This blog is designed to support data driven problem solving through quantitative analysis. This is as opposed to governing through positive talking points. So, I will leave this with the County Commission as I will personally miss all of you and will not be at the meeting on Monday. And please, if you would, if anyone has questions about the data or sees a mistake in the data, please let me know. I may have done something wrong. Its about the data driven quantitative conversation beyond positive talking points and not about being perfectly right for me.

At the same time, I must say, that I am surprised, given local needs, at the lack of advocacy, beyond just me, for a meaningful property tax increase. That advocacy should be somewhere in the system and its not which goes to one of my concerns of lacking vitality to fuel growth from those type of left of center advocacy organizations that would typically push for a property tax increase. It seems left of center organizations in Memphis are tapped down for some reason on many real economic development matters. Don’t know why???

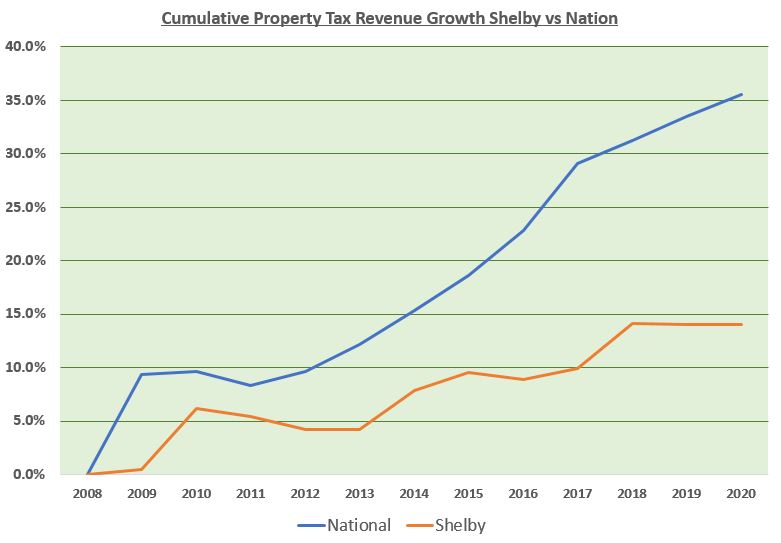

Anyway, the below data begins to make the case for an increase in the property tax rate. Representing 10% of the budget, Shelby County sales tax growth has kept pace with the rest of the country but property tax revenue growth has not while representing 60%+ of County revenues. There is not just one reason for this. It appears to be a number of reasons to include: 1) below average economic growth 2) Low less than optimal tax rates 3) low property values and 4) tax abatements not coming down.

The good news is that there are steps being taken to improve economic growth through a Greater Memphis Chamber new economic development plan and advocacy from the Assessor’s office to increase staffing, which is well below State requirements, to support improved commercial appraising efforts. But there are no conversations for a tax increase which is also part of the problem.

The below graphs, may help the business community see the value to them in increasing the property tax rate to support decreasing poverty while better supporting the societal foundation on which commerce thrives. Raising property tax rates is a business solution to a business problem as supported by data.

The first graph compares Shelby County property tax growth with the rest of the country. Had Shelby County property tax rates achieved national growth rates, annual County property tax revenue would be $145M higher. See graph below and spreadsheet here and please bring concerns of the data to my attention as this blog is trying to drive an informed and accurate data driven conversation beyond positive talking points.

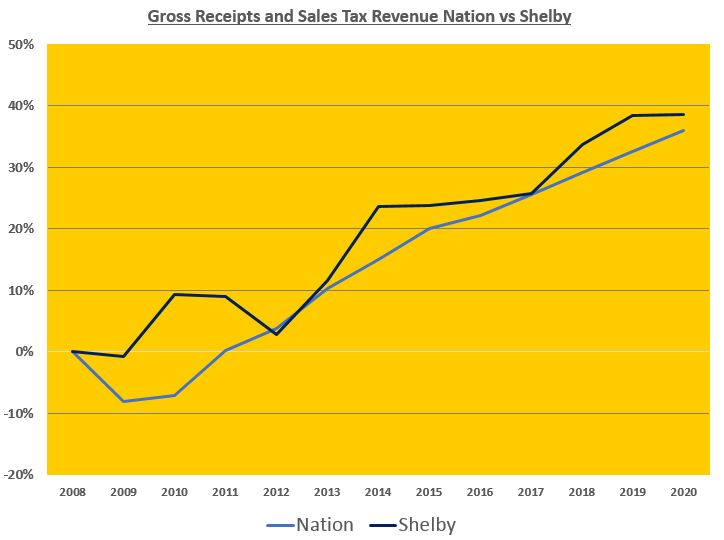

Next, is a graph of Shelby County gross receipts and sales tax revenue growth rates over the same period. As you can see, Shelby County gross receipts revenue has exceeded the growth rate of the rest of the country.

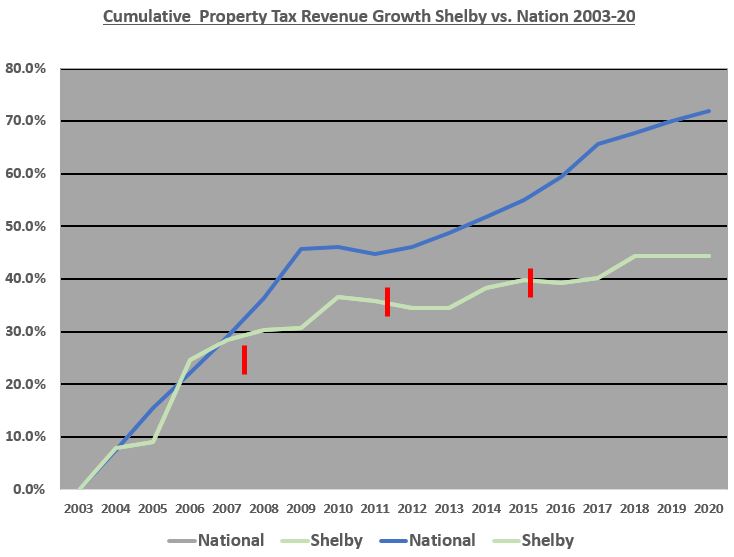

And finally, this is a graph of cumulative property tax growth from 2003-20 of Shelby County vs the nation. Had Shelby County achieved national trend line property tax growth since 2003, annual recurring property tax revenue would be $100M higher.

Conclusion

A strong data driven business case can be made for confronting lagging property tax revenue on a variety of fronts to include 1) increasing property tax rates 2) fully staffing the Assessors office per State requirements and 3) decreasing tax abatements.

Again, please email me questions or concerns about the data as I would like to get this right so that we can have an informed, accurate and data driven conversation to support local tax policy. My email is jkent@pathtrek.net

References