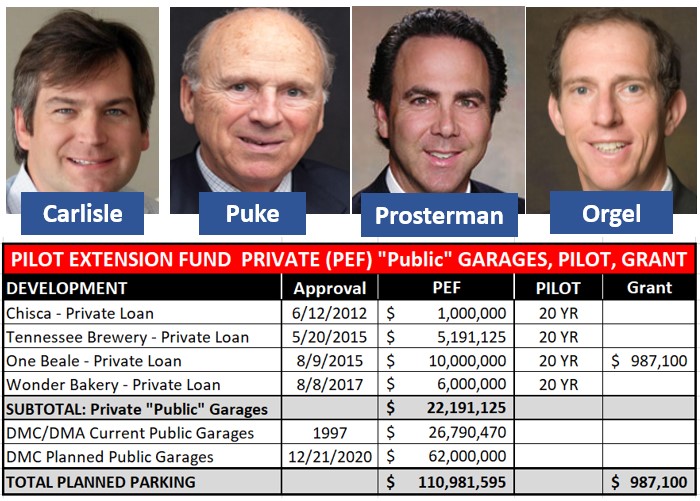

“Double dipping” is the finding, as research into the PILOT Extension Fund (PEF) continues. Local developers in Carlisle (One Beale), Puke, Prosterman (Wonder Bakery) and Orgel (Brewery) have leveraged the PEF for long term loans to finance construction on private “public” parking garages, while then getting 20 year 80%+ property tax abatements, on the overall development, that includes tax abatements on the parking garage !

Also, just an aside on an unrelated matter, Prosterman is the beneficiary of $2M in TnInvestco state funds, for a startup called Hapten Sciences, that has only resulted in 2 employees over 10 yrs.

Anyway, approved loans for private “public” parking garages total $22M. And the term lengths of these taxpayer funded private loans are like 45 years. A low interest long term loan, using taxpayer money from abatements + another 80% abatement for the finished project = A DOUBLE DIP !! (See above table with data sourced from the DMC Database).

Further, based on a review of the DMC financials, its unclear if loans are being repaid to the Downtown Mobility Authority (DMA). And Carlisle got a garage loan, a 20 yr abatement and a $1m grant for One Beale. This does not include the new 30 yr PILOT for the Grand Hyatt or the benefit of the planned $42M mobility center across the street from the One Beale development.

The PEF is a restricted public parking fund, funded with extended corporate/real estate tax abatements. And its also true that, over the years, Downtown Memphis Commission CEOs, have asserted a false belief, that this abatement money is NOT the taxpayer’s money, but the DMCs money, based on an Attorney General’s opinion issued in 1997. The actual legality of the fund remains an open question.

Wonder why no local traditional or non-traditional publications have questioned the $62M PILOT Extension Fund expenditure? Its strange that no one is asking what would $62M do for affordable housing or public transit? Or why there is a parking plan and no economic development plan? At the same time, with no formal working definition of “economic development”, it’s clear local “visionaries” have defined economic development as corporate, real estate AND now parking development.

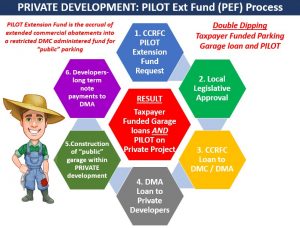

PEF Private “Public” Parking Garage Loan Process

Basically, these loans are publicly funded loans, for parking garage construction for private developments, that allow public parking, whether or not there is demand for public parking in the area. Here clickable graphic and the PEF loan process:

parking, whether or not there is demand for public parking in the area. Here clickable graphic and the PEF loan process:

- DMC Center City Revenue Finance Corporation (CCRFC) approves a PEF request and seeks local legislative approval.

- Once legislative approval occurs, the CCRFC arranges financing and provides funds to the Downtown Mobility Authority (DMA) for administration and distribution

- DMA loans the funds to private developer

- Private developer builds and manages the “public” garage on their private development

- Developer repays DMA loan over 45 years or so

- Developer benefits from Double Dip of taxpayer funded low interest loans and 20 yr 80% property tax abatement on the garage and their private development.

Now, after the above, the DMC is going to spend anther $62M on public parking, when in 2019, DMC’s DMA only generated $2M in revenue, before expenses, on 5,500 public parking spaces. At a conservative $10 per day, that is only a 10% occupancy rate. During COVID, DMA 2020 revenue was off $400K, down to $1.6M.

But based on the 2019 analysis, a bunch of folks are not paying for parking or there are a bunch of empty spaces, which negates the need for additional public parking. So much for any funding focus on needed public transit, affordable housing or education. All total, the PEF plan is to finance $111M in public parking.

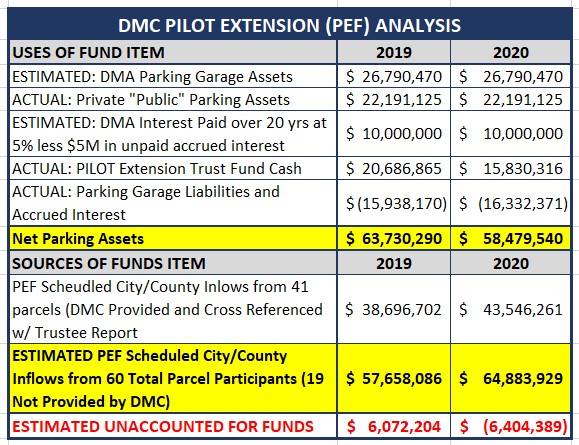

PEF Analysis Update

As new information on the PEF is obtained, the above table is updated. For example, we do not know how much money has flowed into the PEF over time. The above estimates are based on public testimony and DMC public information requests that are cross referenced with the County Trustee Report. For example, as of today 12/30, based on a public information request to the City of Memphis on 12/8/20, the City has no idea how much was contributed to the PEF in 2019, much less over the last 20 years.

To that extent, the new information discerned, from the DMC financial statement and website, were the private “public” garage assets, that provided the information to adjust the unaccounted funds down by $22M, resulting in an estimated $6M surplus in 2019 and $5.6M deficit in 2020.

PEF Open Due Diligence Questions

Besides the outrageous Double Dipping and $62M priority put on downtown parking, at a huge cost to everything else, these open due diligence questions remain:

- Legal authority of the PEF ?

- Historic contributions to the PEF ?

- Valid lease agreements to support future fund inflows and corresponding debt service ?

Maybe we will find out the above…..