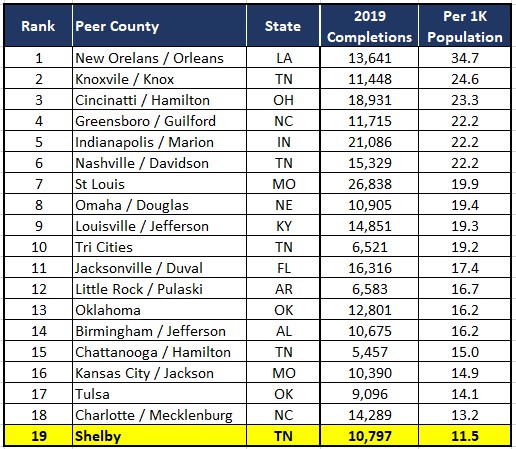

Garage Loan To Grant Conversion

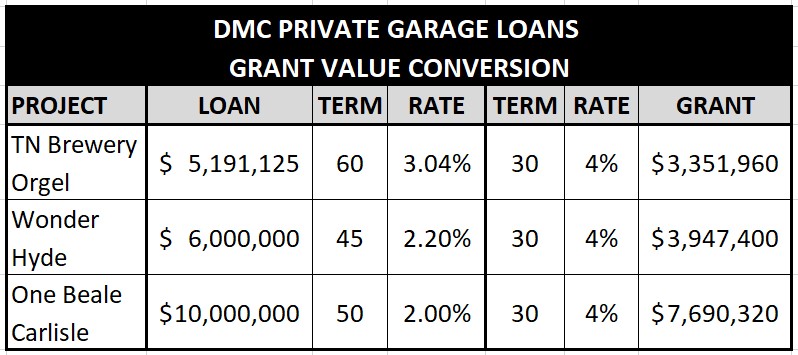

PILOT EXTENSION FUND: Run It Like a Business

Local leaders should allow the purchase of the 100 N. Main building using the PILOT Extension Fund. But they should reject Mayor Jim Strickland’s new $15M PILOT Extension and $10M Accelerate Memphis fund requests.

In the midst of COVID, since December 1, 2020, Strickland has strangely sponsored, an astounding $87M in expenditures for downtown public parking related projects. That is $77M from the Downtown Memphis Commission (DMC) PILOT extension fund and $10M from the proposed $200M Accelerate Memphis bond issue for neighborhood revitalization. Here are some quick facts about the PILOT Extension Fund (PEF):

The PEF is Memphis and Shelby County taxpayer, not DMC funds

The DMC manages 5,500 public parking garage spaces, that in 2019 pre-COVID, generate $2,025,547 in revenue or $368 per space.

The DMC PEF presently owes the City of Memphis $10.5M

Over 25 years, the PEF will consist of $137,381,691 in taxpayer funds. $15M existing balance + $102,622,791 in restricted tax proceeds + $19,758,900 in debt service payments

Most interesting, $19,758,900 in PEF proceeds comes from debt service payments from $23M in DMC loans for private garage development. The PEF was never intended to serve as a loan fund for private garage development.

Effectively, through the DMC PEF, $23M in taxpayer money has been misused, to construct private garages, using taxpayer funded loans. The loans provide an overly generous weighted average 49 yr term and 2.18% interest rate. The taxpayer funded loans were made to local “visionaries” like Hyde, Orgel and Carlisle.

Orgel is teed up to get another $3.5M loan with Strickland’s $87M parking plan, that includes $62M in parking projects, $22M to clean up the 100 N. Main blight, indirectly incented by the DMC Loews incentive package and $3.5M for Orgel’s Snuff District private garage.

Meanwhile, Councilman Martavius Jones is questioning these plans, where he seems to confuse who is behind the support of these lofty parking projects. Jones, representing taxpayers, stated in Council Committee, “we have already spent 80% of the $100M (actually $137M)”. It’s not spent yet, without City/County legislative approval.

Jones should be commended for his healthy skepticism of the proposed parking expenditures, while noting it is not the taxpayers but the Elitists planning to spend $87M for public parking. The $87M also includes $22M to clean up the 100 N. Main mess left by the DMC, who again, currently owes the City of Memphis $10.5M.

All of the above occurs under the Memphis Tomorrow “government efficiency” program. In their coaching, the corporate elitists commonly advise to “run government like a business”. Perhaps that is what should be done with the PEF, while serving the customer taxpayer.

Awakening and Run it Like a Business

Another legislative player in the public parking binge has been Commissioner Mark Billingsley. In December, after referring the PEF back to committee for review, Billingsley had an awakening of sorts. Two week later, Billingsley plowed forward in favor of $62M in public parking expenditures, while disallowing committee due diligence.

Now that is quite an awakening ! With that in mind, the below generous analysis occurs with a similar hypothetical awakening, that reluctantly accepts the need for more downtown public parking. To get there, one has to ignore the $250K DMC Downtown Parking Study, that showed a surplus of available parking in the downtown core.

To that extent, the below generous analysis evaluates planned downtown parking investments like a business. In this way, using a business lens, the question becomes:

“Today, what is the MOST that should be spent on downtown public parking?”

Given: DMC generated $2,024,547 in Pre-COVID 2019 parking revenue with 5,500 spaces or $368 per space.

Given: Currently, DMC will add 1029 public parking spaces from the $87M project

Assumption: Generously, all revenue from increased spaces will be treated as profit, with no associated expenses. 1029 spaces x $368 = $378,672. Even more generous, make it $400,000 per year in increased profits from increased and improved public parking infrastructure

Assumption: Downtown commercial property taxes will increase by $1M per year, due to improved public parking infrastructure.

Assumption: 20% of overall project cost are attributed to interest costs, since the $62M in approved projects do not include interest on borrowed funds.

Analysis: $400,000 (parking profit) + $1,000,000 (commercial property taxes)=$1,400,000 per year x 25 years = $35,000 000. The current approved public parking expenditures do not include interest costs, so the overall amount needs to be discounted for interest cost by an overall 20% . $35,000,000 x. 80 = $28,000,000

In this overly generous analysis, the most that should be approved today for downtown public parking is $28M.

Better Way – Recommendation

In the midst of COVID and considering the DMC owes the City of Memphis $10.5M, today, there is just a better way than $87M for downtown public parking related projects.

Given what has been approved in $62M, that leaves a $34M approval surplus from the most that should have been approved for public parking in $28M. Additionally, there is $25M more proposed. Given the former, these are recommendations to make up for the $34M approval surplus, in context with the $25M currently being proposed by Strickland.

The DMC should purchase 100 N. Main for $12M, within the existing $62M approved budget. This leaves an approval surplus of $22M ($34M-$12M)

For economic development purposes, EDGE should contribute $10M of their $22M in cash assets to the overall project. $22M – $10M = $12M approval surplus

The Orgel private garage project of $3.5M should be rejected because it is a misuse of taxpayer funding. $12M-$3.5M=$8.5M approval surplus.

Using a business approach, the above recommendations leave in place the current $62M approval but requires all proposed PEF work to be done within the approved $62M budget, while not allocating any of the proposed Accelerate Memphis funding to the 100 N. Main.

With these changes, a $34M approval surplus can be cut to $8.5M. More work to be done to find $8.5M but that too can be found. More on that later……

DMC Private Garage Loans

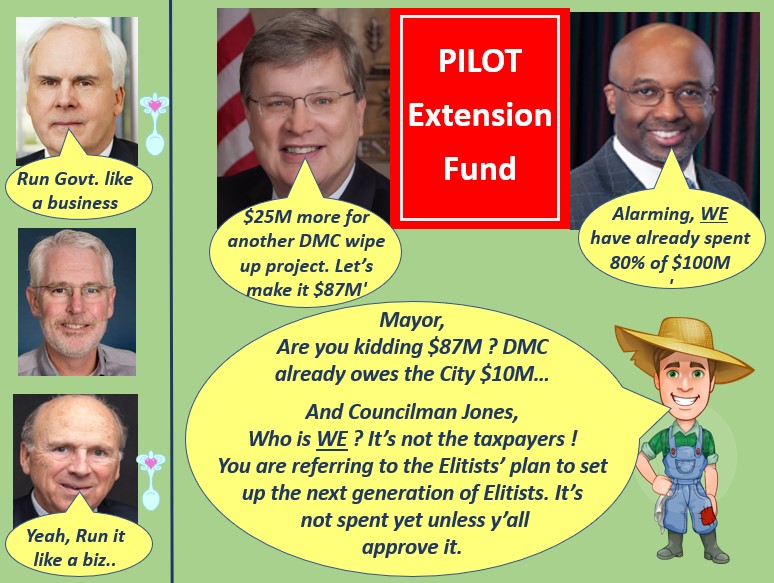

PIPELINE: No Community Benefit

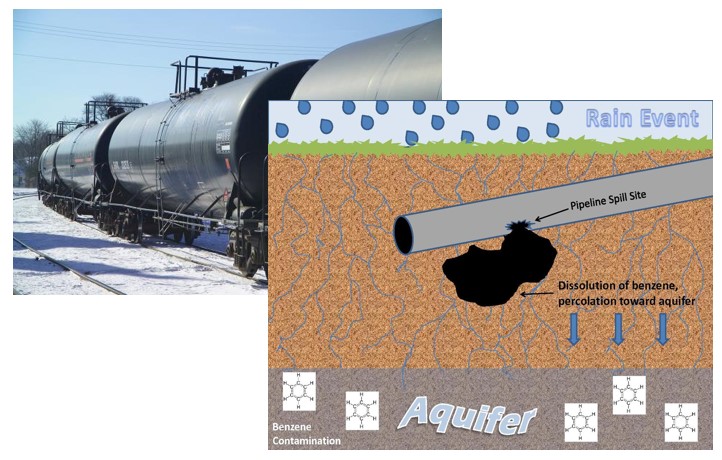

Who the hell in the community is FOR this pipeline ? If one thinks about it, no one really. Even Commissioner Edmund Ford, Jr., who has been cited as the closest public proponent of the pipeline, is not for it, but publicly neutral. That’s because, considering the risks, there is no community benefit to running an oil pipeline through the City of Memphis.

Valero, Plains All American and Byhalia Connection are really the only ones for the pipeline. Valero and Plains All American, headquartered in Texas, are set to net nearly $100M per year in estimated profits from the local 49 mile pipeline project, scheduled to transport $7.7B in oil product per year, from Oklahoma to the Gulf Coast.

More analysis on the project profits later. But the project involves the construction of an underground pipeline, in a seismic zone, putting high quality drinking water, located deep underground in the sand aquifer at risk. At risk, is high quality drinking water, also commercially used by a number of local companies.

Meanwhile, Byhalia Connection touts $3M in regional taxes during construction and $500K in Memphis/Shelby recurring annual taxes as benefits. Oh and lets not forget the $1M in mostly hush money doled out to local groups with the unfortunate inclusion of the Center of Applied Earth Science and Engineering Research (CAESER) at the University of Memphis for $250K. C’mon, this is community benefit?

CAESER is an unfortunate inclusion, because they could provide a powerful community voice by exercising public university thought leadership on the matter. CAESER is publicly tasked with researching risks to the sand aquifer that supplies local drinking water. But sadly, in exchange for a “gift” of $250K out of the $1M, from pipeline advocates, CAESER cannot take a public position on the pipeline.

While there are really no true community advocates, opposition has been mobilized by Memphis Community Against the Pipeline (MCAP), led by Justin J. Pearson. MCAP, while representing those that would be most impacted by a potential pipeline in the Southwest Memphis Black community, has mounted a strong community business case for opposing the pipeline, based largely on environmental injustice and community risks to precious drinking water.

And, Protect the Aquifer, led by Ward Archer, has also mobilized against the pipeline. Protect the Aquifer is dedicated to the protection, conservation and management of the Memphis Sands Aquifer. So why is Valero and All Plains for the pipeline ?

Analysis – Why FOR a Pipeline ?

First Valero is already into the Memphis/Shelby taxpayer for a $25M EDGE retention PILOT that they should have never been awarded in 2012. They were never going anywhere else other than where Valero Memphis sits today. Now, Valero wants to put local drinking water, which also serves as a commercial resource at risk, for increased profits and no community benefit.

First Valero is already into the Memphis/Shelby taxpayer for a $25M EDGE retention PILOT that they should have never been awarded in 2012. They were never going anywhere else other than where Valero Memphis sits today. Now, Valero wants to put local drinking water, which also serves as a commercial resource at risk, for increased profits and no community benefit.

The reason a pipeline is desirable for Valero is increased profits through the reduction of oil transport costs. Collectively, while scheduled to transport $7.7B per year in oil product, Valero and Plains All American are set to pocket an estimated $100M in increased profits. So how is $100M in profits derived ?

Analysis and Assumption

Below are the givens and the assumptions:

Given: Memphis Daily News $7.7B of product per year and $21M per day. At $50 per barrel that is 420,00 barrels per day to be transported from Oklahoma to the Gulf Coast and 153,300,000 barrels per year.

Given: US Energy Information Association The price to transport oil from point A to B by rail is $10-15 compared to $5 per barrel for pipeline.

Given: Byhalia Connection – Based on $3M in personal property taxes per year, along the entire route, the cost of the pipeline is estimated to be $200M. Depreciation at $10M per year over 20 year life.

Assumption: The cost of shipping by rail is assumed to be the higher $15, due to disrupting pipeline flow to load and unload tanker cars in transporting oil from Valero to the Capline pipeline in Marshall County MS.

Assumption: Plains All American profits $2 per barrel on $5 per barrel before pipeline depreciation costs. Both Valero and Plains All American profit by $12 per barrel before pipeline depreciation costs.

Estimate: Length of pipeline from Oklahoma to Gulf Coast is 800 Miles. Byhalia Connection is 49 Miles. 49/800 = 6.125% of total route.

Therefore the following analysis can be conducted:

153,300,000 Barrels per year x $12 x 6.125% = $112,675,500

$112,675,500 – $10,000,000 (Annual Pipeline Depreciation) =$102,675,500

The total annual estimated profit of Valero and Plains All American for the Byhalia Connection pipeline project is $102,675,500. Or, over 20 years would be $2.05 Billion.

Conclusion

Nobody in the Memphis community is FOR the pipeline. And this is why. While putting high quality drinking and commercial water resource at risk, $500K in annual property taxes is NO community benefit. Even Edmund Ford, Jr. knows that !

NO HELP SHELBY COUNTY DELEGATION: Don’t Confuse Local Reform with State Incentive Programs

When having a discussion about a complex issue, it does not help to confuse the issue. In a meaningful discussion started by Commissioner Tami Sawyer, the question of local tax incentives has to do with the abatement of LOCAL taxes, economic development measurement and compliance. Specific local incentive policy, while related, is a separate and distinct consideration from specific state incentive programming.

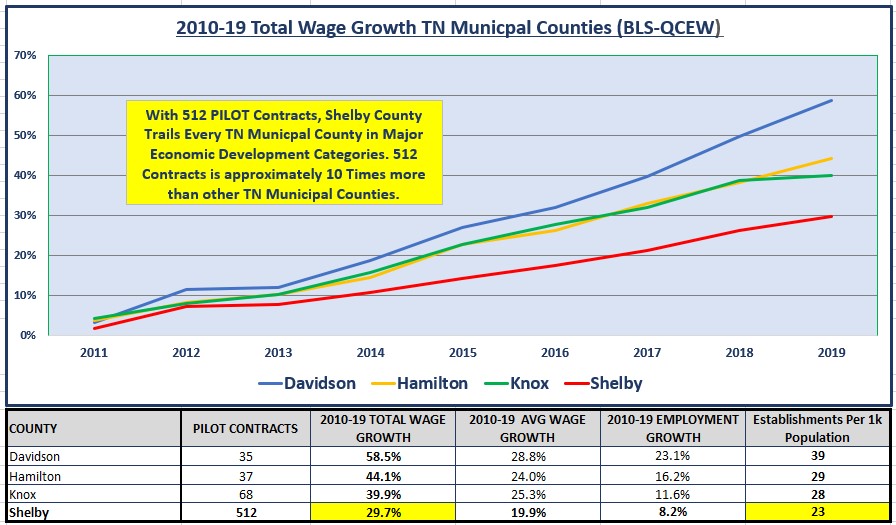

At the same time, $50M of some $120M in local tax incentives, per year, can be shown to be in excess, when benchmarked against other communities. That is $50M per year, that is not going to serve a Memphis/Shelby majority Black community in need.

When talking big numbers, people can’t seem to envision what $50M means for a community in need. So let’s just spread it across the political spectrum. How about $20M for public transit, $10M for public safety, $10M for vocational education and $10M for everything else ?

The above version of taxpayer justice has escaped Memphians, occurring with the aid of elitist marketing, under the label of “social justice” programming, like MWBE and affordable housing, that help justify excessive corporate/real estate incentives for the small few. Such programming, has effectively been tactically weaponized against a majority Black community in need, while furthering widespread taxpayer injustice.

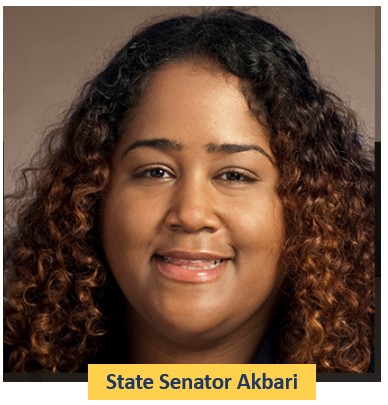

With regard to confusing the needed local discussion over incentives, in a recent Commercial Appeal article, State Senator Raumesh Akbari said in an unhelpful and status quo statement:

“It is a prisoners’ dilemma,” Akbari said. “We have to have them [incentives] in the frame that we’re in right now, because Mississippi has a state income tax, and can provide cash assistance upfront, which makes it very difficult for Memphis or Tennessee to compete.”

No one that is serious about PILOT reform is advancing an argument to end all PILOTs. NO ONE ! Akbari Commercial Appeal statement appears to toe the line, with common tactics used by EDGE and other local abating boards, in framing up the discussion in an all or none PILOTs discussion and then further confusing the issue with state incentive programming.

As far as “cash upfront” as a distinguishing feature of Mississippi economic development programming, I am not sure what that really means. After all, FedEx is getting a $3M cash award for moving across town. And EDGE with $22M in unused cash on their balance sheet, can now award cash for high paying jobs while bringing down abatement costs. And we just saw, with due diligence obstructed, $16M in upfront cash assets approved for unneeded Downtown public parking, for the Downtown Memphis Commission, in an overall $62M approval.

Secondly, many feel the income tax issue is really a wash from an economic development perspective. If not, that is a state level economic development matter not local. While data in the press is hard to come by, it appears that LOCAL Northern Mississippi government offers 66% tax abatement on new capital investment for a common standard 10 year term. Local and State Mississippi incentives need to be part of a formal research process, while hopefully pursuing a future regional interstate economic development effort.

Overall, the Tennessee General Assembly’s Shelby County Delegation has been little help on the matter of excessive corporate welfare in Memphis. In fact, the delegation has largely enabled the excesses in the following ways.

Through local rule, the Shelby County Delegation enabled the Tennessee General Assembly to allow for residential PILOTs in Shelby County only, across Tennessee. This allowed, Shelby County local industrial development boards, while fee incented by local real estate interests and under state law, to award local residential PILOTs, without any limits from the State.

The voice of the Shelby County Delegation has been mute on the answering the formal question of local government’s authority over local abating boards. For example can Shelby County or Memphis City set their own PILOT requirements, without joint Council-Commission approval or even individually disallowing abatements by abating boards ? I believe legally, that either City or County can act independently in their authority over abating boards.

Confusing the state and local economic development incentive programming, while NOT using their own publications, in the State Comptroller PILOT report to educate the Memphis public on excess corporate welfare while legislatively engaging the issue.

Having clarity on the questions of local and state authority, is critical to productive PILOT reform discussions.

State and Local Legislative Recommendations

Local legislative bodies should in no way, wait for movement from state officials in reforming local incentives. Besides, the income tax issue is a wash in most quarters, unless you are EDGE of course. At the same time, here are some legislative recommendations in support of meaningful PILOT discussions and hopefully reform:

Don’t listen to the civic idiots and Elitist FedEx/Memphis Tomorrow complex on matters of public economic development. This complex sadly includes the public University of Memphis.

Individual local legislative bodies should know their own individual legal authority over abating boards.

As advanced by County Commissioner Michael Whaley, local legislative bodies should gather their own independent independent data, as informed by official governmental data sources and benchmarked against other cities, to validate the existence of fiscally liberal and non free market corporate welfare subsidies that contribute massively to a systemic public revenue problem. Here is an example – http://mcclmeasured.net/data

Local legislative bodies should conduct their own research in correctly sizing local tax incentives, excluding any benefits from tactically weaponized and marketed social justice programming, with research based assumptions to inform economic modeling. Additional local regulations less common elsewhere, like MWBE, corrupt an objective analysis while complicating the economic development recruitment process. Once benchmarked, additional years can be awarded for elective participation in, yes, vitally important social justice programming.

As repeatedly recommended by the Shelby County Trustee and perhaps in partnership with the State of Tennessee Comptroller, local legislative bodies should fund a consolidated tax incentive database for industrial development board compliance monitoring and economic development measurement.

The Shelby County Legislative Delegation should advocate for state level tax incentive programming, that will either end regionally destructive border wars or advance state tax incentive programming legislation, that directly combats the income tax state level incentive programming offered by Mississippi.

The Shelby County Delegation should seek a state legal opinion that clearly states individual local government authority (Memphis and Shelby County) over local industrial development boards.

The above actions will inform a productive public discussion and hopefully meaningful action on tax incentive reform. And local reform considerations should not hinge, in any way, state considerations as the income tax discussion is a really a wash in most quarters.

Sleep

POWER OF TEAM

COVID: Free Speech Obstruction Accelerated

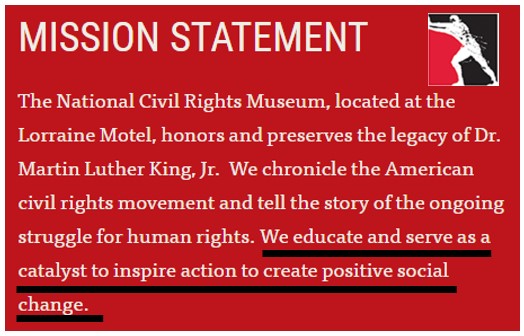

One would think that during COVID, with limits on the public’s participation in public meetings, that the press and other institutions would step up their game. That is not the case in Memphis and includes the likes of the National Civil Rights Museum, who actually celebrates free speech and protest. Its an exercise in racially diverse elitism and the oppression of free speech.

Recently, I submitted a piece to the Tri State Defender (TSD). Prior to the purchase of TSD by a group led by Calvin Anderson, Dr. Anjanku would publish my submissions and edit them if necessary. Over the course of our relationship, Anjanaku published 3 of 4 pieces of my work. And I appreciated it.

Now after the Anderson purchase of TSD, I cannot even get a courtesy response on a TSD submission. As a note, Anderson was part of the EDGE Task Force 2 yrs ago, that accomplished nothing and also serves on the LaunchTN startup board, which has neglected Memphis from startup investments when compared to the rest of the state.

Further, under Dann Miller, the Commercial Appeal (CA) is obstructing commenting on their articles, which discriminates against Memphians, when compared to CA’s other Tennessee markets. And the Daily Memphian has never been willing to even consider my customer submissions, as Bill Dries fails to report on the recent County Commission obstruction of requested due diligence on a $62M consideration. That obstruction is discussed below in my now published rejected TSD submission.

And finally, the National Civil Rights Museum (NCRM), in all of their glory about free speech and protest, cannot take public criticism of their elitist and oppressive NCRM Board and Executive Committee. Its a board that appears to get together from time to time to masturbate about their social justice accomplishments, while exchanging business leads for further elitist oppression.

NCRM Exchange

During the NCRM 1/18/21 MLK birthday virtual celebration, the NCRM deleted my protest comment that effectively said that “MLK would puke all over the NCRM board”. NCRM is not about free speech but seems much more about controlling an elitist narrative that is focused on Civil Rights history of 50 years ago and beyond, while ignoring the elitist oppression occurring today.

Here is an email from Terri Freeman to me regarding the 1/18/21 event, where Freeman cites the NCRM mission statement. The fact is that the NCRM Board’s strategic direction of almost exclusively focusing on history of 50 yrs ago and beyond, violates their mission statement component of: educating and serving as a catalyst to inspire action and create positive social change.

Per the NCRM bylaws, a Board Executive Committee oversees daily NCRM staff operations, by individuals likely heavily influenced by the following local corporations: AutoZone, First Horizons, Baptist Hospital, FedEx and International Paper. Its effectively the same companies that are predominantly represented on all the local non-profit boards, stifling local thought diversity.

Anyway, below is a rejected piece, submitted to the TSD, that attempted to get in mainstream publication, the County Commission obstruction of requested due diligence that occurred on December 21, 2020.

Rejected TSD Column

Curtis Weathers recently wrote a compelling piece on the educational opportunities provided by the tragic events at our Nation’s Capitol on January 6, 2021. While sad, the event offers robust National civic exploratory inquiry into the Constitution, impeachment process, first amendment and social media. The only advantage to the event is that it was press covered and everyone saw it, which provides the opportunity for deeper analysis. Much harder to see, is what goes uncovered regarding local government, by the local press, while perhaps undermining the local community.

So, what about local Memphis history and government? It must be stated that the Tennessee State Civics Standards do not even mention such terms as “governmental oversight” or “quasi- governmental agencies”. Local quasi-government agencies are public board bodies, with staffs and budgets, that operate outside of traditional government. Such agencies include the likes of Memphis Light Gas and Water (MLGW), Economic Development Growth Engine (EDGE) and Downtown Memphis Commission (DMC).

These organizations have either direct control over local tax dollars or have significant influence over the well being of the local population. These are also agencies that operate under the auspices of local governmental oversight and involve multi-million-dollar questions impacting the local community.

While not locally reported, the Shelby County Commission made history on December 21, 2020 by neglecting their oversight function, which is arguably common, and going further to obstruct requested due diligence on a $62M funding allocation, for public parking, made by the Downtown Memphis Commission. The County Trustee, Assessor and Chief Financial Officer all made requests to perform due diligence on the matter, but were overtly obstructed by the Shelby County Commission!

The $62M request involved the use of taxpayer money, funded through a restricted fund that no one in County government seemed to know about, as expressed through on the public record testimony. On December 7, 2020, the $62M matter was correctly referred to committee for due diligence, based on a motion made by Commissioner Mark Billingsley. At the next Commission meeting, on December 21, 2020, Billingsley strangely reversed his position and moved to reconsider the $62M question, effectively obstructing, requested by County officials, due diligence. This is a stunning piece of local history.

The former does not mention that on December 21, the DMC made at least two, on the record, material misrepresentations involving 1) mistaken annual City and County tax dollar contributions to the fund and 2) the understating of parking garage fund financial liabilities by $12M. Both misrepresentations greased the skids for not performing due diligence and approving the $62M public parking allocation. The $62M approval was for public parking, that is not presently needed, based on the DMC downtown parking study.

Further, due diligence would have revealed $23M in possibly illegal taxpayer funded loans made to private developers using the fund. Given this local historical event, if it is somehow possible to be accommodated by the state standards in the local curriculum, these are questions that might arise for local curricular exploration:

- How many quasi-governmental agencies, with their own budgets and assets funded by taxpayers, operate outside of local government, where local government has oversight authority?

- How have external agencies impacted local budgets for education, public safety, infrastructure, and public health?

- How much have quasi-governmental agencies abated in local taxes and how does that compare with other municipalities in the rest of the state?

- What is the role of the free press in covering local government oversight of quasi agencies and non-profits or lack thereof?

Needless to say, these quasi-governmental agencies and corresponding local government oversight have significant impact on our local community. Are our leaders of tomorrow learning anything at all about this critical area of local public governance?

Conclusion

Not part of the original restrained TSD submission, the potentially illegal garage loans above, involve Puke Hyde, who chairs the NCRM Executive Committee. The currency in Memphis is not “Moving Memphis Forward” but instead glorifying elitist oppression…..

LOGICAL: No PILOT Moratorium but Reform

Its logical to reject a PILOT moratorium. But its both logical and fiscally responsible to reform PILOTs. After all, the data makes an overwhelming case against current payment-in-lieu of taxes (PILOT) driven economic development policy. Values supporting continual competitive decline are culturally embedded into board performance of local economic development agencies, while the small few feed on a Memphis community in need. The former is the unquestioned brainchild of such civic idiots as Puke Hyde and Blackjack Smith.

In County Commission today, as system stakeholders, both Beverly Robertson, Chamber and Reid Dulberger, EDGE signaled an openness to PILOT reform, while being against a PILOT moratorium. Both Robertson and Dulberger should be asked to present 1) their definition of economic development, 2) data supported research to support their positions on PILOT policy recommendations 3) what is meant by the term “free markets” and 4) what is meant by the term “business friendly”.

In considering the answers to the above, the Commission should understand that the Chamber is not an economic development but a business development organization whose members are financially driven by profits. Nothing wrong with profits, but profits are not in direct alignment with the financial incentives of the public sector. EDGE on the other hand, is fee incented to award large corporate/real estate PILOTs, with board members, that often professionally benefit from such awards. This fee configuration is contradictory to the financial well being of the public sector.

To that extent, abolishment of abating boards or new board appointments may be needed to carry out the work of real economic development. Real economic development is typically defined around improving the quality of life, mostly accomplished through increased wages, which is in financial alignment with County government but not the Chamber and EDGE.

Commission Discussion

While Commissioner Sawyer’s commendable PILOT moratorium lacks support for passage, it appears to have been successful at starting the PILOT reform discussion, with the aid of Commission Chairman Eddie Jones. Sawyer’s remarks around reform seemed to focus on community benefit programming. But much of that, like MWBE and affordable housing, has already been weaponized against the Memphis community in support of excessive PILOTs, that undermine the local tax base.

For example, established local businesses and affluent individuals dominate EDGE MWBE receipts. The greatest community benefit comes in the form of eliminating excessive PILOT awards, in support of taxpayer justice, that more appropriately funds education, public health, transit, roads and etc for all.

Commissioner Michael Whaley focused on reigning in PILOT extensions. But fiscally speaking, extensions are just the tip of the iceberg and have the same fiscal impact as does new PILOTs for the same property (FedEx WTC) or abating existing real property taxes (Ubiquiti), which are both commonly done.

Commissioner Edmund Ford touted successful community builder PILOTs and the need for better communication with abating boards. No one is sounding the alarm against community builder PILOTs that, for example, support grocery store construction in a food desert. And communication can be most easily improved with easy to understand, data driven web based technology to inform real time oversight, which has been professionally proposed by this blog.

Data and PILOT Policy

The data is explicitly clear that current PILOT policy is not working. This is expressed in the form of sluggish and below average job growth, average wage growth, median household income growth and deficient small business establishments to power the local economy. With an excessive 512 PILOTs, which dwarfs other TN municipalities by approximately 10x, the data clearly points to the need for PILOT reform. For an expanded view, see this comprehensive data set.

PILOT Reform

First, County government needs to see themselves as the County’s chief economic development organization while seeing the Chamber, as an influential stakeholder and not a partner.

Partner recognition of the Chamber blurs the lines of public and private accountability. Memphis needs to strengthen its public sector, as many local problems are rooted in the public sector’s weakness while mistakenly trusting in the “vision” of idiots Puke Hyde and Blackjack Smith and their public-private complex.

With clear lines, the County should then author their own defined economic development plan, with robust debate and measured stakeholder input, while reforming PILOTs. PILOT reform would, ideally, look like the following:

- Validate that current PILOT policy is a failure through data informed from authoritative sources like County Government, State Comptroller, Census and Bureau of Labor and Statistics. Local officials do not need local abating board data to validate this failed reality.

- Use a standard baseline of 10 yr term length for PILOTs, which is a common standard elsewhere with no community participation requirements like (MWBE). This effectively serves the entire community and education through taxpayer justice, by reducing overall amounts through reduced term lengths. Sham “MWBE” and “affordable housing” have been tactically used to justify excessive PILOTs and taxpayer injustice.

- Use research, such as the Upjohn sponsored research of Dr. Timothy Bartik, in guiding assumption development in projecting tax revenue

- Apply research to project tax revenues and incentive sizing, while getting off the 75% abatement for all amount and insuring a return for taxpayers. When referencing County documentation, abatements outstrip year over year (YOY) revenue gains, nearly 5 to 1. Had PILOTs worked, as promised, YOY revenue gains would have exceeded or, at least, been in line with PILOT abatements.

- Offer additional PILOT years for elective community participation in areas like properly overseen MWBE and affordable housing.

- Consolidate abatement boards, while financially aligning their financial incentives with real economic development and consolidating abatement and economic development measurement into a single web based platform to facilitate real time oversight.

Conclusion

Through a failed and sheltered narrative, FedEx and Memphis Tomorrow have had their foot on the throat of Memphis for too long. When one studies the data, its stunning the elitists actually believe that this is good for themselves, but they do. This delusion reveals their complete backwards idiocy…..