Pictured above: Council Transportation Chair Ford, MLGW Chair Michael Pohlman, MLGW CEO Doug McGowen, Mayor Paul Young, Council Chair Ford Canale, and Council Budget Chair Chase Carlisle

Pictured above: Council Transportation Chair Ford, MLGW Chair Michael Pohlman, MLGW CEO Doug McGowen, Mayor Paul Young, Council Chair Ford Canale, and Council Budget Chair Chase Carlisle

Currently three operating conspiracies are occurring in the City of Memphis. The MLGW tree trimming conspiracy is joined by the MLGW Board of Commissioners, Young Administration, City Council, and local press apparatus. The Accelerate Memphis and MATA conspiracies exclude the MLGW Board of Commissioners but involve the others mentioned.

With respect to the $228M MLGW tree trimming scandal and while accepting and integrating Doug McGowen’s data points, McGowen’s arguments against a tree trimming ripoff were publicly destroyed by me at the November 19, 2025 MLGW Board of Commissioners meeting. See the video starting at 00:03:15.

The conspiratorial coverup of the MLGW tree trimming scandal is most evident in questioning, that did not happen by the MLGW Board of Commissioners and Memphis City Council, like:

Why are budgeted tree trimming costs increasing in 2026 to $39M from $35.5M in 2025 when there is no accelerated overgrowth trim need?

Doug McGowen, MLGW CEO, has no rational answer to the former question. Asking McGowen this question, on the public record, would expose the now estimated $56-73M tree trimming public ripoff ($23M in 2026) out of the total $228M total contract amount.

And to make matters worse, public commenters that are concerned about MLGW public cost containment were blasted by City Council Budget Chair Chase Carlisle, to which the entire City Council concurs, with their unanimous rubber stamping 2026 MLGW budget approval. No City Councilor objected to the civic ignorance spewed by Carlisle at the November 18, 2025, Memphis City Council meeting.

Carlisle spewed ignorance reveals his and the City Council’s negligence away from, not a deep budget dive but merely examining a single tree trimming line item in the 2026 MLGW budget. Additionally, Carlisle idiotically asserted that private meeting discussions, with MLGW, are sufficient in replacing public oversight.

Further and dissenting from Carlisle spewing, MLGW Chair Philip Spinosa failed to work hard enough to examine the single tree trimming 2026 MLGW budget line item at $39M, increasing from $35.5M in 2025. And from Carlisle and Doug McGowen remarks, the idea that Carlisle, McGowen, and City Council appreciate the public’s advocacy around public cost containment is disingenuous and entirely unbelievable.

Chair Canale Makes It Worse

VIDEO – November 18, 2025 Memphis City Council Meeting

Video references: Public commenters 00:52:30, Carlisle rant and McGowen remarks 01:00:35

Following Carlisle’s rant, Council Chair Ford Canale then makes matters worse by smugly asking Doug McGowen for a brief synopsis. McGowen was granted unlimited time, by the Chair, to only then publicly spew more incomplete mistruths and distractions. McGowen remarks punctuate MLGW’s lacking credibility and conspiratorial tree trimming scandal.

For example, there is no evidence to support McGowen’s assertion of decades of preventative maintenance underfunding. In fact, the Taxpayer Justice Institute found the opposite and adequate historic capital spending. Adequate historic capital spend, coupled with a failing grid, points to the likelihood of historic public contract underperformance and a local culture of public corruption.

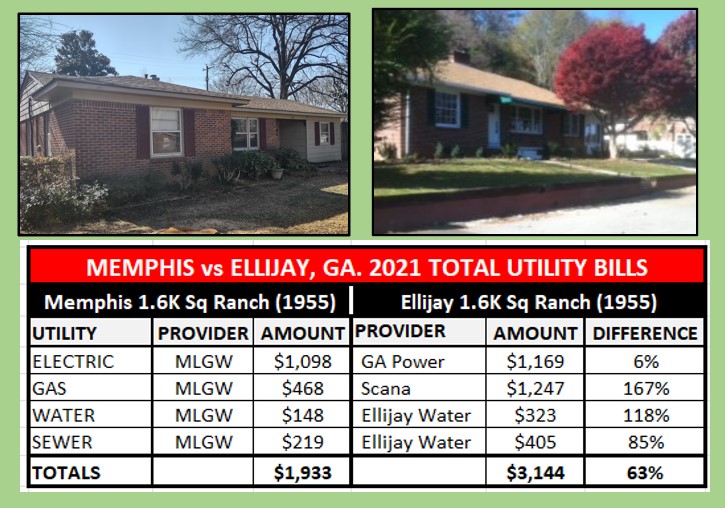

Next, McGowen asserts that MLGW has the lowest combined rates (Electric, Gas and Water) in the country. This is not true. MLGW has the lowest combined winter rates but not year-round rates. MLGW electric rates, which don’t fare well with peer utilities, spike local combined rates up in non-winter months.

When using MLGW’s 2025 published rate comparison to calculate year-round rates with actual usage (Sea Isle home), MLGW ranks a respectable 3rd in combined rates in the country. But this ranking is at risk with no local institutional checks to enforce MLGW public cost containment and when coupled with MLGW’s forward leaning rate increase posture.

In fact, MLGW electrical rates rank 17th of 40 utilities and below other TVA utilities in Chattanooga, Huntsville, Jackson, and Nashville. $23M in excessive annual tree trimming costs contribute significantly to higher electrical rates.

As far as the ready to go availability of MLGW tree trimming RFP and contract documentation, regardless of what McGowen says on the public record, such documentation is not presently available.

McGowen also implies that MLGW’s annual independent audit would have picked up excessive tree trimming costs. Not true. The MLGW 2024 independent audit states:

“The purpose of this report on internal control over compliance is solely to describe the scope of our testing of internal control over compliance and the results of that testing based on the requirements of the Uniform Guidance (federal rules governing federal funds). Accordingly, this report is not suitable for any other purpose.”

In other words, MLGW’s annual audit does not include a critical evaluation of tree trimming costs funded with local ratepayer revenue. All the former proves a public governance culture, that supports unchecked public costs and false or distracting assertions by public officials.

So the MLGW tree trimming conspiratorial scandal persists joined by the MLGW Board of Commissioners, City Council, Young Administration and local press apparatus.

Accelerate Memphis and MATA

Even with new reporting in Councilor Chase Carlisle’s budget committee, there is no by project cost accounting for the $200M Accelerate Memphis initiative. This lack of available accounting points to a culture of public concealment and corruption.

And there have been no MATA public meetings or Council oversight meetings, in Councilor Edmund Ford Sr’s Transportation committee, since August 27, 2025. There now exists a public MATA blackout, which is unreported by the local media. This reality points to public concealment and lack of MATA public oversight by the Memphis City Council.