NOTICE: With clarifying information, this blog can be modified for the benefit of informed community discussion with revised assumptions. This table has been corrected, since its original publication, in favor of the fund, by adding $10M in estimated interest payments, for use of funds, over 20 yrs. This lessens the amount in estimated unaccounted funds.

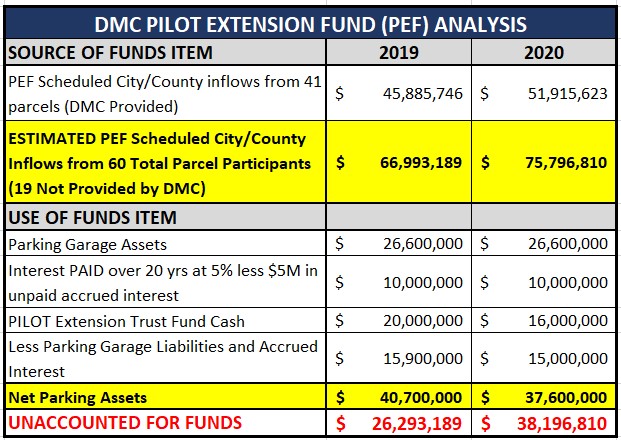

Based on an analysis of the 2019 Downtown Memphis Commission (DMC) audited financials and information obtained via a public information request to the DMC, the DMC PIL Extension Fund (PEF) appears to be $26-38M short.

The DMC staff was helpful in providing information related to the PEF. DMC provided information to include PILOT parcel, project name, PILOT begin date, original term, extension date, extension term and PILOT end date. That information was cross referenced with the 2019 Shelby County Trustee PILOT report to derive total historical “scheduled” contributions to the PEF in City and County taxes.

The DMC provided parcels currently contributing to the PEF, but did not provide 19 parcels that had participated in the fund since 1997, that have since returned to the tax rolls. Methodologies for this analysis will be defined below. But first, what is the PILOT Extension Fund and the questions surrounding it?

Parking Extension Fund (PEF)

The Parking Extension Fund (PEF) was birthed in 1997 based on a State Attorney General’s opinion regarding local government’s authority in approving the extension of payment in lieu of taxes (PILOT) for community betterment. PILOTs are reduced commercial property taxes designed to encourage increased commercial investment.

Based on recent on the record County Commission testimony (see item 27 at 2:09:45 in video), the PEF would extend commercial PILOTs, with the abated portion being dedicated to a restricted DMC administered fund, known today as the PEF, to support the development of downtown parking. The availability of public parking assets would, in theory, encourage commercial investment.

Public knowledge of the PEF, is sparse with many local legislators learning about the fund, which has existed since the late 1990s, for the first time in December 2020. This learning comes as the DMC attempts to get legislative approval for a $62M downtown public parking project. Given the sparse knowledge base having inherited the PEF years ago, both appointed and elected officials are raising questions.

Questions by Rock Star Public Servants

Leading questioning and facilitating discussion regarding the PEF before the County Commission, were Shelby County Chief Financial Officer Mathilde Crosby and County Trustee Regina Newman. Both are highly skilled rock star professionals, with collectively, needed financial and legal backgrounds to facilitate PEF inquiry for the public good.

Primary areas of questioning and discussion by Crosby and Newman concerned: 1) legal authority for the existence of the fund as properly authorized by local government, 2) the availability of contractual lease agreements to support the revenue requirements of the PEF and 3) how much has historically been contributed to the fund. All of these questions remain open with the Shelby County Commission, led by Chairman Eddie Jones, smartly deferring action on the $62M PEF request and referring the matter back to the January 6, 2021 Economic Development Committee.

Based on public testimony, public information requests and 2019 DMC financials, this blog is concerned with helping to facilitate the discussion around historic contributions to the fund and corresponding downtown public parking assets.

$25-40M Estimated PEF Deficit and Methodology

As stated earlier, the deficit for the PEF is estimated, based on this analysis, to be between $26-$38M. Further, in contradiction to public testimony, PILOT extensions have occurred robustly in the 2010s, with some extensions, preapproved to take effect after 2020. But what about the deficit and how was this estimated deficit derived ?

SOURCE OF FUNDS

Estimated PEF Total Scheduled Inflows from 60 Total Parcels – DMC’s Jennifer Oswalt testified before Commission, that there were at one point, 60 abated parcels contributing to the fund. DMC provided 41 parcels via public information request. Those 41 parcels were then cross referenced with the 2019 Trustee Report to derive, from the DMC provided extension dates, historic contribution amounts to the fund.

Then, the County amounts were multiplied by 1.79 to derive a City/County total amount. And finally, to account for the missing 19 parcels, that had participated in the fund in the past, the total City/County amount for 2019 and 2020 was multiplied by 1.49. From the late 1990s, as of 2019, the total estimated amount of scheduled contributions is $66,993,189 and $75,796,810 for 2020.

USE OF FUNDS

Parking Garage Assets – Using the 2019 DMC financials, page 28 states $29.4M in buildings, with the DMC office building, per the Assessor website, having an appraised value of $2.8M. That results in a net of $26.6M, which in this analysis, is assigned to parking garage assets.

PILOT Extension Trust Fund Cash – For the PILOT Trust Fund, page 18 of the 2019 DMC financials states $20M and per Oswalt public testimony $16M for 2020.

Interest Paid – Estimates interest paid over 20 years, using a 5% interest rate, on $26.6M in parking garage assets.

Parking Garage Liabilities – Page 30 of 2019 DMC Financials, $15.9M in debt and accrued interest. From that, the 2020 estimate is $15M.

Net Parking Assets – Calculation of (Parking Garage Assets + Interest Paid +PEF Cash) – (Parking Garage Liabilities)

Unaccounted for Funds – Calculation of (Estimated Total Scheduled PEF Inflows) – (Net Parking Assets) arriving at -26M for 2019 and -$38M for 2020.

Conclusion

As information emerges, there will probably be additional blogs on the PEF. Please send comments, feedback and concerns to me at jkent@pathtrek.net.