The Elitist Memphis Tomorrow complex stifles commerce through a lack of transactions with locally owned small businesses. And this is especially detrimental to the Black business community. With a 54% Black Shelby County population, increasing transactions with locally owned Black businesses is paramount to countywide economic survival.

Instead of increasing local transactions, the elitist put local firms on the non-profit hamster wheel of meeting space, business planning, expos and certifications. None of this is required to increase transactional velocity with small business. The elitist hamster wheel was eluded to in Jason Bolton’s excellent Memphis Business Journal (MBJ) piece.

Further, the former occurs, as the elitist hijack MWBE programming originally designed for supporting small businesses on the margin. This works for those getting hefty corporate/real estate incentives that just want the convenience of dealing with the type of firms they always have.

And that’s not the mention, the leading MWBE connector, in the Mid-South Minority Business Continuum only works with established companies with second layers of management and institutional processes. Stunning….

The elitists are wreckers of commerce. Through their hamster wheel, they dismiss locally owned small business, botch the workforce development system and award themselves lavish corporate/real estate incentives while public measurement goes out the window. Can’t make this stuff up.

Commerce Off Generally and Black Business

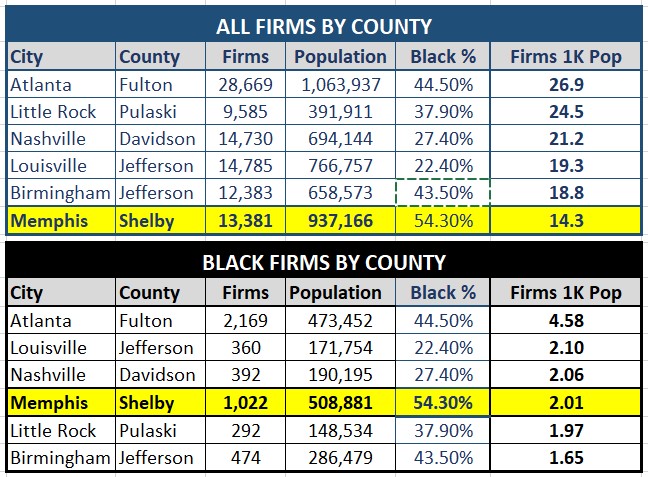

Commerce is off generally in Memphis and Shelby County with 14 business firms per 1K of population. Using the same census data source used by the MBJ, but using countywide data for the same peer cities, Shelby County locally owned firms with employees, per 1K population, dramatically trails the peer group.

With a peer leading 54% black population, building Black business is vital to Shelby County’s economic survival. See below data tables:

Conclusion

Reform and rigorous oversight is needed for MWBE programming involving recipients of excessive corporate/real estate incentives. Given the results, MWBE requirements to justify future tax incentive awards needs to end.

At the same time, dramatic incentive reform is needed to address the public structural revenue problem which will also provide local government funds to directly administer MWBE/LOSB programming for those small businesses that really need it.

But even the above won’t come close to addressing the need. The real solution will come with just transacting locally outside of government programming….