Sparked by this Daily Memphian article, this blog digs into North Mississippi tax incentives, using only the information on the Desoto County Economic Development webpage.

So much has been made of the economic development monster, to the South, in Northern Mississippi. At the same time, several existing local companies have leveraged that scary monster, to garner local tax abatements, also known as a retention payment in lieu of taxes (PILOT).

Retention PILOTs and abating existing real property taxes for low wage jobs is where the excess resides in local job PILOTs. At any rate, the following analysis has been conducted to help inform the local conversation around job PILOTs.

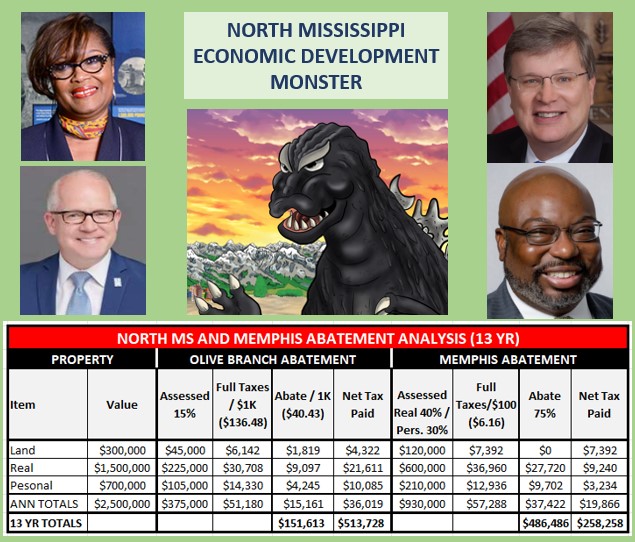

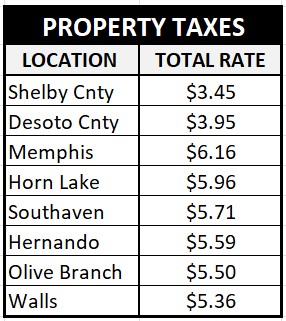

Since taxes are calculated differently in Mississippi than in Tennessee, this analysis standardizes on a grouping of commercial property values taken from this Desoto County Economic Development webpage and pertaining to Olive Branch, MS. The analysis also standardizes on a 13 yr abatement term, as that is the approximate average term for EDGE job PILOTs, when dollar weighted.

As shown in the table above, those property values are $300K in land, $1.5M in a building (real property) and $700K in personal property such as machinery. Using the aforementioned property values, while referencing information found on the Desoto County webpage regarding tax abatements, the above table analysis reveals the following observations:

Over 13 years, Memphis/Shelby County abates $486K, while the new recruited corporation pays $258K in local commercial property taxes.

Over 13 years, Olive Branch/Desoto abates $151K, while the corporation pays $514K in local commercial property taxes.

Memphis/Shelby can provide the same tax liability, as Northern Mississippi abated projects, for new corporate recruitment, by abating 63% for 10 yrs and not 75%. Mississippi limits local tax abatements to 10 yrs.

For retention PILOTs, Memphis/Shelby could have provided existing local corporations, with approximately the same tax liability as Northern Mississippi on unabated projects, with an estimated 25% tax abatement, while also helping corporations avoid relocation costs. Using the numbers above, 10% would have accomplished the previously mentioned goal, but it is assumed that the property tax differential was greater in the past than now. Within job PILOTs, retention PILOTs and abating existing property taxes for low wage jobs is where the incentive excess locally resides.

Corporations with significant personal property investments, may have lower tax liabilities in Tennessee, as Mississippi assesses personal property at approximately 33% more. Please see the personal property full taxes column in the table above.

While it is not part of this analysis, if not exempted, Mississippi taxes finished goods inventory. This puts upward pressure on commercial tax liabilities in Mississippi. Manufacturers appear to have less flexibility, as there appears to be fewer tax exemptions for raw material inventory.

As one can see, there are some structural local tax advantages to operating in Memphis vs Northern Mississippi.

Conclusion

While Mississippi calculates property taxes differently, the above tax rates were converted to Tennessee commercial tax rates based on the commercial property values used above. In this way an apples to apples comparison can occur.

All that to say, more than anything, companies are going to locate where they can find an available site and a community that meets their needs. Tax abatements are just a small portion of the overall decision, which provides no reason to undermine the tax base with excessive tax abatements.

After all, even Mississippi excludes education taxes as well as localities excluding other taxes from their economic development programming…..

NOTE: Only local economic development funded programming was part of this analysis. State economic development programming, that includes income tax rebates in MS., was not part of this analysis. In my opinion, our Tennessee economic developers in Nashville, view no income tax vs income tax rebates to corporations as a net benefit to Tennessee. At worst, I believe it is a wash.