The problem with the proposed $10M Memphis/Shelby government pension fund ask by the Memphis Corporate Community Leadership (MCCL) complex for the Epicenter local small business initiative is that the culture and policy environment do not exist in Memphis for small business success. Otherwise, the ask would make complete sense. This blog is a response to Evanoff’s recent Epicenter article.

Memphis/Shelby government should counter the offer with a request for the MCCL to support a policy environment and culture that supports small business and for “Big Daddy” Fred Smith to come up with another $6M on top of Smith’s $10M investment for the fund. Using “Big Daddy” as an example in this case, Smith has reported net worth of $5.4 billion. $16M would be .3% of Smith’s reported net worth which mirrors what is being asked collectively of City of Memphis and Shelby County pension funds valued at $3.3B resulting in the $10M ask.

CONGRATS TO ALL ON INDIGO !

Waddell Premise Off

While David Waddell’s big idea of investing in Memphis small business makes complete sense, his premise is off as reported in the Commercial Appeal. Waddell says in the article, “What I think we should do is pick five businesses and make them huge,”

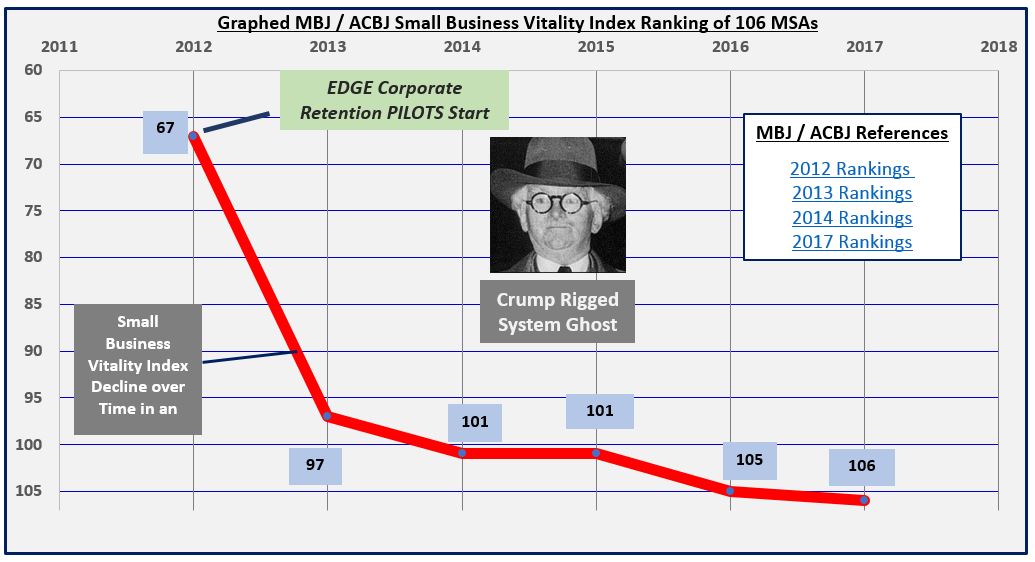

Why concentrate on only five companies? How about instead, focus on building out a more vibrant and diversified economy that has Memphis ranked at least 53rd out of 106 metros in small business vitality? That type of culture is what is going to attract entrepreneurs and new business to the City. In the last publication of the Memphis Business Journal Small Business Vitality Index, the Memphis MSA was dead last out of 106 metros. 53rd out of 106 metros would be average, is achieveable and would require many more local small business establishments.

In fact, the data proves that the MCCL establishment does not support transacting with local small business much less loaning them money or investing in them. The data indicates the establishment is reluctant to give a poor bastard an order. In line with the Crump machine of the 1940s, what the Memphis establishment does, is create bureaucratic programs that say they support community needs as the community fails to realize community benefit from government funding.

While Waddell’s premise falls flat, his Epicenter design makes sense. The design, in part, resembles a self-sustaining and investable Memphis small business cap fund that would provide fee based back office services, loans and venture capital with the first $100M perhaps looking like this: $22M in back office, $60M in loans and $20M in venture capital which could easily yield investors 10% to 13% provided that the culture and policy environment supports Memphis small business.

Policy Environment

MCCL has traditionally supported, in practice, policy that benefitted corporate/real estate interests and not small business. This is evidenced in a locally excessively rich tax incentive environment that benefits corporate/real estate interests. In a Good Jobs First survey report, many of the respondents say “spending on incentives for big businesses strain the tax base for public goods such as education and infrastructure that benefit all employers and truly form the bedrock from which small businesses can grow.”

For whatever reason, local Memphis economic developers, in practice, believe rich incentives for corporate/real estate interests optimize economic development outcomes at the expense of true economic development in the attraction and demand drivers of workforce development, public transit and site development. The former is work that supports small business as well as corporate/real estate interests. Vibrant communities attract investment; not incentives. Incentives only help close the deal.

Examples of a deficient small business policy environment include:

EDGE – The Economic Development Growth Engine (EDGE) retention payment-in-lieu of taxes PILOT program that uses incomplete bogus accounting to justify excessive tax abatements for existing local corporate/real estate interests. The program comes at a estimated cost of $250M+ to Memphis/Shelby taxpayers as opposed to the $600M+ gain as claimed by EDGE. The Best of the Worst of EDGE can be found here.

Real Estate Development as Economic Development – At the most recent EDGE meeting, a real estate deal labeled as “economic development” cost Memphis/Shelby taxpayers $500K for 30 warehousing jobs while abating $2M in existing property taxes as EDGE pockets $51K in fees.

Workforce Development – Deficient and disconnected workforce development efforts that are 4 years behind schedule. The MCCL has been unable to select a common commercially available job board, promote a common occupational assessment or articulate an alignment protocol on behalf of employers to help direct local workforce development efforts. STUNNING…..

Public Transit – Two years after insufficient funding was identified as the primary obstacle to adequate public transit, efforts are only now getting started with addressing the problem while having Justin Baker of the Memphis Bus Riders Union, perform the heavy research lift of coming up with a funding solution for public transit. This is currently occurring in County Public Transit Ad Hoc committee work.

Abating Authority – Although Indigo is news, tax abatement organizations, such as the Downtown Memphis Commission as well as other abatement boards are creating new taxpayer funded incentives that are apparently unknown to the public .

Besides the culture, the policy environment is not in place to support small business based on the findings of the Good Jobs First report. Therefore, investing in small business will likely not generate an adequate return for Memphis/Shelby County government pension funds.

Memphis/Shelby Government Counter Offer

Memphis/Shelby government should aggressively consider investing $10M in the Epicenter small business initiative should the MCCL support a supportive culture and policy environment for small business to thrive. Memphis/Shelby Government should counter with the following requests:

Memphis Tomorrow – Request for Memphis Tomorrow to come up with a committed plan to immediately identify and invest $270M in the community in small business/Epicenter, workforce development, public transit and public infrastructure to support success for small business. The $270M ask is based on the $9B in investment income generated locally as shown in Evanoff’s CA article. This assumes a 10% return on $90B in invested assets. Currently, the effective .3% being floated as an investment amount in the Memphis/Shelby government ask would be $270M based on .3% of $90B. The additional $1.2B of the $1.5B ask of Memphis Tomorrow for excessiveness that has overly concentrated wealth with corporate/real estate interests will be addressed in a later blog.

Greater Memphis Chamber – Memphis Chamber should support getting started now with connected workforce development with funding support coming from the above $270M while advocating an alignment protocol on behalf of employers to help direct connected workforce development programming.

Excessive PILOTS– End retention PILOTs for existing business and focus incentives on new business.

Public Transit – Memphis Tomorrow/ Chamber should publicly advocate for a specific funding solution in support of adequate public transit with public transit funding supplemented by the $270M above ask.

Approval – Have all new incentive instruments approved by local legislative bodies.

Benefit / Cost Ratio – MCCL should collaborate with local government to derive benefit/cost ratio for community investment and above a 1.0 to inform the development of a hurdle rate of sorts and smart taxpayer funded incentives. If there is no taxpayer benefit in community investment as implied by a 1.0 benefit/cost ratio, public officials might as well go home.

With the above funding and policy commitments from MCCL, a supportive small business culture should evolve in Memphis which would make $10M in pension funds proceeds a smart taxpayer investment.

Conclusion

Without a supportive culture and policy environment, investing in a Memphis small business cap fund won’t work for taxpayers. The right policy environment will help insure cultural evolution in support of local small business and the evolution of the community as a whole through the implementation of balanced economic development policy.