Governor Bill Lee,

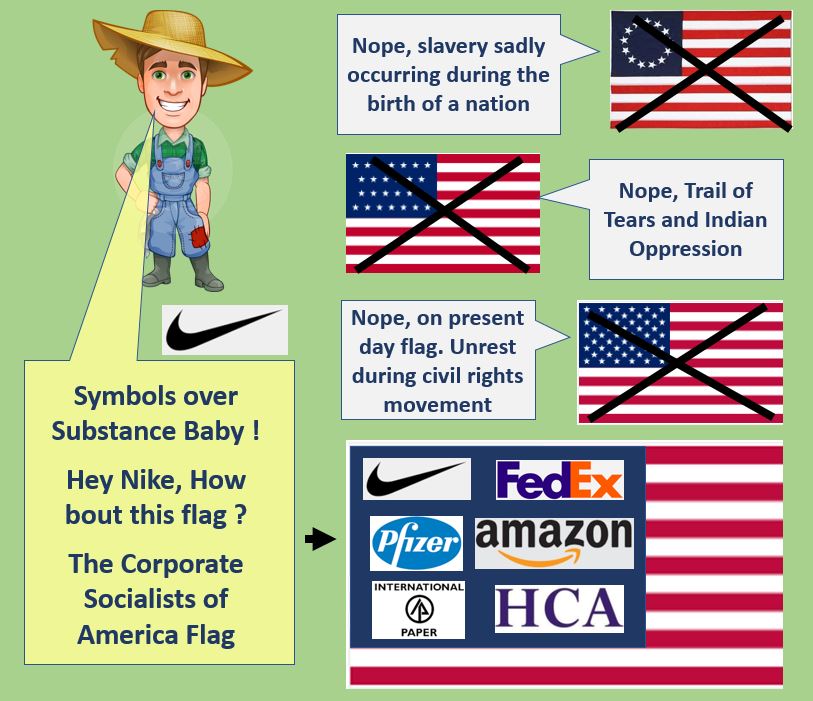

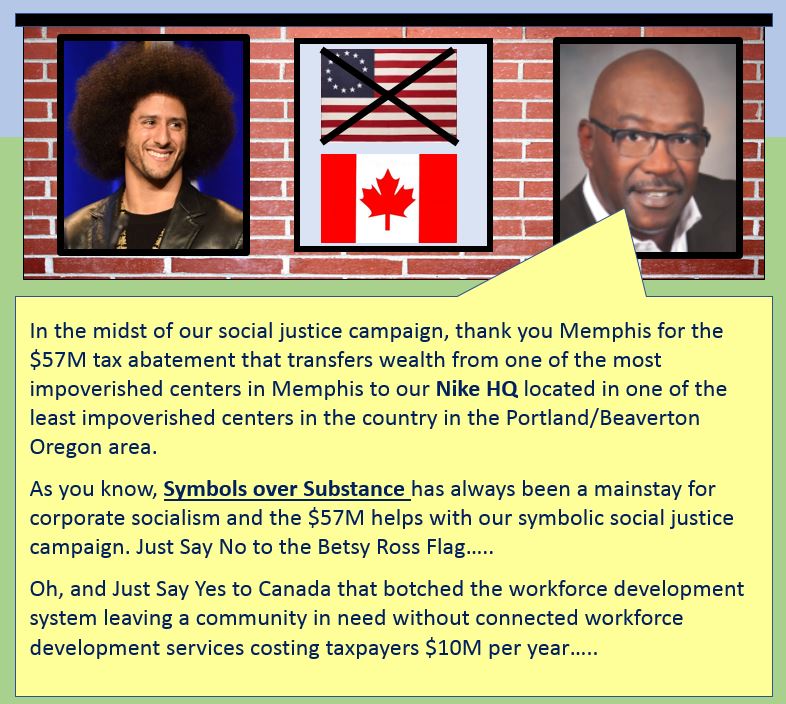

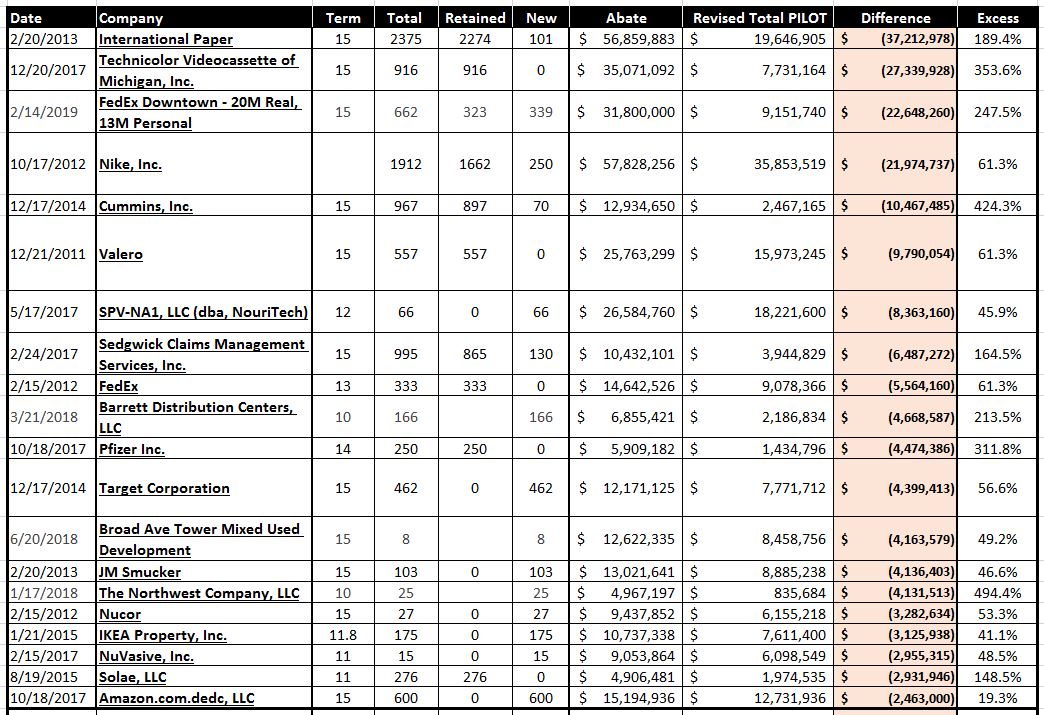

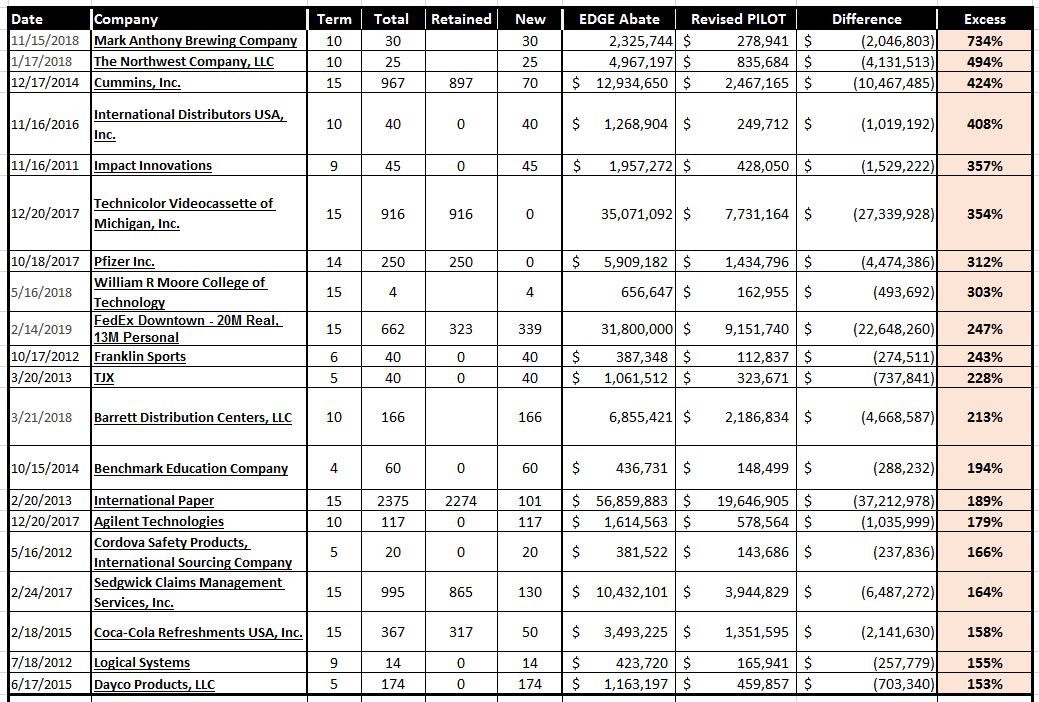

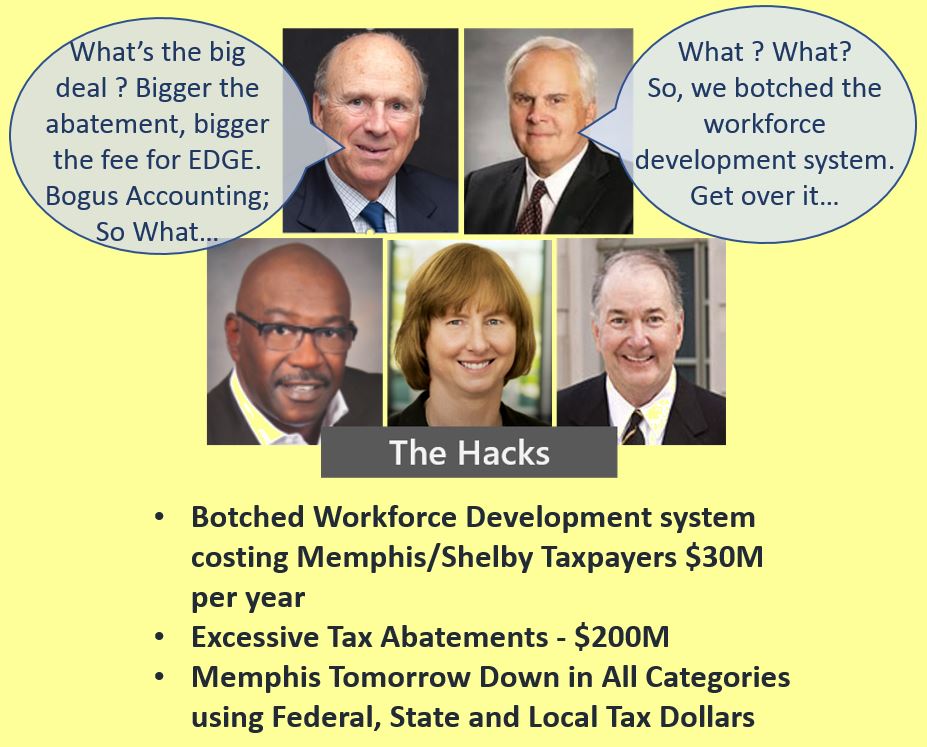

Can the State take back over the University of Memphis Board of Trustees ? I think it would provide a degree of local independence in matters of local research that would call into question Memphis power centers. Its stunning to see the complete lack of creativity and the just more of the same of the FedEx/Memphis Tomorrow complex assembled as Board under Brad Martin. Dr. Rudd said he answers to the Board. That’s the problem in Memphis. Everyone answers to hack FedEx/Memphis Tomorrow complex…..