Hats off to the Memphis Business Journal for teeing up the tax incentive discussion. The MBJ, arguably with the least political capital to do so, based on their target audience, more often than any other media outlet raises questions about excessive corporate/real estate tax incentives as advocated for by the FedEx / Memphis Tomorrow complex. The MBJ gets that elitist corporate socialism for the benefit of the small few is anti-business. To that extent, the need for Hack Reform is paramount !

But then again and unfortunately, the MBJ article seems to frame the discussion around an all or none incentive debate. Without question, the use of economic incentives are required in the competitive economic development space. But the questions are, 1) Who is really charged to lead economic development efforts; local government or business development organizations like the Greater Memphis Chamber? 2) Are Memphis/Shelby economic incentives excessive?, 3) Why 75% abatement all the time? and finally 4) Are there perverse drivers in place like fee revenue that contribute to excessive incentives that lead abating authorities to represent corporate/real estate interests over the taxpayer?

And as far as Richard Smith, mentioned in the MBJ piece, he has been in an impossible position. He is charged with optimizing economic development policy while inheriting the elitist economic policy pronouncements of the culturally engrained FedEx/Memphis Tomorrow corporate socialists leadership complex that have not worked. Smith has tried to get movement on economic development reforms only to be undercut by the FedEx/Memphis Tomorrow complex.

And from the article, its true that economic incentives are required for the FedEx Downtown expansion but not $32M in incentives. But Smith is not an activist or an economist, but a FedEx corporate leader charged with pursuing the maximum available incentives just like his Chamber Board Vice Chair in Willie Gregory of Nike did a few years back with a $57M abatement that transferred wealth from one of the most impoverished areas of the country in Memphis to one of the least impoverished in Portland, Oregon.

This excessive wealth transfer systematically occurs at the same time Nike’s social justice campaign proceeds. Again, its an impossible position for Smith to have the objectivity to chart optimal economic development policy while being hampered by the FedEx/Memphis Tomorrow corporate socialists. The very corporate socialists who are down in all of their community and economic development categories over 20 years while their initiatives feast upon your Federal, State and Local tax dollars.

So, moving forward lets answer the questions posed above and propose solutions.

Who Should Lead Economic Development?

Since taxpayers fund economic development efforts, local government should define, measure and lead economic development efforts with input from first the University community and secondarily from the business, education and public at large communities. But, good luck on getting the University of Memphis and Robot Rudd to show up and allow his subject matter experts to present based on objective research findings.

Over time, local government has unfortunately allowed the FedEx / Memphis Tomorrow complex to botch the workforce development system while allowing excessive corporate/real estate incentives for the benefit of the small few to roar as small business vitality has plummeted. This is a corporate socialist design for decline and has cost Memphis/Shelby taxpayers some $250M in tax revenue shortfalls since 2010 while presently recurring at $50M per year.

Are Memphis/Shelby Incentives Excessive?

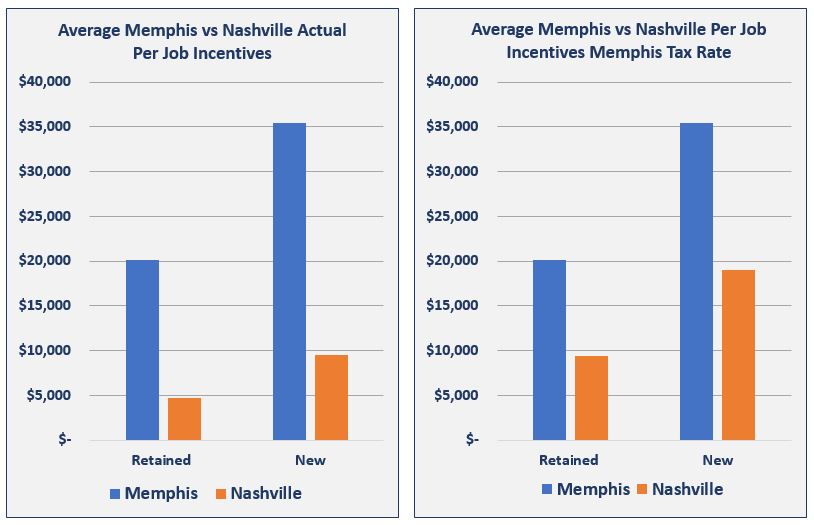

Memphis/Shelby tax incentives are excessive while having been justified with hack bogus projection accounting over 8 years while in many cases abating taxes against existing property. The below charts show per job total incentives for Memphis vs Nashville for retained and new jobs benchmarked against Nashville incentives. The chart on the left shows actual abatement amounts and the chart on the right converts the Nashville abatement amount to higher Memphis/Shelby property taxes.

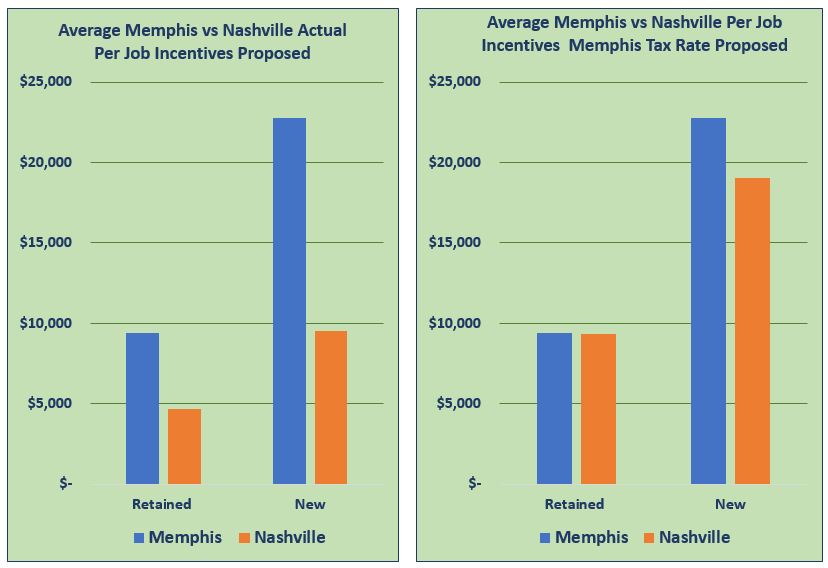

The proposed solution for right sizing job tax incentives is to maintain EDGE and DMC term and capital investment minimums with a 50% abatement for new capital investment down from 75% while not abating existing property taxes. Further, in order to qualify for capital investment abatements, current employment levels must be maintained for the abatement term while 1% of total wages for new jobs would be abated in addition to the capital investment abatement.

Applying this formula against approved EDGE abatements since 2011 would have reduced total job tax abatements by $220M and would have still been equal to Nashville per job retention abatements and 20% more than Nashville for new jobs when Nashville abatement amounts are converted to a higher Memphis tax rate.

Under this arrangement, to give a few specific examples, the FedEx Downtown total project abatement would have totaled $9.2M down from $32M and Auto Zone would have totaled $8.9M down from $11.3M. The FedEx proposed abatement calculation assumes $20M in real property investment and $13M in personal property over a 15 year term. See below chart to see the impact of the proposed incentive solution when benchmarked against Nashville.

75% Abatements and Perverse Drivers

Fee revenue for abating boards creates perverted drivers that in effect have abating boards representing corporate/real estate interests over the taxpayer. This results in creating a perverse market condition and 75% abatements for all while maximizing fee revenue with higher abatement awards . Its a design for decline authored by the FedEx/Memphis Tomorrow corporate community leadership complex.

Fee revenue should go to local government with abating boards funded through annual appropriation. Its unfortunate that this perversion was not addressed in the sham EDGE Council / Commission review committees both chaired by FedEx employees. And its also unfortunate that the review of some 9 other abating boards has yet to be scheduled by the County Commission as required by their own resolution.

Conclusion

Local government should lead economic development efforts and listen to taxpayers. Listening to economic development subject matter experts and taxpayers is the best possible economic development strategy available. Such a strategy, would mark a departure away from a closed economic system and the hack elitist corporate socialism of the FedEx/Memphis Tomorrow complex while engaging in Hack Reform.

And then again, there is $250M in lost community investments presently accelerating and recurring at $50M in Memphis/Shelby tax revenue shortfalls. Really, how does a Memphis community in need, left behind in the global economy, recover from those shortfalls ???