Out of the gate, taxpayers are being bullied in local tax incentive deliberations. While deliberations operate under a big lie, the public University of Memphis (UofM) has partnered with the Greater Memphis Chamber in local tax incentive deliberations, that involve a closed to the public joint City Council/County Commission convening. Memphians have been robbed of independent public university thought leadership and don’t even know it. Can it get anymore rigged than that ?

With the Chamber routinely partnering with Memphis Tomorrow, Economic Development Growth Engine (EDGE) and the Downtown Memphis Commission (DMC), one would think the publicly funded UofM would partner with local government and taxpayers to level the playing field. But not in Memphis, making the case for institutional bullying by the UofM.

This is the very Memphis/Shelby taxpayer, that has been bullied for years by local corporate/real estate interests. This occurs as local legislators operate under the lie that regulating tax incentives must occur through some rare joint Council/Commission convening and agreement. Such regulation can occur independently, at anytime, by either legislative body and should be ongoing, while using the pulpit of local government. But local legislators seem content accepting the lie and proceeding in their pre-designed elitist sandbox.

The Deliberation

Legislators, content being sheltered from reality, as the UofM institutionally bullies taxpayers, have yet to champion any external best practice economic development research during joint discussions. Not even research, by the now untrustworthy UofM, which in 2017 published We Are Not Lost – Amazon Gave Us a Map, was championed by local legislators.

The Amazon Map effectively de-emphasizes tax incentives, while prioritizing areas that excessive corporate incentives dilute, like workforce and public transportation. For that matter, Amazon is making a huge $200M investment in Memphis, without tax incentives, which is sadly going uncelebrated.

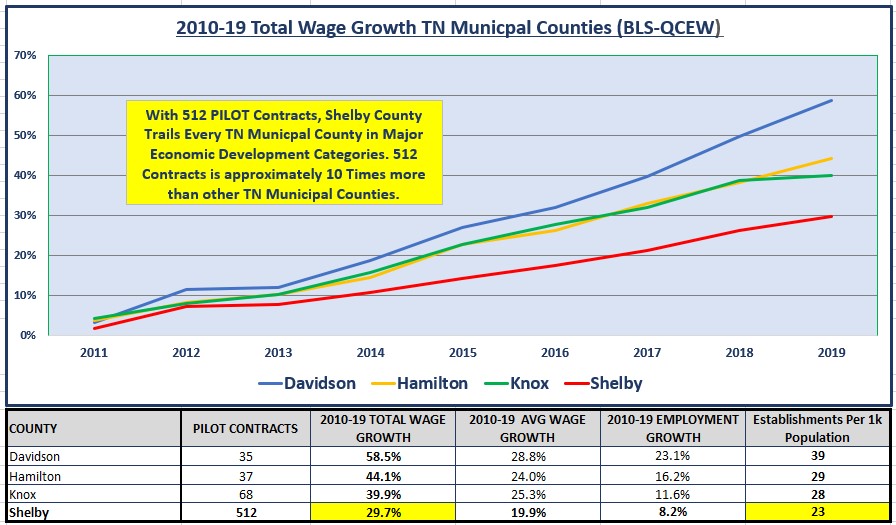

Instead, in deliberations, legislators continue to hear from the same entities that have bullied taxpayers for years in EDGE, DMC and Chamber, without the aid of independent public university thought leadership from the UofM. Authored not by research, but by the excessive incentive examples of FedEx, AutoZone, Nike and International Paper, Memphis/Shelby taxpayers are bullied by some $50M per year in excessive corporate incentives, all while a plethora of industrial development boards are systemically fee incented to regularly approve excessive individual incentive awards.

At the same time, Commissioner Tami Sawyer, through questioning of EDGE’s Reid Dulberger, was successful in establishing the existence of an elitist cabal by revealing the formal lobbying relationship between Chamber Chairman Circle member Brian Stephens of Caissa Strategies and EDGE. And Councilman Martavius Jones began making a case for linking incentives to higher wages. Commission Chairman Eddie Jones seems to have his eye on the $138M DMC PILOT Extension Fund, previously used for outlandish and wasteful taxpayer appropriations for developers and downtown public parking.

Given current momentum of discussions, these are specific reforms that should be proposed:

- Public upfront ask of $1.5B returned back to taxpayers from the Memphis Tomorrow complex for deficient economic development leadership over 20 years.

- Define and measure “economic development”

- Centralize all tax incentives, performance and compliance information in a publicly accessible web based repository.

- Reward higher wages with higher EDGE abatement amounts on new capital investment while lowering overall abatements, in for example, 35% – 35K, 40%-$40K, 50%-50K and 100%-100K.

- Require legislative approval for using the EDGE “community reinvestment credit” otherwise known as abating already existing real property taxes and reserving this for high wage transformational economic development opportunities, while performing trade off analysis.

- Shut down the DMC PILOT extension fund, outside of current commitments, while reforming parking operations to return more money to local general funds

- Limit DMC blight reduction real estate development incentives to 10 years, while conceding the removal of “affordable housing” requirements, which is really a marketing tactic for excessive incentives.

With these reforms, local legislators will make true progress for taxpayers. At the same time, other areas that deserve review are 1) the almost $50M that sits, unused and without a plan, on industrial development board balance sheets 2) code enforcement for Memphis Health, Educational and Housing Facility Board PILOTs and 3) fee structures that reward industrial development boards for awarding excessive incentives.

Blackjack Smith knows about the unused money sitting on board balance sheets. FedEx got $3M in grants for their Downtown expansion, while ripping off the taxpayer for another $3M in the non-public approval of the 100% abatement extension for the FedEx World Trade Center in Collierville. All the while, local status quo PILOT advocates lie and say, that Memphis does not provide cash grants as part of their tax incentive offering.

All of this to say, that substantive tax incentive reform is in order for the overall public good.

Conclusion

As for the institutional bullying by the UofM, its really sad and more of the same. The #1 accomplishment that would throw the UofM into the national spotlight is the turnaround of Memphis. That will only occur, with the UofM not surrendering its public university thought leadership and partnering with local and Tennessee taxpayers.

But sadly, time after time, the UofM has chosen not to partner with taxpayers. Its my suspicion that educational institutionalists, from around the state, were so repulsed by the state funded UofM runs on local taxpayers, that included bullying and lies under Rudd and the new local corporate Board of Trustees, that Rudd in a sense was forced out.

Memphis needs independent public university thought leadership, that works in partnership with taxpayers, not more institutional bullying……