An argument can be made for a 8 yr PILOT for Raymond James (RJ) that creates 100 new jobs at $63K and $23M in new capital investment while consolidating operations.

But it must be said, there are no real standards for EDGE PILOTs. Over the weekend there was chatter across social media on pros and cons approving the RJ PILOT. For instance, Tom Jones of Smart City seems to impose the original “but for” requirement for tax incentives which is what it should be ! The “but for” requirement is that “but for” the incentive, the “economic development” project would not occur. Considering “but for”, RJ is likely not going anywhere else making the incentive unnecessary.

At the same time, in practice, “but for” was abandoned pretty much when EDGE was created with the Valero project. Valero practically can’t go anywhere else. Which brings us to the reality that, in practice, “but for” has been gone as has been reliable projection accounting, for 8 years, while excessive abatements proliferate. The existence of bogus inflated projection accounting has been used to justify excessive corporate/real estate abatements for the benefit of the small few while creating the need for the more accurate Tax Incentive Fiscal Note Impact (TIFNI) tool.

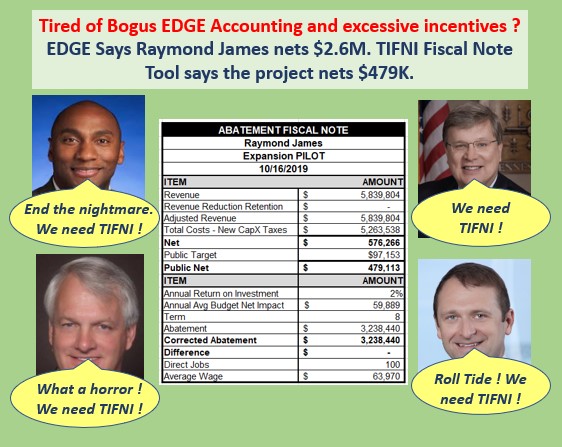

When TIFNI is used on RJ, TIFNI finds a $480K net benefit for taxpayers. This differs greatly than the $2.6M benefit EDGE claims pointing to the need for TIFNI fiscal impact analysis in addition to economic impact analysis. Economic impact analysis alone results in incomplete project accounting. At the same time, when applying TIFNI, of some 95 PILOTs, RJ exceeds the fiscal benefit of some 56 of 95 EDGE Board approved job PILOTs.

So while the return on the RJ project is only 2%, it exceeds the performance of 56 of 95 PILOTs. This data point validates one of the causes of unmet community needs and flat tax revenues due to excessive incentives. A reduction in the RJ PILOT percentage from the standard 75% would yield a greater return on investment for the taxpayer and should be considered.

Conclusion

PILOT reform is long overdue in Memphis where bogus projection accounting has resulted in $500M+ in job incentives compared to $135M in Indianapolis that had greater percentage job growth. Ideally, PILOT reform would include the enforcement of “but for”, fiscal impact analysis and a policy that would right size abatements with 50% on new capital investment provided current job levels are maintained, 1% abatement on total wages of new direct jobs only while maintaining EDGE investment and term minimums.

The only standard there seems to be for an EDGE job PILOT is available vacant space in need of a commercial tenant. At which point, the EDGE Board, if necessary will abate existing taxes to allow a prospective tenant to reach EDGE capital investment minimums that credit the value of existing vacant property as community investment while abating existing taxes. The former is a taxpayer nightmare and would be addressed under the above PILOT reform with the implementation of fiscal impact analysis and TIFNI.