An old fashioned tax increase might be just the right response to Corporate Socialism that has dominated the local policy landscape for years. With some $800M in approved tax abatements, a 4% City / County property tax increase would raise approximately $40M in property tax revenue to address tax revenue shortfalls that have been further irritated by below peer average total wage growth.

Such new revenue would fill part of the gap to fund true economic development efforts in such areas as transit and workforce development. A 4% tax increase would cost Shelby County homeowners, on average, less than $70 per year and could bridge the funding gap as more comprehensive economic and workforce development implementation occurs under the leadership of Beverly Robertson and the Greater Memphis Chamber.

This proposal comes after studies completed two years ago identified inadequate funding as the chief obstacle to adequate transit service provided by the Memphis Area Transit Authority (MATA). Local studies found that a $30M investment in transit can generate $120M in economic returns while addressing poverty through increased disposable income from household transportation savings.

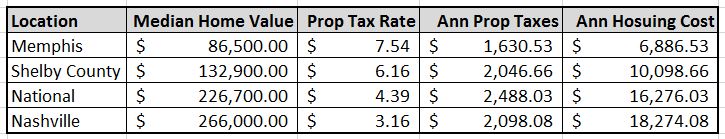

While numerous funding solutions have been discussed none have been formally proposed to close the funding gap. This results, as those resistant to property tax increases, accurately state Memphis/Shelby property tax rates are high. But given low property values in Memphis/Shelby, higher property tax rates don’t tell the complete story. Given this reality, the below table shows 4% increased Memphis/Shelby tax rates and total annual home ownership costs for various locations assuming a 4.5% 30-year mortgage. A $6.16 blended property rate is used for Shelby County outside of Memphis to accommodate for higher residential property values, municipal taxes and unincorporated Shelby County.

Corporate Socialism

This blog believes socialism and particularly corporate socialism is Un-American. Fake fiscal conservatism has been used as the basis for decreasing taxes for years as spending levels continue to rise while corporate interests thrive. One of the greatest examples for corporate socialism nationally is in private healthcare where Americans pay 2.5x the world average for effectively the same outcomes. To give this some context, the excess costs are the equivalent of a new car for every man, woman and child or a home for a family of 4 in the United States.

In Memphis, corporate socialism has taken hold with 9 abating tax boards and excessive retention PILOT policy that has been shown to cost taxpayers over $100M while being reported as a $700M gain by the EDGE Board. All of which occurs as small business vitality plummets and below peer average wage growth occurs while corporate/real estate interests thrive.

But there is good news. The Memphis activist community is responding with such true rock star leaders as Earle Fisher (People’s Convention), Pearl Walker (MRYE), Britney Thornton (MICAH) and Charles Belenky (May Day). These individuals are speaking out for the people and in many cases against corporate socialism.

Incentive Reform

While there is also good news on the economic development front with an exciting plan announced by the Greater Memphis Chamber in a targeted industry recruitment plan while also emphasizing small business and workforce development that leverages local assets in the river, rail, runway and roads, tax incentive reform is needed. To that extent, the following incentive reform recommendations are made:

- New EDGE Board

- End retention and residential PILOTs

- Shelby County Assessor formal analysis of all tax incentives

- Abatement board fee alignment that incents Memphis/Shelby taxpayer representation

- Shelby County Commission evaluation of all 9 abating boards.

- Advocacy for Federal and State legislation to prohibit the use of tax incentives for recruiting company relocations within 200 miles in order to support regional economic development efforts

When the above recommendations are coupled with better economic and workforce development implementation, Memphis quality of life can only improve for All.

Conclusion

A tax increase and incentive reform can help bridge the gap to improved economic development outcomes while providing Memphis/Shelby citizens with mission critical services that support local economic development and poverty reduction. Memphis is alive with an exciting economic development plan, a more informed activist community and hopefully more rigorous legislative oversight. These forces, working for a better Memphis, provide the city with the needed vitality to correct local imbalances and thrive well into the future.

References

https://www.zillow.com/nashville-tn/home-values/

https://www.zillow.com/shelby-county-tn/home-values/