianapolis is a minimum wage eligible for abatement which is now set at $18 per hour in Nashville and Indy.

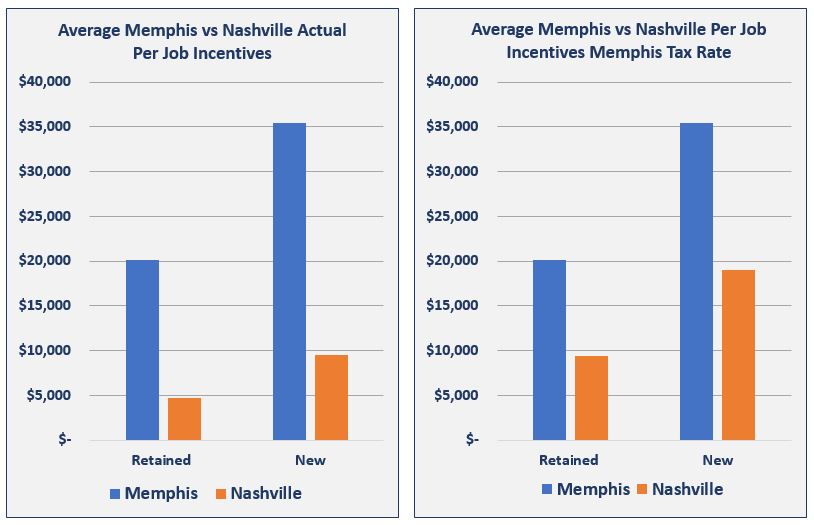

The below charts show how historic Memphis job tax incentives compare to Nashville on a per job incented basis in actual terms on the left while doubling the Nashville abatement amount on the right to compensate for the higher Memphis tax rate.

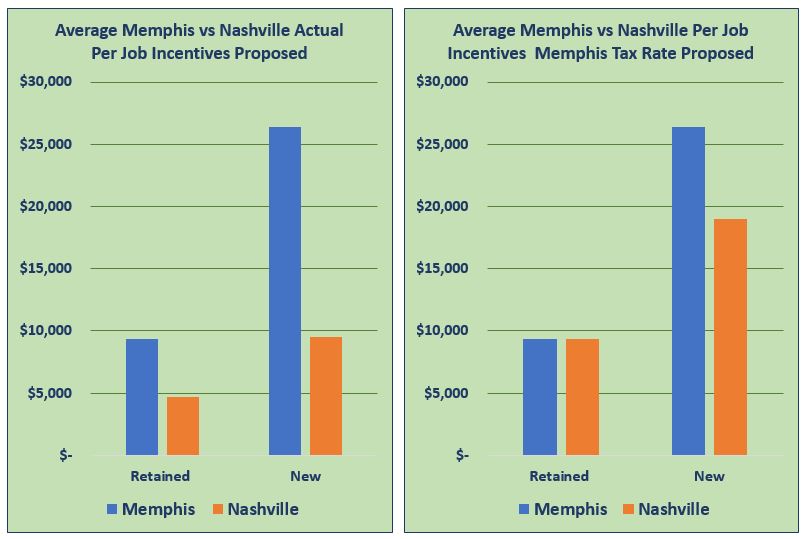

The charts below show the impact of the proposed job tax incentive reform model based on PILOT history. In effect, the proposed reform model would still be in actual terms more than twice the amount of Nashville on a per job basis amount as shown on the left while right sizing PILOTs and still being more than Nashville when considering the higher Memphis tax rate as shown on the right. This proposal generously surrenders the lower Memphis business cost operating environment and minimum eligible wage arguments.

To achieve overall 50% on new capital investment, local companies would probably get less than 50% abatement while relocating companies would get more than 50% abatement to compensate for relocation costs to bolster the success rate of external economic development recruitment work. See below charts:

Analysis – More Complete Story High Property Tax Rate

Commissioner Brandon Morrison regularly expresses concern for the high Memphis/Shelby property tax rate regarding economic development work. She is right. The Memphis/Shelby property tax rate is high both on a statewide and national basis. But even with the higher property tax rate, Memphis/Shelby has a low business cost environment ranking 13 out of 100 cities.

The chief question for businesses as far as cost is “what is the overall cost environment in Memphis/Shelby for business operations?” The answer is a very low cost business operating environment making Morrison’s concerns tell only part of the story. Her concerns are similar to a low-cost automobile (overall business costs) with expensive rims (high property tax rate). In this way, overall transportation costs are low as with overall Memphis/Shelby business operations cost in Memphis while conceding more expensive cost components. This reality of a low business cost environment should further raise concerns of excessive tax incentives in an already low-cost business operating environment. The fact is that Memphis/Shelby has been spending excessive amounts on a problem that it does not have in high business operations cost.

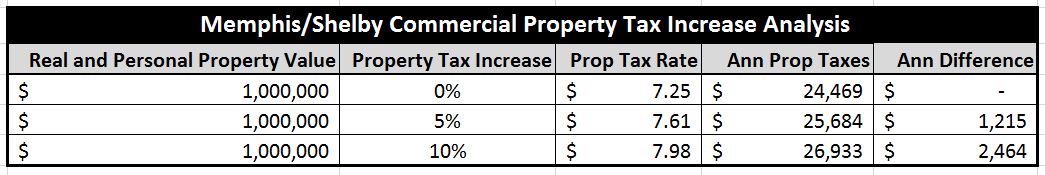

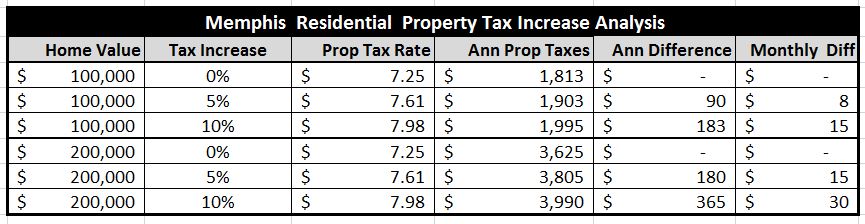

Moreover, an increased property tax rate is likely needed to make Memphis a more attractive business investment destination while bridging the gap for excessive tax incentives of the past. Given this, the below table reveals the increased amount of costs that would need to be absorbed or passed on to commercial real estate tenants with a 5% and 10% increase in the property tax rate on an annual basis. The below table assumes 25% of overall appraised property value is personal property depreciated to 50% of its original value. Also, below is a residential analysis.

Under the property tax increases above, annual business facility cost would increase by .12% for a 5% property rate tax increase and .24% for a 10% increase. A 5 % property tax increase would raise approximately $50M and a 10% property tax rate increase $100M.

Conclusion – Simply Bust It Out

It’s simple. Shelby County Mayor Lee Harris should bust out PILOT reform and a 10% property tax increase while welcoming specific counter proposals in tax utility fees (TUFs) and proposals from the Chamber to fund needed community improvements to attract business investment. The advantage of a property tax increase is that it is something everyone understands while providing a real solution. At the same time, a specific proposal such as a property tax increase puts other entities on the hook to define and provide specific counter funding proposals.

It would be especially helpful, if the local business community would agree to support a property tax increase and PILOT reform to bridge the tax growth revenue gap brought on by excessive tax abatements, the botching of the workforce development system and subsequent below average slow total wage growth.

With the combination of new funding proposals, PILOT reform and economic and workforce development implementation that leverage community assets, Memphis can optimize economic development efforts and achieve better outcomes for the community as a whole.