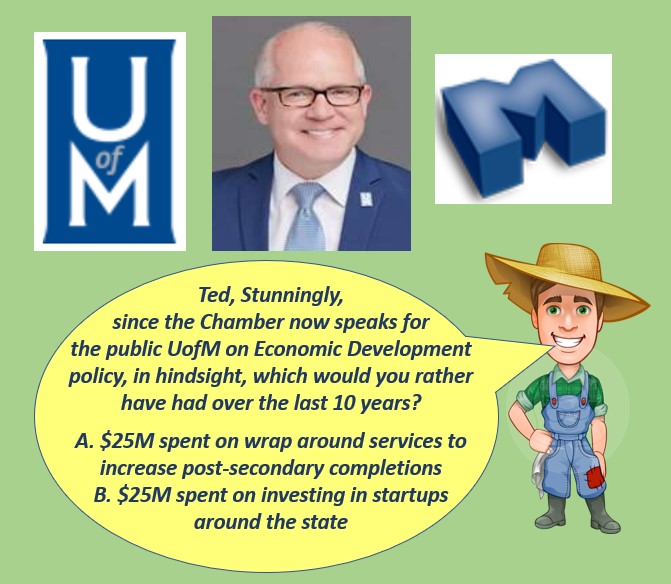

Who knows what Ted Townsend thinks. But I bet, based on hindsight, Blackjack himself would now want $25M to have been spent on wrap around services to improve post-secondary completion rates. No reason to ask, the public University of Memphis, because the Greater Memphis Chamber now speaks for the University of Memphis on economic development matters.

Here is what is known now. Based on an analysis of TnInvestco and LaunchTN data of Memphis startup companies, with local active State of TN certificates of existence, 74 jobs are associated with those Memphis startups that have leveraged State of TN funding. Those 74 jobs have materialized over ramp up period of 10 years. If one assumes that 50% of those jobs would have happened anyway, without State funding and a 50% reduction to arrive at marginal average filled jobs for the 10 yr ramp up term, that equates to 18.5 jobs over the 10 year term.

The above comes after $24M, in State funding, has been invested in startups statewide by Memphis based Innova and MB Ventures funds, supplemented with $1.5M, specifically for Memphis startups provided by LaunchTN. That’s $25M in eligible state funding for Memphis, which based on the above assumptions, has resulted in a marginal average of 19 jobs in Shelby County over 10 years.

Further, since from previous blogs it has been shown that the distribution benefit from startups to taxpayers has been meager, that leaves the primary public benefit being jobs provided by startups. From this program, the longshot hope for taxpayers is a startup will result in an explosion in local jobs through the creation of, for example, the next AutoZone. Nothing even remotely close to this has materialized which will be shown in the next section.

So that leaves us with, “what if” hindsight analysis. What if $2.5M per year had been invested in wrap around services at $1,000 per year for at-risk post-secondary students, what would the result have been ? 2,500 students could be served per year with $2.5M, while increasing local public post-secondary enrollment. Assuming 3 year postsecondary completion and a 20% marginal success rate, that would equate to 4,000 more filled jobs by the end of year 10 and a marginal average of 2,000 more filled jobs across the 10 yr term as compared to 19 local jobs from startups.

So even though annual enrollment would have jumped for all post-secondary institutions, to include the UofM, still not sure what Ted Townsend would say, while speaking for the Chamber and UofM. But what would have been best for taxpayers, is pretty clear. And that is investing in workforce.

But what about the state funding for the local startup community? How did that fare for individual companies?

StartUp Status

The managers of the local startup funds, that have been supplemented by State TNinvestco and LaunchTN programs are Ken Woody of Innova and Gary Stevenson of MB Ventures. David Waddell is Board Chair of the Epicenter, that partners with LaunchTN to develop the local entrepreneurial ecosystem while interacting with funds like Innova and MB Ventures.

First, most startups fail. So going over all of the failed ventures would not be productive, only to say, on the front end, that most of them have in fact failed. At the same time, looking for successes in the data, as expressed in local jobs and peculiarities is worthwhile. So here are some facts about local startup investments, involving TNInvestco, MB Ventures and LaunchTN:

Crossroads, an MB Venture funding startup shows the most local Memphis jobs, with 39. That comes after a $200,000 state investment and $33M private investment allocated by MB Investment.

IScreen Vision has 11 Memphis jobs, after a $1.7M State and a $9.7M private investment allocated by Innova.

Cagenix, the recipient of a $1.3M state and $2.1M private investment allocated by Innova, reports 12 local jobs

Hapten Science, as allocated by MB Venture, has the largest local State investment at $2.1M accompanied with a $7.3M MB private investment. Gary Prosterman serves as Board Chair. Raymod Hage is the CEO but his LinkedIn profile shows he lives in Malvern, PA. Hapten reports 2 local jobs.

Veracity Medical Solutions, which received a $1.4M State and a $400K private investment, as allocated by MB Venture investment, reports 19 local jobs but their website shows an Indianapolis address.

A range of state funded startups like Hera Health, Diatech Diabetes, Second Keys and others list 88 Union as their business address, but none of the companies are listed in the directory at the physical location. Notable occupants of 88 Union include KBG Technologies and Crone Law Firm.

Shown as a Memphis investment, Better Walk, as allocated by Innova and MB received 150K State and $3M in total private investment, has an Atlanta address and reports 5 local jobs.

Nanophthalmics, as allocated by Innova and MB, received $150K in State funds and is shown to be a Memphis investment. But the Secretary of State shows a Nashville address.

Cast21, as allocated by MB, received $25K in State funds and $2.1M in private funds, has a Chicago address, per their website.

Interestingly, two Memphis music startups in Musistic and Soundstache were supported not by Memphis but Nashville investors in the Solidus investment group with a total of $30K in state and $950K in private funds.

There have been some exits from investments with the acquiring company, at times, being far outside Shelby County and at other times being local. Those company departures would appear to severely diminish local filled jobs, a promised benefit of taxpayer funding of startups

Please advise me if there are any questions of , suggestions for, corrections or clarifications needed for the above data points.

Closing Question

This startup programming looks similar to MWBE with only a small few benefitting.

So, again Ted Townsend, speaking for the UofM and Chamber, which would you have preferred $25M in state funds to go to startups around the state or $25M to increase post-secondary completion rates?

References