Key performance indicators (KPIs) funded and owned by Shelby County Government are needed for economic and workforce development measurement. Shelby County expenditures in these mission critical areas exceed $500M per year, yet there are no county owned KPIs to inform economic and workforce development oversight and policy work. The development of KPIs, which would also include a tax incentive fiscal note impact (TIFNI) platform for measuring (ROI) on tax incentives, could potentially be funded with $1.7M in misappropriated EDGE/Depot funds that should come back to taxpayers. This is an issue that has unfortunately gone locally unreported.

Federal and State government fund source their own KPIs, why shouldn’t Shelby County Government ?

Reliable KPI customer taxpayer centric measurement efforts have not been implemented or sustained by multiple organizations external to Shelby County government leaving policymakers and the customer taxpayer in the dark regarding hefty taxpayer funded expenditures. Perhaps the reason for this KPI unsustainability of outside organizations regarding taxpayer funds is because the vested interest is not there in measuring the effectiveness of funds outside of their organization.

And reliable measurement concerns regarding the Economic Development Growth Engine (EDGE) Scorecard methodology related to inflated tax revenue projections involving $500M+ in job tax incentives, have been regularly questioned in public proceedings, in the Daily Memphian and by The Beacon Center of Tennessee.

Exploring EDGE Incentive Accounting

With tax incentives having been the primary Memphis/Shelby economic development tool and inflated projection accounting concerns going back 8 years, KPIs would correct EDGE tax incentive projection accounting concerns with complete accounting and a fiscal note for all agency abatements in a single centralized tax incentive repository as requested by the Trustee’s office. This action would enable pubic return on investment (ROI) analysis for tax incentives while providing insight for optimizing economic and workforce development investments in the digital educonomy.

For example, on this upcoming quarterly EDGE report to the Shelby County Commission, FR8 Zone and Cherry Tree tax incentive projects collectively claim $3.5M in projected tax revenue against $3.75M in tax abatement incentives. At the same time, there is $942K combined on both projects that inflate projected tax revenue by claiming existing property tax revenue as new project revenue. This finding adjusts revenue down from $3.5M to $2.6M against $3.75M in abatements resulting in a $1.15M taxpayer loss while recruiting low wage logistics warehousing jobs.

Further, there is another low wage warehouse project on the EDGE agenda for this week in LeSaint Logistics. The LeSaint Logistics project also overstates project revenue by $1.5M by claiming existing property tax revenue as project revenue. This reduces revenue from $4M to $2.5M against a tax abatement of $5.5M resulting in a taxpayer loss of $3M.

Concerning, the above EDGE incentives result in $4.15M in taxpayer losses to incent low wage warehousing jobs. These are the very type of logistics jobs that the 2014 Brookings Focus Memphis Economic Development plan set goals from which to diversify away. But Brookings FOCUS KPI measurement efforts were never implemented thereby keeping the door open for taxpayer losing incentives, like the ones above, for low wage warehousing jobs.

Overall, concerns of excessive incentives are routinely publicly voiced with the persistent winners being corporate/real estate interests while property tax revenues remain flat in the face of EDGE inflated tax revenue projections, lagging small business vitality and workforce development outcomes. Small business and workforce are the primary drivers of any local economy.

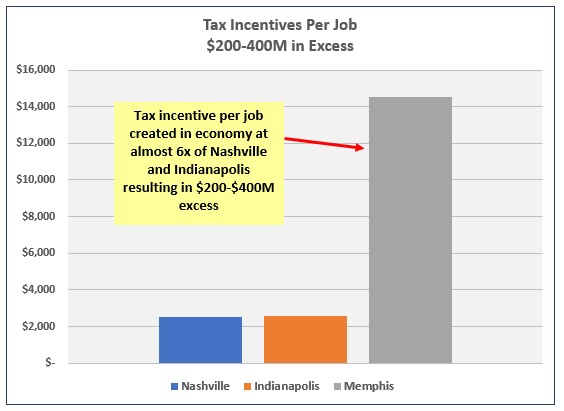

The above microanalysis of individual incentive awards (FR8, Cherry Tree and LeSaint) supports part of the flawed incremental methodology that has caused local job incentive awards to grow so large over time, not to mention the retention tax incentive accounting concerns confronted by the Beacon Center of Tennessee. The chart below, which has been published before, shows the per job cost of EDGE tax incentives when compared to peer cities Nashville and Indianapolis while pointing to an overall local $200-400M excess, when compared to other cities. These excesses accelerated under the Brookings FOCUS Plan where KPIs were not sustained.

And then there is the OaksEdge high end senior living residential PILOT on the agenda this week for a $22M tax incentive which is $22M more than would be awarded in any other County in Tennessee. Besides, the residential PILOT was designed to support infill development to attract Millennials to Memphis. But this is a whole other excessive PILOT story that involves the irresponsible expansion of the original intent of residential PILOTs which is arguably already a fiscally liberal provision exclusively allowed for Shelby County in the State of Tennessee. So back to the Brookings FOCUS economic development plan and KPIs.

Brookings FOCUS Plan

The Brookings FOCUS Economic Development plan was a public-private partnership planning effort and product of the Memphis and Shelby County Regional Economic Development Plan Steering Committee Co-Chaired by former Mayor A.C. Wharton, Shelby County Mayor Mark Luttrell and Christine Richards, formerly Chief Counsel for FedEx. The planning project was managed by the Economic Development Growth Engine (EDGE) and the steering committee consisted of representatives from education, industry and local government.

The 2014 Brookings FOCUS plan set out to 1) diversify away from logistics, 2) improve workforce through increased educational attainment, 3) increase support for entrepreneurs, startups and small business and 4) increase employment density in the urban core. Given these key findings, KPIs can be applied to measure the effectiveness of the Bookings FOCUS plan and taxpayer funded economic development efforts.

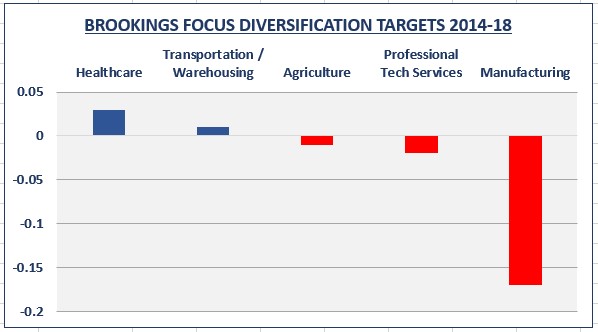

Per the Brookings FOCUS plan, as an example of a KPI for diversifying away from and decreasing transportation logistics low wage warehousing jobs with a focus on increasing healthcare, agriculture, professional tech services and manufacturing, a KPI can be deployed. This KPI uses Bureau of Labor and Statistics (BLS) data to measure industrial wage concentration changes in Shelby County as compared to the nation since 2014. Healthcare was the only improvement for Shelby County while Transportation targeted for decrease, increased and agriculture, professional tech services and manufacturing targets for increase, all decreased. Most concerning, was the significant fall in manufacturing industrial wage concentration.

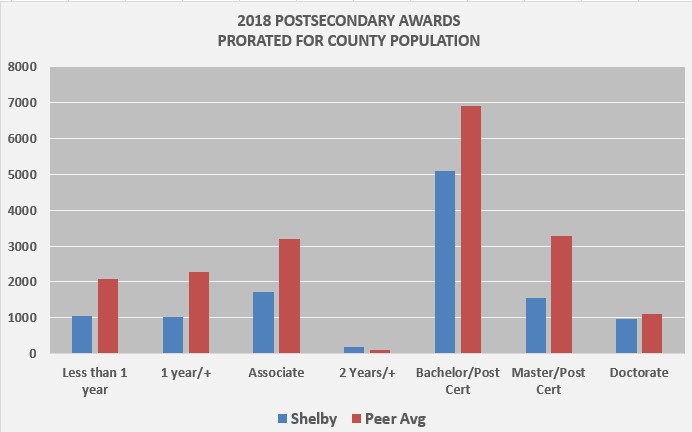

As expressed through the below KPI, challenging all local industrial sectors for growth is an unprepared workforce with below peer average postsecondary educational attainment and program completion. The below shows how Shelby County postsecondary educational attainment, across all ward levels, compares vs 15 Shelby County peers. In short, Memphis/Shelby needs to increase postsecondary completions by 6,000 per year while promoting in demand career pathways, with digital technology in mind to serve all industrial sectors.

Shelby County Recommended KPIs

Federal and State government fund source and own their KPIs. Why shouldn’t Shelby County Government ? After all, there appears to be a local $1.7M funding source and external to Shelby County Government, local organizations have not executed in the KPI area. Besides, such organizations often lack a vested interest and have an agenda that is not in direct alignment with customer taxpayers. While the potential number of KPIs are endless, these are a few simple recommended KPIs for economic and workforce development measurement using authoritative Federal, State and Local government data sources:

- Centralized Tax Incentive Database for all Agencies with Fiscal Note Support

- Average Wages

- Total Wages

- Total Employment

- Unemployment rate

- Business Establishments per 1k Population

- Postsecondary Educational Attainment by Award Level and Career Cluster

- Industrial Employment and Diversification

In fact, deploying fewer simple but highly impactful KPIs that the County owns and maintains is probably best. A few simple KPIs will get the County started, with more to come. The KPIs will equip policymakers with the needed customer taxpayer aligned data, owned, funded and maintained by the County to inform public oversight and economic/workforce policy development.