The Tennessee Department of Economic and Community Development (TNECD) is accelerating economic inequality, in their small business programming, for a measly 4.1% annual return for Tennessee taxpayers. More of the return analysis later.

TNECD program design, using taxpayer dollars, has incented venture capitalists to chase market momentum, where it already exists, in Nashville ! Folks like polo player Orrin Ingram and Denny Bottorff of Ingram Industries benefit from public funds, in Nashville, where it is least needed. Bottorff’s, Nashville NuScriptrx, took down $7.3M in public funding across 5 different funds, from both the TnInvestco and LaunchTN programs. Ingram’s YouScience project took down $1.4M from LaunchTN.

Again, from the previous blog and per Bureau of Labor and Statistics, Nashville’s Davidson County has 37 business establishments per 1K population, compared to Memphis/Shelby at 23. The need for small business funding is in Memphis, not Nashville. Further, venture capital funds are often used to gamble on the next large company and not Mom and Pop’s, which is what Memphis needs more of to power its local economy. Memphis lacks sufficient small business establishments, especially in the Black community, to competitively power the local economy.

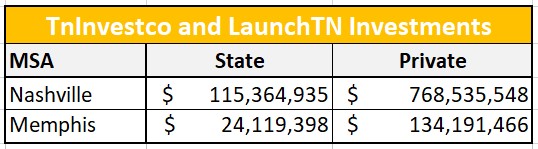

Nashville and Memphis

In theory, TNECD programming, through TNInvestco and LaunchTN, supports capital formation for emerging small business entrepreneurs. But as one can see, public dollars are going to support established businessmen like Ingram and Bottorrf. Total State facilitated investments, from TNInvestco and LaunchTN programs, total $115M for Nashville and $24M for Memphis, while follow on private capital totals $768M for Nashville and $134M for Memphis.

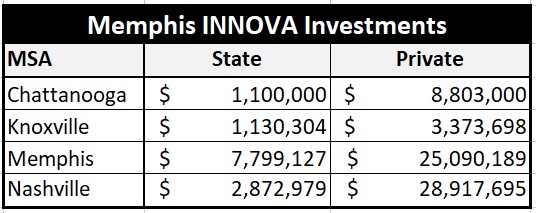

And to make matters worse, Memphis based INNOVA, of the TNInvestco program, redistributed $5.1M in state funding for investments outside of Memphis, while keeping $7.8M in Memphis. As far as INNOVA private capital, $42M was invested outside of Memphis, while $29M was invested in Memphis startups. Of the above, INNOVA invested $1.1M in state funds and $28.7M in private funds in Bottorrf’s NuScripts. See below table sourced from TnInvestco.

Unfortunately, Shelby County Government and Epicenter are both partnered with INNOVA. In a recent Daily Memphian article by Sam Stockard, Jan Bouten, INNOVA fund manager, was unavailable for comment. All that to say, on top of the elitist corporate socialist policy in Memphis, that favors large local corporations, it’s easy to see, from the above table, why Memphis struggles.

State ROI Analysis

Using public documentation, the above informal quantitative analysis was conducted, to facilitate initial policy discussions for greatly improving small business economic development programming. The above analysis is likely to change once TNECD answers questions posed by this blog. So far, TNECD has been unresponsive.

To that extent, this blog welcomes suggested corrections to this analysis and feedback. Given the former disclaimer, a measly 4.1% Tennessee taxpayer annual return, over 10 years, was generated from TnInvestco and LaunchTN, seemingly to accelerate inequality, all while making risky startup investments and subsidizing select venture capitalists.

By comparison, the Tennessee Consolidated Retirement System generated a 9.4% annualized return in more conservative investments. And, not surprisingly, no one seems to know what private investors made on their investments.

While building an ecosystem for entrepreneurship, TNInvestco and LaunchTN were sold to taxpayers based on increased tax revenue from more small business jobs and returns generated by investing in startups. Those benefits are included in the above analysis.

To that extent, since several startup companies are participating in both TnInvestco and LaunchTN, both programs need to be evaluated together. Given this, a total of 3,206 jobs was the outcome of the collective analysis, which took the highest number of jobs reported, per company, from both programs.

It was also assumed that investments, jobs and distributions, increased equally and linearly over the 10 yr. term. As far as economic multipliers, it is assumed that 50% of the investments would have occurred anyway without state funds, which in effect, imposes a 2.0 economic multiplier in the analysis.

The analysis used conservative assumptions, based on public documentation, in favor of TNInvestco and LaunchTN. Based on this, it is more likely the 4.1% ROI will decrease than increase with informed feedback or additional information. The analysis included, for example, 356 jobs from the 40 year established, Nashville operating Gray Line Tours company.

So please send me questions, feedback and suggested corrections to improve the analysis for the benefit of policy improvement, Tennessee taxpayers and small business. My email is jkent@pathtrek.net

References