A FIRESIDE CHAT: BILL RHODES

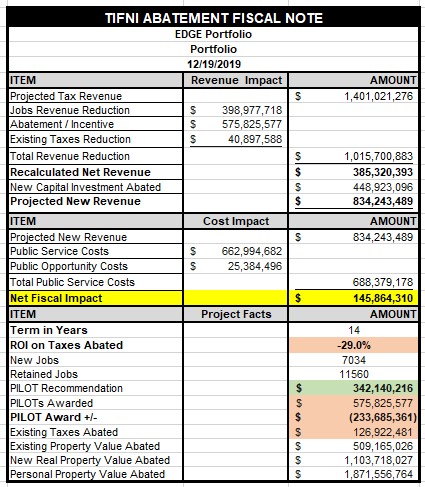

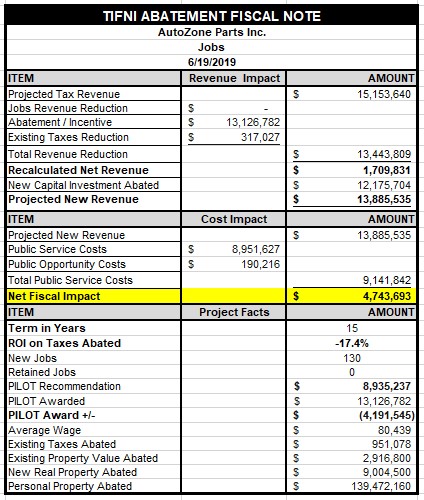

On Wednesday, AutoZone went in and got an increase on their already excessive EDGE abatement from $11M to $13M while reducing the net taxpayer benefit from $3M to $2M. When fiscal impact analysis is imposed, the projected abatement return on investment for taxpayers is –17.4%.

AutoZone is led by Bill Rhodes who also sits on The Memphis Tomorrow and Hyde Foundation Boards. We decided to invite Bill for a fireside chat to which he hopes he accepts. Here are some advance questions:

Bill, in your private and public leadership positions, we hope that people such as yourself can see the nexus between an evolving publicly supported ecosystem and private profitability. What was the thought process at AutoZone to decrease the net taxpayer benefit of the AutoZone EDGE project from $3M to $2M in the midst of flat public revenues ?

Bill, did you know at a $9M abatement, the Memphis/Shelby taxpayer could have broke even at the end of the 15 year term? Do you see the public-private benefit of achieving at least taxpayer breakeven over a 15 year term with the AutoZone project ?

Bill, now we know our tax rates are high in Memphis. In Nashville, your abatement would have been about $3M. Double that for the high tax rate in Memphis and make it $6M and then kick in another $1M for Nashville being a hotter city and you have an abatement of $7M. Don’t you think $9M is business friendly while the taxpayer breaks even after 15 years ?

Bill, with the AutoZone project, we abated $1M in already existing property taxes. With flat local public tax revenues, does that really seem like it would help AutoZone profitability while risking the possibility that AutoZone growth might not be adequately publicly supported ?

Bill, we abate 75% in taxes for existing companies. Where did that thinking come from ? It reeks of anti-business corporate socialism and elitism. What ever happened to the partnership concept of say 50% for an existing local corporation in AutoZone operating in a nationally low business cost environment in Memphis ?

Bill, so how did the Memphis Tomorrow CEO organization pull off being down in all categories over almost 20 years as their initiatives use Federal, State and Local taxpayer money?

Bill, what was the deal with the unmeasured Brookings FOCUS economic development plan that came out of the Memphis Tomorrow Fast Forward initiative and the botched workforce development effort over 5 years while excessive tax incentives roared for the benefit of corporate/real estate interests ? It seems to be a prescription for ecosystem decline. Is there another way this can be viewed ?

Anyway Bill, contact us if you would like to schedule the fireside chat. And here is the new fiscal note for the AutoZone project.

AUTOZONE: TIFNI Abatement Fiscal Note

JUST FOR KICKS

Just for kicks, since I go to a bunch of EDGE meetings, I thought I would try to reconcile what the EDGE Board approves with the 2018 Annual Shelby County Trustee’s Report. First before I get started, I know the Shelby County Trustee is NOT in charge of reconciling EDGE Board approvals with EDGE contracts. But who is ?

The Shelby County Trustee only bills and collects taxes based on legal requirements, and for this discussion, an authorized industrial development board payment-in-lieu of taxes (PILOT) contract. With that stated, based on what is EDGE Board approved and what is showing up in the Trustee’s report varies widely unless I am misinterpreting something, which is entirely possible and why I am writing this blog.

RE-CON-CILE

First, the EDGE Board typically approves an excessive 75% city-county tax abatement for a 10 – 15 year period or a payment-in-lieu of taxes of 25% of property taxes due. But this is what the 2018 Shelby County Trustee Report reveals based on contract amounts regarding County property taxes:

For real property, $3,434,440 is billed based on PILOT contracts instead of $25,627,065. That is 13.4% instead of 25%. Had 25% been billed that would mean $6,406,766 in billings or $2.972,326 more in PILOT revenue.

For personal property, $246,809 is billed based on PILOT contract instead of $12,269,542. That is 2% instead of 25%. Had 25% been billed, that would mean $3,067,385 in billings or $2,820,576 more in PILOT revenue.

The total estimated variance between what is typically approved in a 25% PILOT and what is showing up in PILOT contracted billings in the 2018 Shelby County Trustee Report is an estimated $5,792,902 PILOT revenue shortfall.

Other Questions

Also in trying to reconcile EDGE approvals with The Shelby County Trustee Report, is the “Owner” the property owner or the entity that EDGE awards the abatement ?

And if something is drafted in contract that is significantly different from what is publicly EDGE Board approved, shouldn’t the revision of what was originally approved come back for public hearing and approval ?

Anyway, here is my spreadsheet work.

Please advise if I am analyzing this reconciliation in the wrong way. Thank you.

DEBATE

I AM A HACK

Dear Santa

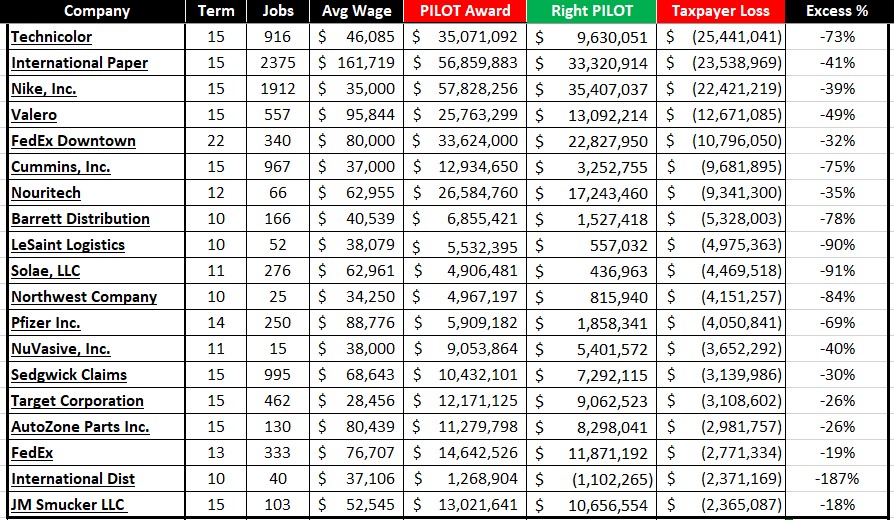

TOP 20 WORST JOB PILOTS: When the Taxpayer Loses, Business Loses

The local hack elitist “visionaries” of the Memphis Tomorrow cartel, apparently don’t know business loses when the taxpayer loses. When the taxpayer loses, business loses millions in various ways to include deficient workforce, public transit, inadequate roadways and public safety concerns. But in their defense, many businesses that are beneficiaries of excessive incentives are just participating in the locally promoted incentive program. They don’t know, through excessive corporate/real estate incentives, that public policy has been stupidly constructed to undermine the very ecosystem that supports their success.

And at the State level, The Shelby County Delegation doesn’t seem to question anything regarding tax incentives brought before them that impacts the local taxpayer. Take for example the $21M FedEx sales tax break for hub expansion. Local taxpayers will shoulder $5M of that and there is no published economic impact plan to justify the incentive. Why not ?

And further, the Delegation seems content with the residential PILOTs where Shelby County is the only County in the State that offers any tax incentive for residential construction. What’s more alarming, even if Shelby County had a unique need for a residential tax incentive, the delegation did not bother to protect the local taxpayer with implementation guidelines that would limit the abatement amount. Hence, local taxpayers are getting hammered with excessive 75% abatements on select residential developments.

Underwriting all of this excess, is the lack of reliable economic and fiscal impact analysis resulting in excessive tax incentives. All occurring where excessive incentives are needed least in a nationally low business cost environment in Memphis. If legislators, the public and business had reliable economic and fiscal impact analysis, they would have a basis to reform incentives while also informing smarter economic and community investments. The solution is a tax incentive fiscal note impact (TIFNI) for every abatement which affords independent public measurement of the economic development complex housed within a centralized tax incentive repository.

And for the record, The Beacon Center, in their recent report, missed the total amount of state and local tax incentives slushed out to FedEx occurring without any economic impact analysis. The total amount was $66M for Downtown and hub modernization not $14M.

The Worst PILOTs

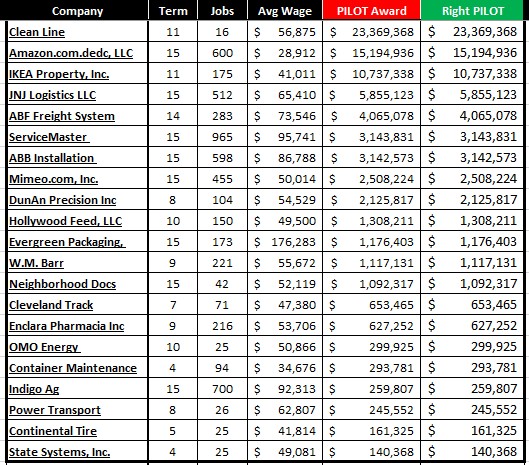

Below, using a fairly liberal standard of taxpayers just breaking even at the end of the abatement term, the worst EDGE job PILOTs are listed sorted first by amount and then by percentage. The initial listings are followed by a listing of right sized PILOT awards. In the current economic development environment, there are examples of responsible PILOT awards. The listings below show the PILOT awarded and a generous business friendly right size PILOT award in its place based on reliable economic and fiscal impact analysis. The problem is not the existence of PILOTs but excessive PILOTs enabled by bogus projection accounting and a lack of legislative and press oversight.

Based on the sizing of incentives in other cities, it is clear that other cities are practicing some degree of restraint and someone somewhere is doing the math related to reliable economic and fiscal impact analysis. But this work is irresponsibly not occurring in Memphis.

What’s interesting about the listing are many PILOTs that don’t make the headlines like Raymond James, FedEx, AutoZone and etc. are shown below. Huge taxpayer losses are routinely occurring without public knowledge due to a non-investigative press and lack of rigorous legislative oversight while a community in need suffers and the small few benefit.

The more than 100% loss occurs within fiscal impact analysis as a result of egregiously abating existing real property taxes in addition taxes that occur from new capital investment.

Best PILOTs

BEHIND THE HEADLINES: Tax Incentives and FedEx

In a City plagued with excessive incentives, there is no help from the local media. On Behind The Headlines, Eric Barnes and Bill Dries hosted Richard Smith of FedEx who is outgoing board chair of the Greater Memphis Chamber.

Barnes and Dries could have asked about return on investment (ROI) of incentives or potential incentive excessiveness. But instead, they just confirmed all cities offer economic development incentives without probing deeper on for example inflated bogus projection accounting that has gone to justify excessive incentives leaving the Memphis/Shelby taxpayer holding the bag. The ROI question would have potentially revealed that there is no reliable ROI methodology for measuring tax incentives for the customer taxpayer.

As far as FedEx, they have received $66M in state and local incentives for moving to a different local zip code downtown, promising 340 new jobs and investing $1.5B in hub modernization. Barnes and Dries could have asked Smith about the projected economic impact for $66M in state and local incentives given that there is no published economic impact plan. But that question was not raised.

To that extent, Smith played his Chamber and FedEx executive role while accurately describing the Chamber as a “business association” with the mission of economic recruitment, policy advocacy and workforce development and pitching the benefits of an incentive supported ($34M) Fortune 100 FedEx headquarters downtown.

Smith went on to accurately identify business recruitment prospects as the “customer” of the taxpayer when using public incentives in the work of economic development. At the same time, Smith did not identify the taxpayer as an “investment customer” in the use of economic development incentives just as shareholders are investment customers of corporations. This points to a problem in the current environment where there is no reliable independent public measurement of the public-private economic-workforce development complex. This leaves a Memphis/Shelby customer taxpayer dismissed in the midst of excessive corporate/real estate incentives.

Smith mentioned the known loss of Electrolux. But Electrolux can be defended as a one time bad deal. What can’t be defended, and the local media in a rigged system is doing little to help, is the systemic implementation of bogus projection accounting over 8 years to justify excessive tax incentives ($250M+) for the benefit of corporate/real estate interests. This occurs while dismissing a Memphis community in need and true economic development in small business and workforce development.

Based on an Evanoff CA article, it appears that FedEx may be feeling the effects of a botched disconnected workforce development system. Its a botched system that has systemically occurred over the past 5 years under the publicly unmeasured FedEx/Memphis Tomorrow corporate community leadership cartel. The botched workforce development system has cost local business and taxpayers millions while excessive incentives have roared for the benefit of the small few and corporate/real estate interests.

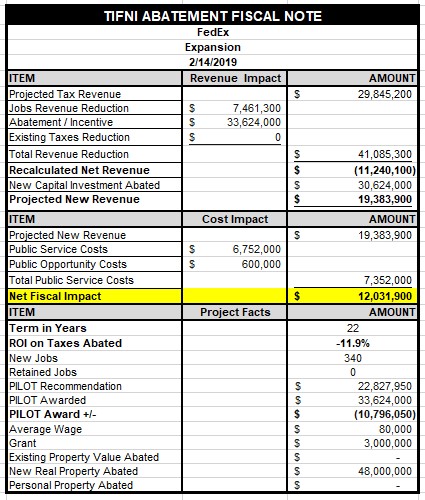

So is FedEx Downtown a Good Deal for Taxpayers ?

No one really knows if the FedEx package of incentives is a good deal for taxpayers. There has not been a reliable economic impact summary published on the $66M in state and local incentives. Local taxpayers will shoulder about $34M for the downtown and $5M for the hub project.

But we have enough data on the FedEx Downtown project to bust out a fiscal note to evaluate the incentive using responsible assumptions. Using a 2.0 multiplier for economic impact, over 22 years, the net fiscal impact for 340 new jobs is $12M. Based on the total incentive of $34M, that equates to a -11.9% annual return. This type of arrangement points to one of the causes of flat property tax revenue growth.

A more customer taxpayer centric total abatement amount, while being generous to the opportunity of locating downtown a cherished Fortune 100 FedEx Downtown headquarters would be a $23M abatement over 22 years or $10M less. This abatement amount would have insured taxpayers recaptured their abatement proceeds after a generous 22 year term. See below fiscal note:

Conclusion

The local media is not helping to expose the story of a Memphis community in need that has been systematically hung out by excessive corporate/real estate incentives using bogus projection accounting. The only solution to helping Memphis move forward is independent public measurement that recognizes the taxpayer as the investment customer in public-private initiatives.

And besides, right sizing incentives is not a pro or anti-business endeavor. Its just a math equation to size incentives while recognizing the taxpayer as the investment customer in public-private economic development work.

HERE WE GO AGAIN: Don’t Handicap Gregory Again with No Public Measurement

Here we go again. More of the same faces carouselling through Memphis corporate community leadership cartel. Public officials need to give Willie Gregory, as the new Greater Memphis Board Chairman, a chance at success in moving Memphis forward with independent public measurement of the public-private complex. Without independent public measurement, public-private initiatives will leave taxpayers holding the bag.

In the recent past, without independent public measurement, Gregory led the botching of the Memphis workforce development system as the initial Board Chairman of the Greater Memphis Alliance for Competitive Workforce (GMACW). GMACW was a Greater Memphis Chamber “Moon Mission”. But it went nowhere, as GMACW was taken over by EDGE who then sustained the botch leaving Memphis 5 years behind schedule on connected workforce development efforts costing local businesses and taxpayers millions.

Pageantry

In fact, in a sea of pageantry, Gregory and team seemed to celebrate the botch with a Nike – GMACW event at the National Civil Rights Museum on April 4, 2016, when GMACW was already a year behind schedule in delivering needed connected workforce development services. The event was entitled “Have We Achieved Dr. King’s Dream?” Nope, you certainly have not achieved the dream if you are botching the workforce development system, wasting taxpayer money and leaving a community in need with disconnected workforce development services. For whatever reason, pageantry events are often mistaken as implementation in Memphis.

In yet another pageantry event, in May of 2016, The City and County announced an ACT National Career Readiness Certificate initiative to improve workforce development efforts. But it was never implemented. So damn strange. But non-implementation is normal in Memphis. Other cities measure local improvement initiatives and when work goes off track as it often does, they course correct. But course correction does not happen in Memphis which is largely enabled by a lack of public measurement and oversight.

Gregory in his acceptance remarks said, “Our mayor is a Memphian, both county and city. Beverly Robertson is a Memphian. I’m a Memphian, Richard [Smith] is a Memphian,” he said. “I’m saying that to say we grow our own here in Memphis”. What’s concerning about what Gregory said is that those from Memphis only know systems of decline after 20 years under the Memphis Tomorrow CEO cartel. Memphis Tomorrow is the City’s #1 problem while being down in all categories over almost 20 years as their publicly unmeasured initiatives use taxpayer money.

In many ways, it seems folks that come from outside to perform transformative work become confused and leave. Perhaps because of the lack of implementation focus. Glen Fenter, an accomplished executive educator and initial CEO of GMACW came and left as did Eric Miller, Chamber Economic Development SVP. I know I have been confused after having worked in communities across the country at the lack of local implementation when it involves taxpayer money in Memphis.

But the Memphis cartel doesn’t know how to process dissent or course correcting innovation thus leaving the City to stagnate and decline. The Chamber after 3 years of knowing funding is the challenge with transit has yet to publish a transit funding position. And everyone has been waiting 2 years for their economic development plan and now workforce development plan.

But in reality, business development is the work of the Chamber and economic and workforce development are core public government functions. Local government should be publishing their own economic and workforce development plans while independently measuring public-private partnerships and indeed recognizing the Chamber as an influential stakeholder along with taxpayers.

Excessive Incentives Undermine Economic Development

Gregory touted workforce development in his acceptance remarks. But excessive corporate/real estate incentives have dominated local economic development efforts while undermining needed funding for workforce development.

This incentive excessiveness can even be shown to be anti-business with declining small business vitality and below peer average total wage growth. EDGE, who is now over GMACW, never holds public meetings while they meet practically every month to approve excessive corporate/real estate incentives for jobs that cannot be filled. And this occurs in a city with nationally low overall business operational costs making excessive incentives less necessary.

Gregory’s own Nike can be used as an example of an excessive incentive. Memphis abated $57M in taxes to transfer wealth from one of the most impoverished areas in the country in Memphis to one of the least impoverished in the Portland, Oregon area where the Nike headquarters is located.

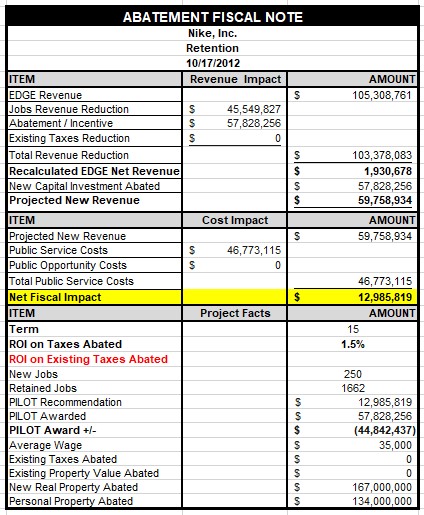

Upon figuring economic and fiscal impact, using responsible assumptions, the Nike abatement generates $13M in net fiscal impact after 15 years for Memphis/Shelby taxpayers on the $57M abatement. That is a 1.5% simple interest annual return.

The right size Nike abatement, when considering average wages and new capital investment is $13M not $57M, resulting in a $45M excess abatement. Keep in mind, with greater job growth, Indianapolis had $135M in job tax incentives on 110 projects whereas Nike was $57M for one project and overall EDGE has awarded $500M+ in job tax incentives. EDGE projects, using inflated accounting to justify the excessive abatement, $47M in net revenue without fiscal impact analysis for Nike.

Clearly, Indianapolis is doing the real math of economic and fiscal impact in sizing their incentives. But the math on incentives isn’t being done in Memphis while awarding everyone the same 75% abatement and in some cases abating existing property taxes. See below Nike fiscal note using the tax incentive fiscal note impact (TIFNI) platform:

Sadly Memphis/Shelby has no way of measuring their return on investment of incentives. There is no reliable economic and fiscal impact analysis and even if public officials decided to undertake an evaluation, they could not do it as there is no central repository for housing tax incentive data for 9 abating boards. This results in both a measurement and data problem.

Conclusion

Local public officials should support Willie Gregory and the public-private complex with independent public measurement. Without independent public measurement, Gregory won’t be successful and Memphis won’t move forward….