The following analysis is designed to provide a more accurate analysis of the impact Memphis/Shelby property tax rates when considering a variety of cost variables in comparison with other geographic regions. The reason for this analysis is to better understand the potential impact of increasing property taxes to raise tax revenue through a 5% City / County property tax increase in order to reduce poverty and improve overall quality of life primarily through funding and providing adequate public transit services. Studies have shown that a $30M investment in transit will generate $120M in economic returns.

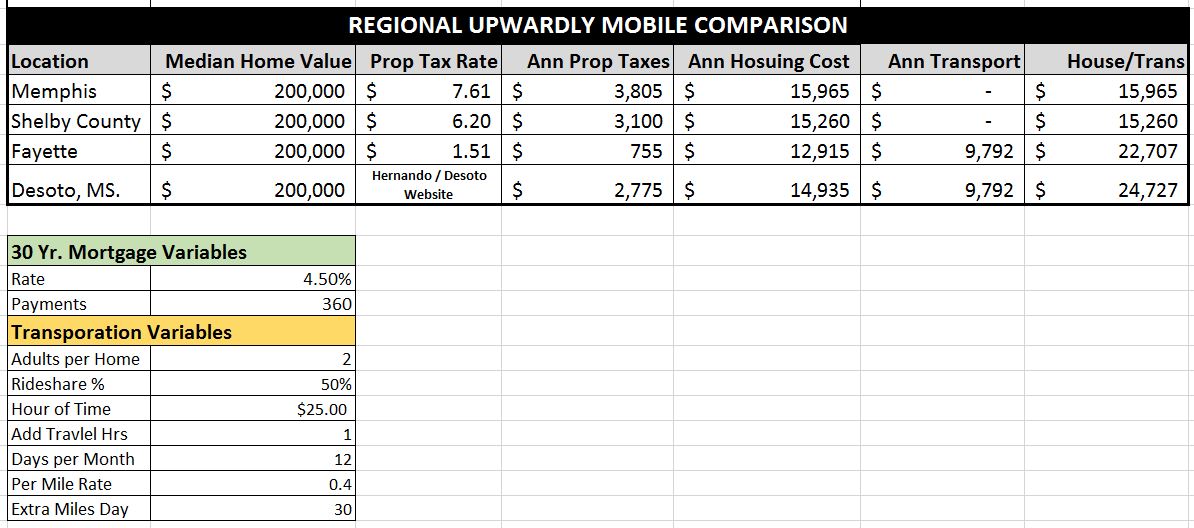

A 5% Memphis/Shelby property tax increase is projected in this model to produce $40M in additional tax revenue based on $1B in total property tax revenue. A 20% reduction in tax revenue is built into the modeling to provide price elasticity for lost tax revenue due to increased property tax rates.

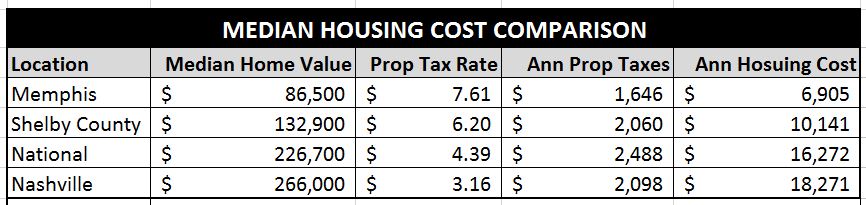

The first table compares Memphis/Shelby County total housing cost versus Nashville and the Nation. A $7.61 total Memphis tax rate is used and a $6.20 Shelby County rate is used to accommodate for higher property values outside of Memphis and additional municipal taxes.

Next, the table below provides a regional analysis in comparison with bordering Fayette and Desoto counties with lower property tax rates. The modeling is designed to show the impact of increased transportation costs for more mobile populations that choose to depart Memphis/Shelby due to a property tax increase of 5%. Download the following spreadsheet to change the color coded modeling assumptions for your personal use. Below are the results that show the net cost impact when considering increased transportation costs and relocating due to a 5% increase in Memphis/Shelby property taxes.