Just a quick note before getting started. I think that picture of Beverly Roberston pops on my website. Maybe she will be featured regularly ! Anyway….

No one is really talking about the elimination of tax incentives for industry recruitment and meaningful local business expansion. In fact, it’s the belief of this blog, that while Mayor Harris laid down a needed political marker, he doesn’t practically believe in the end to all incentives. All too often, those that are for incentive reform are labeled as anti-business which could not be further from the truth. The fact is that excessive incentives undermine the societal foundation on which commerce thrives and are therefore bad for business.

The Greater Memphis Chamber’s Beverly Roberston’s Daily Memphian opinion piece and Mayor Harris’s political marker both avoid the question of needed incentive reform and more importantly the establishment of a platform for a massive philanthropic ask for socialistic corporate welfare excesses afforded through so called “economic development” incentives.

It’s true, per Roberston’s piece, that elected officials don’t technically understand incentives which creates problems for critical incentive evaluation and reform. And the press has been wholly ineffective in covering incentives because they don’t understand them either or they are trying to protect Memphis Royalty from being exposed for their excesses that have fed on the taxpayer and a community in need.

This blog is about measuring the effectiveness of the FedEx/ Memphis Tomorrow corporate community leadership complex and quantitatively educating the public on such matters. The incentive discussion is most often all or none and without effective quantitative context which this blog will address and consistently addresses with regard to public-private initiatives while proposing solutions.

The Big Untold Story

The big untold stories in the press related to incentives are 1) critical evaluation of the EDGE retention PILOT program which also affords a critical evaluation of EDGE overall making the Electrolux story a nothingburger 2) Rules not being followed in for example the recent ridiculous Mark Anthony PILOT award or minimum payments not being collected from Electrolux per the published schedule even after the huge abatement and 3) the lack of scheduling for the review of 9 other abating boards per Shelby County Commission resolution.

Roberston’s column identifies examples of three PILOTs in Mimeo, Indigo Ag and FedEx Logistics that can be defended as responsible incentives although the FedEx incentive was arguably excessive overall while still benefitting taxpayer. And there are other incentives that can be defended. Reid Dulberger in public hearings will often cite Evergreen and WM Barr. But citing those incentives, tells only part of the story of an excessive socialistic corporate welfare culture that has undermined true economic development in public safety, transit, workforce and small business development.

And besides Memphis 3.0 identified small business and workforce development as the keys to economic growth while referencing a decrease in industry relocations. The only way out of the economic development conundrum is for Memphis corporate royalty to engage those people and small businesses that they have shut out for years through policy and closed Crump culture obstruction as found in the FedEx/Memphis Tomorrow economic development product. Incentive reform provides that pathway which indirectly results in incentives for small business that depend on public resources for their success.

Robertson knows that the Crump era FedEx/Memphis Tomorrow complex has stifled local small business solutions over 4 years to connect local workforce development efforts on the back of a Canadian contract award costing taxpayers $10-15M per year. This results in legislators currently working blindly to connect workforce development efforts while not engaging the work on the ground and punting to yet another pageantry event in a “workforce summit” as corporate welfare roars. Whatever…..

Socialistic Corporate Welfare – EDGE Evaluation

Socialistic corporate welfare imposes capitalism on small business as Memphis Royalty enjoys the benefits of taxpayer funded socialism. Again, no one is calling for the end of all incentives but incentive reform is needed which requires critical evaluation.

Like the findings of this blog related to the EDGE retention PILOT program, the local Memphis press has yet to cover the Beacon Center of Tennessee Report involving the incomplete and bogus accounting of the EDGE retention PILOT program that was used to justify excessive wealth transfers from a community in need to local corporate/real estate interests. Unlike Electrolux, which was a significant but unfortunate loss, the retention PILOT program over an 8-year period is systemic and deliberate in imposing excess wealth transfers on Memphis/Shelby taxpayers.

A retention PILOT abates taxes for an existing business for existing jobs to keep operations in Memphis/Shelby County while allowing real estate investors to lock in long term leases while using bogus incomplete accounting to justify the PILOT award. Its indefensible projection accounting that could not be defended by Fred Smith, Pitt Hyde or Warren Buffett on their best day.

With, in a sense, collaboratively competing evaluation models, both this blog in MCCLM and Beacon evaluation models reveal incomplete projection accounting which has gone to justify excessive tax abatements. The MCCLM model uses a probability model and considers lost economic impact opportunity costs of public investments while Beacon uses a model to evaluate the net impact of new revenue as afforded by the tax incentive.

Unlike the incomplete bogus EDGE projection accounting, The MCCLM method fully accounts for 1) some probability of retention without a retention PILOT but with an expansion PILOT thus allowing the corporation to avoid massive relocation costs 2) economic impact of remaining workforce should a company depart and 3) economic impact lost opportunity costs that come as a result of the retention component of the abatement.

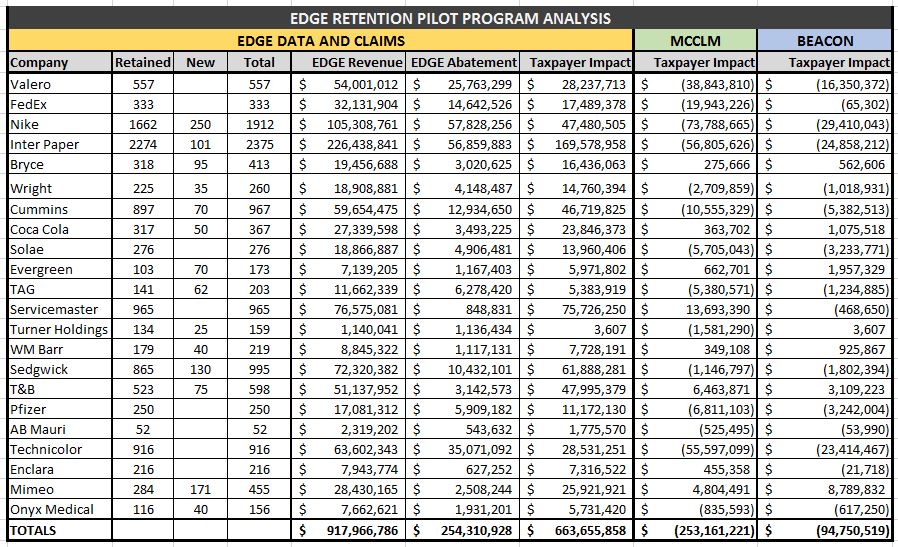

The published Beacon Study used only a partial sampling of EDGE retention PILOTs. The table below extends the Beacon accounting methodology across all retention PILOTs to derive competing methodology findings for the excessive and socialistic corporate welfare retention PILOT program. The findings are as follows:

EDGE Claims a $664M gain from retention PILOTs

MCCLM effectively confirms common sense that abating taxes against the existing tax base is a direct tax loss in a $253M loss resulting in a $917M EDGE projected revenue overstatement

The Beacon methodology finds a $95M loss resulting in a $759 EDGE projected revenue overstatement

Adjusting EDGE revenue accordingly, the MCCLM method finds that the entire EDGE PILOT program, to include expansion PILOTs, is operating at a $115M projected taxpayer loss and the Beacon method finds $43 gain. EDGE claims a $802M gain.

As the EDGE Scorecard, in this case, has been rendered a useless piece of propaganda, a new EDGE Board is needed and away from the Crump Machine tactic of the same people at the table as championed by Richard Smith. The same people at the table is just another example of the FedEx/Memphis Tomorrow economic development product and closed system in the midst of sluggish economic growth results.

Practical Incentive Reform

So, as the extremes of all or none incentive positions do little to advance the technical conversation around practical incentive reform that considers the entire business community and the taxpayer, the following pro-business incentive reform recommendations can be made:

New professionally balanced EDGE Board that represents all facets of the economic development equation

End retention PILOTs and abating taxes against the existing tax base. Retention PILOTs create a moral hazard while making true economic development efforts lazy.

End residential PILOTs as Shelby County is the only County that allows them in the State of Tennessee

End unneeded TIFs like the Poplar Corridor TIF in affluent unblighted areas

Continue responsible incentives for new industry recruitment and large local expansions. The Mark Anthony expansion PILOT is an example of a stupid PILOT award that was nothing more than a real estate deal presented as “economic development” that lost taxpayers $500K as EDGE pocketed $50K in fees

Legislative training for incentive evaluation

Shelby County Commission should schedule the evaluation of the other 9 abating boards

A benefit / cost ratio in excess of 1.0 should be established to more accurately recognize the value of needed and competing public investments to inform PILOT awards

Recognized and scheduled presented taxpayer advocacy in legislative hearings regarding incentives as opposed to just 1 presented side and that of the Chamber/EDGE/DMC economic development complex

Fee reform to insure the taxpayer is being represented in economic development transactions as opposed to representing corporate/real estate interests

Conclusion

Again, no one is for the end to all incentives in the current economic development climate. But a new EDGE Board is needed after 8 years and incentive reform is paramount.

The only way out of the Memphis economic development conundrum is by engaging the work of true economic development as opposed to masquerading incentive awards as economic growth. This will involve huge philanthropic contributions by Memphis Royalty to pay the taxpayer back for excessive socialistic corporate welfare policy encroachments and to engage those very people and small businesses that they have shut out for years.

Unfortunately, after a year, there still is no economic development plan or measurable definition for economic development. And its going to be challenging to implement a platform for measurement that communicates the current state of affairs in a “Momentum At All Costs” backdrop. But we will see. So far, it looks to be, more of the same……