Shelby County Commissioners and the public are blindfolded during this budgeting process. Both Commissioners and the Community lack the public documentation to inform budget decisions related to the massive structural revenue problem facing Shelby County. Its a structural revenue problem brought by the previous Mark Luttrell administration through failed economic development.

The lack of public data rigs the system for more of the same. Commissioners and the public lack breakout data of historic residential property tax revenue, a current Shelby County Trustee report for projected total abatements for 2019 and into the future, any data at all on tax increment financing and the public availability of the EDGE quarterly report to be considered in the upcoming Commission meeting.

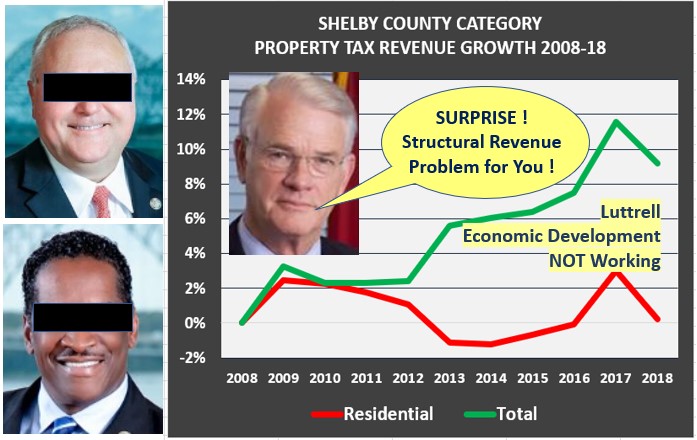

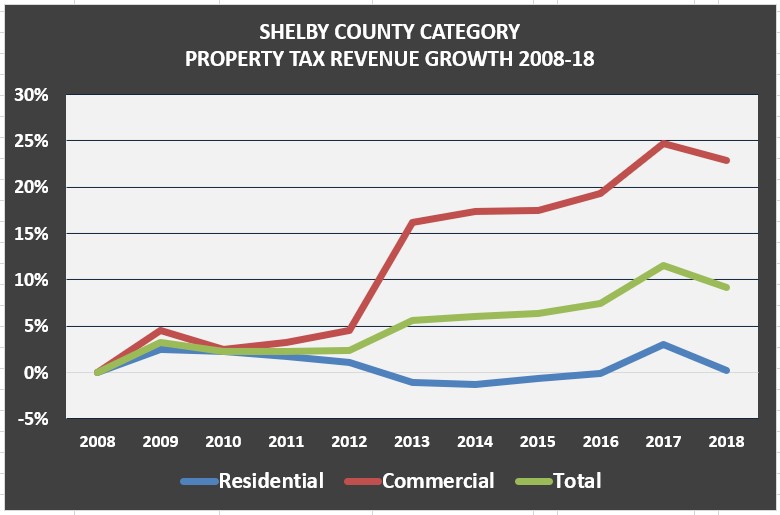

If Commissioners had such public data, they would see that Luttrell’s 8 year Memphis Tomorrow economic development agenda, currently implemented, has failed. Needed breakout data would show flat residential property tax revenue over 10 years (above chart). Increasing home values, that have not occurred, is one of the primary ways that low to moderate income individuals build wealth. And to make matters worse, locally excessive economic development incentives are justified based on increasing County residential property tax revenues.

Now, get ready for this data point which will be ruled incoherent by the local and non-reporting journalist community. After being ridiculed, shut out and even cursed by some local journalists, it’s clear they are jealous while not leading and pursuing my line of innovative and investigative inquiry regarding deficient economic development. Anyway, this data point is simple and coherent as it gets. The following data point was derived from published Shelby County Trustee reports:

From 2008-18, in exchange for promised County tax revenue increases and the abatment of $497M in taxes, Shelby County tax and other revenue only increased by $114M.

See the excessive tax abatements and the catastrophic structural revenue problem ? The structural revenue problem is the product of the Mark Luttrell Memphis Tomorrow “economic development” agenda. The implementation of the former has resulted in a wealth transfer program occurring on the back of an impoverished community in need.

Political Cake: Blame Luttrell

Blame Luttrell for the structural revenue problem. Its stunning, to see local government officials argue over what happened years ago, on the City Council, when a piece of political cake sits right in front of them in the Lutrrell administration.

After all, throughout the country, blaming previous administrations is politically done even when such blame is not true. In this case, blaming Luttrell for the structural revenue problem facing County government provides a political pathway forward while being honest with the public. Its win-win !

Over the weekend, Luttrell wrote an opinion piece in the Daily Memphian on current County budget deliberations focused on spending managaement. Luttrell said, “Economic development is critical as a remedy for the chronic underemployment and poverty that plagues our community.” Does anyone even know what Luttrell or anybody in this town means when they use the term of “economic development”?

It’s a question worth asking because Luttrell went on to talk down County involvement in the Memphis Area Transit Authority. The fact is many communities consider getting people to work a vital component in economic development. So what does Luttrell mean by public participation in “economic development”?

Well, looking at what happened with Luttrell’s economic development agenda may provide insight. Luttrell’s economic development agenda has resulted in the current County structural revenue problem.

First Luttrell worked with the elitist Memphis Tomorrow complex to create the Economic Development Growth Engine (EDGE). He, in effect, helped to create an organization that is financially incented to award as many excessive tax abatements as possible.

These fiscally liberal incentives are justified with the promise of increasing local tax revenues and spending with minority women business enterprises (MWBEs). Unfortunately, both excessive incentives and MWBE programming have lacked sufficient controls, systemically using bogus accounting to justify excessive corporrate/real estatte incentives, while out of town and locally affluent participants enjoy the fruits of MWBE programming. And there is more.

In 2014, Luttrell was a co-chair of the Brookings FOCUS Economic Development initiative. The plan set out to prioritize workforce development while targeting the industries of professional technical, manufacturing and agriculture while deemphasizing distribution. The plan was never measured or implemented while excessive tax incentives exploded for low wage warehouse jobs. Meanwhile, connected workforce development programming failed over a 5 year term, on the back of a foreign contract award, while dismissing small business and a community in need.

So planned economic development was never implemented, excessive incentives exploded and workforce development failed. Any questions of why there is a structural revenue problem ?

Conclusion

Getting away from arguing over what happened on the City Council, and blaming Luttrell is expeditious. It’s honest while providing a political pathway forward in confronting Shelby County’s structural revenue problem for the benefit of taxpayers.

The policy solution would result in spending management, responsible tax/fee increases and research based economic development reform, far away from current day runaway elitism….