A RESOLUTION BY MEMPHIS RAISE YOUR EXPECTATIONS (MRYE) TO FORMALLY RECOGNIZE THE SHELBY COUNTY COMMISSION FOR THEIR LEADERSHIP STAND IN SUPPORT OF JUNIOR ACHIEVEMENT

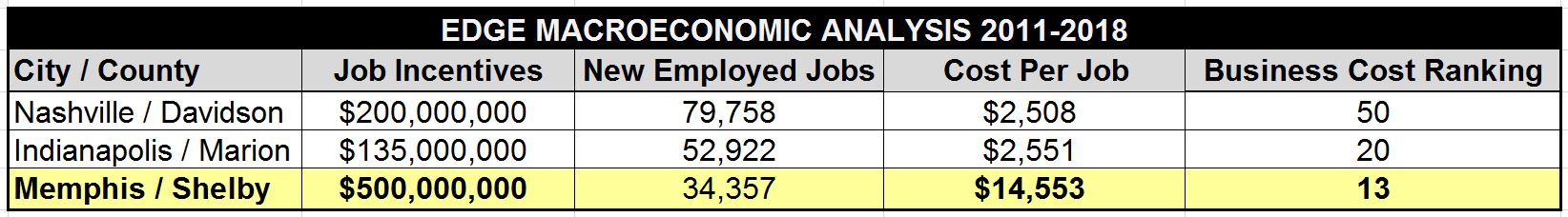

WHEREAS, in the local economic development environment, small businesses are needed to fuel economic growth; and

WHEREAS, entrepreneurial education helps to increase career awareness, work readiness and small business development; and

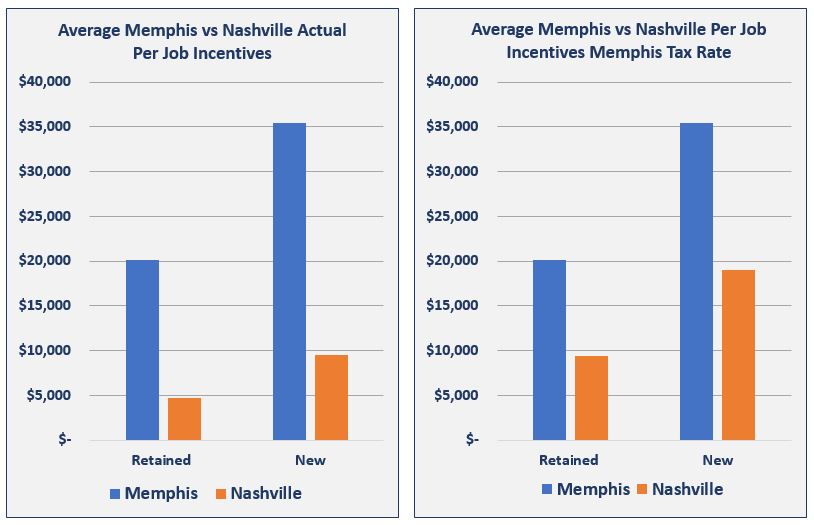

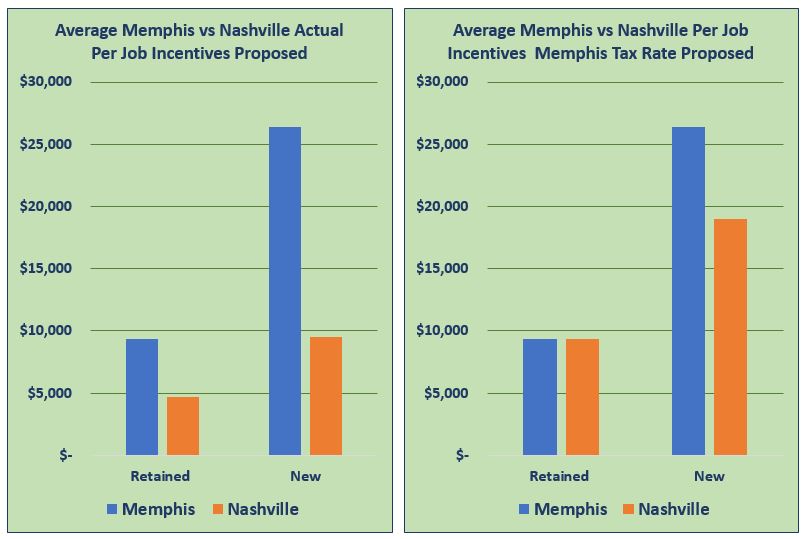

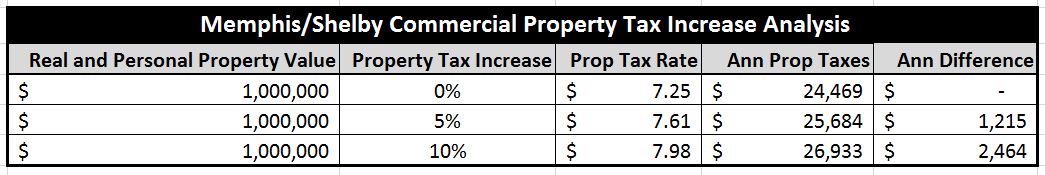

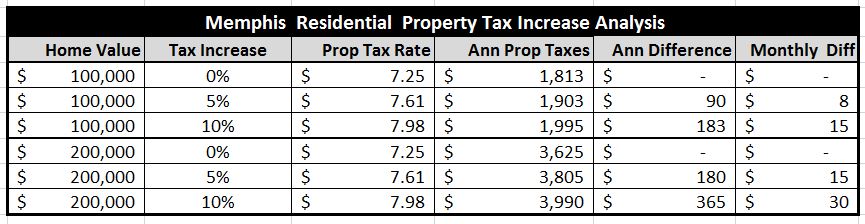

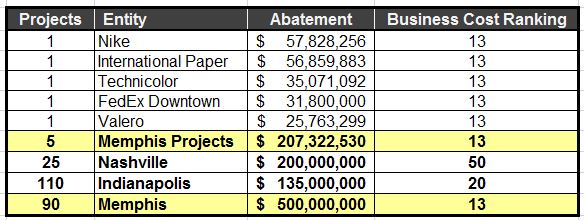

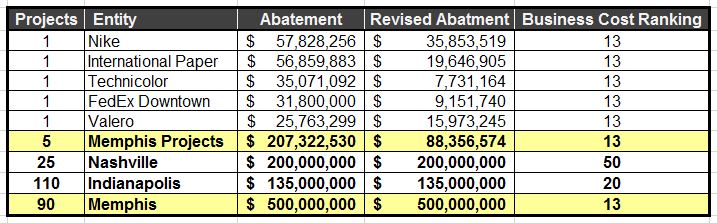

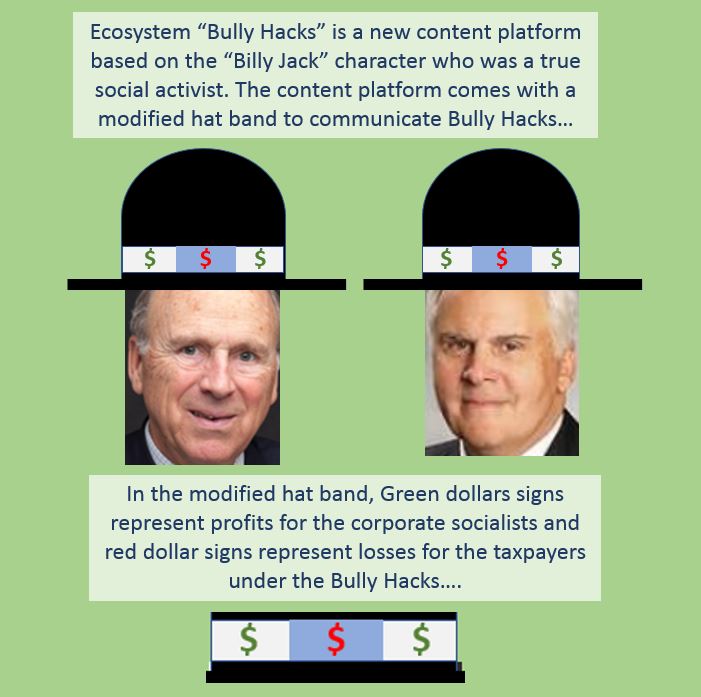

WHEREAS, financial literacy is needed to succeed in business, in life and in local advocacy efforts to check excessive corporate/real estate incentives; and

WHEREAS, Junior Achievement provides relevant programming to support entrepreneurial, work readiness and financial literacy; and

WHEREAS, The Shelby County Commission acted to recognize this community need with $450,000 in funding to support Junior Achievement

NOW, THEREFORE BE IT RESOLVED, that MRYE formally recognizes The Shelby County Commission for their outstanding leadership to fill gaps in local education and workforce development programming with their funding support for Junior Achievement.