What might an independently active area University do to propel economic development? Well, they might compare total wage growth to peer cities while evaluating economic policy incentives. Or, they might advocate for a research based and measurable definition of economic development. Or, they might benchmark local taxpayer funded incentives against another Tennessee city to inform right sizing tax incentives. Or, they might advocate in legislative chambers for their thoughtful policy pronouncements that dampen the importance of incentives for optimal economic and connected workforce development policy for all while promoting local small business.

And then again, an independent University of Memphis (U of M) might deploy their investigative journalism unit to expand on bogus projection accounting used to justify excessive corporate/real estate incentives for the benefit of the small few. But unfortunately, that is not what we have with the U of M. The U of M is merely an extension of the FedEx/Memphis Tomorrow devolutionary community leadership complex through their corporate controlled Board of Trustees.

Dr. David Rudd said he reports to his FedEx/Memphis Tomorrow complex Board of Trustees. That’s the problem. Everyone in Memphis seems to report to the FedEx/Memphis Tomorrow complex hacks and its not working ! The former State Board framework that affords the U of M more independence in local research while allowing for the questioning of Memphis power centers, would be far better for the community.

Worst and Best PILOTs

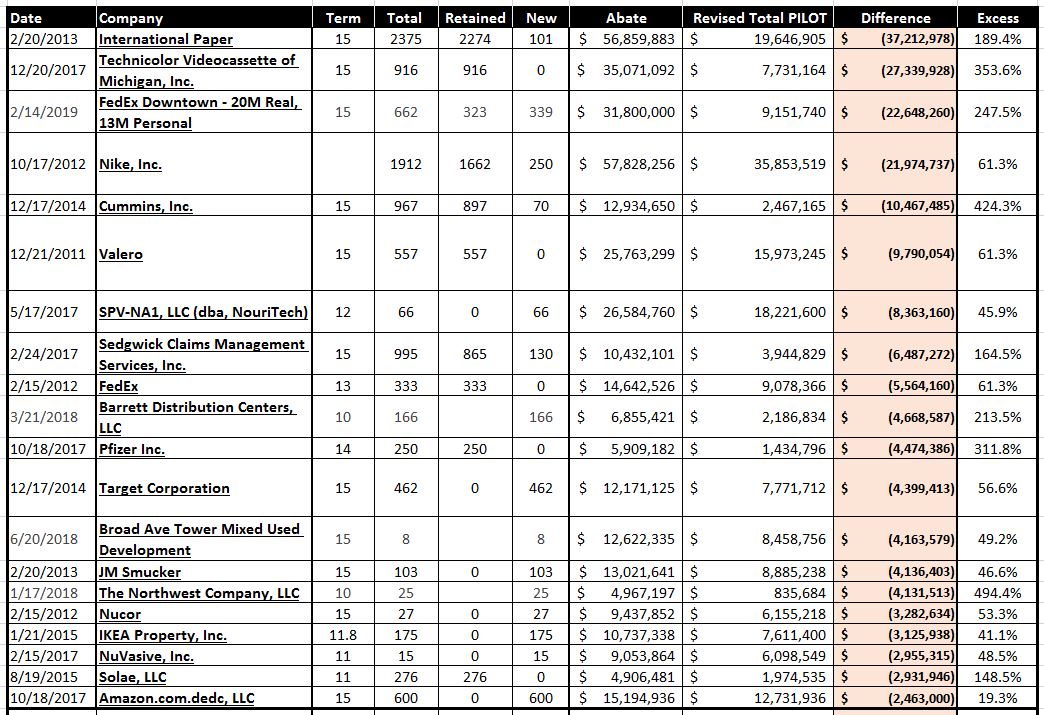

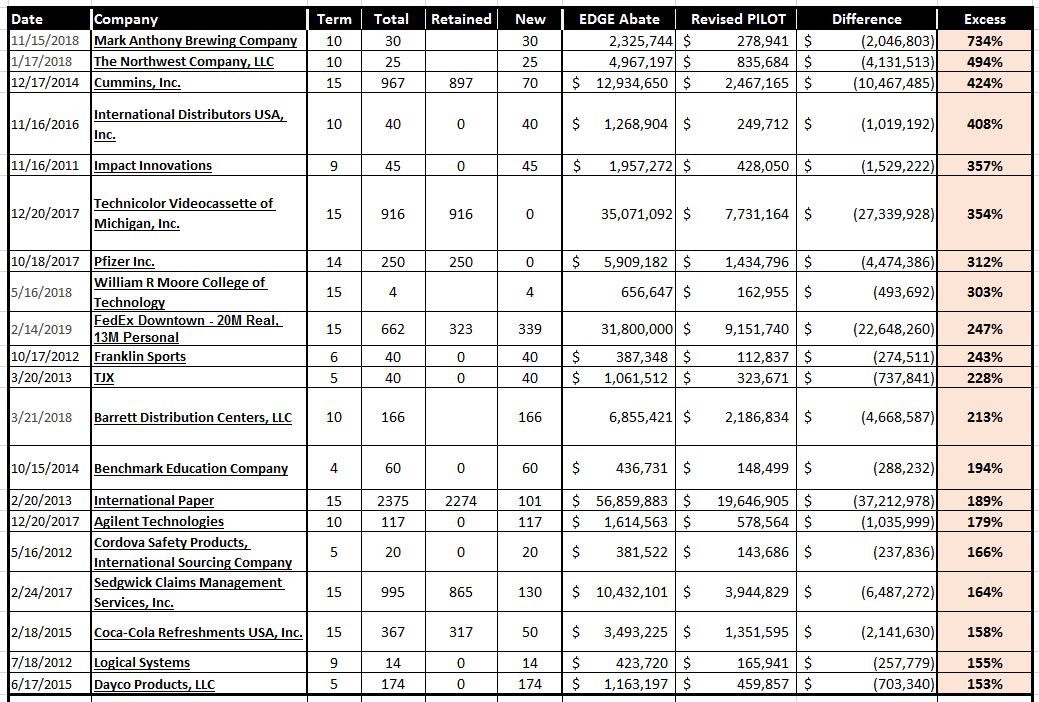

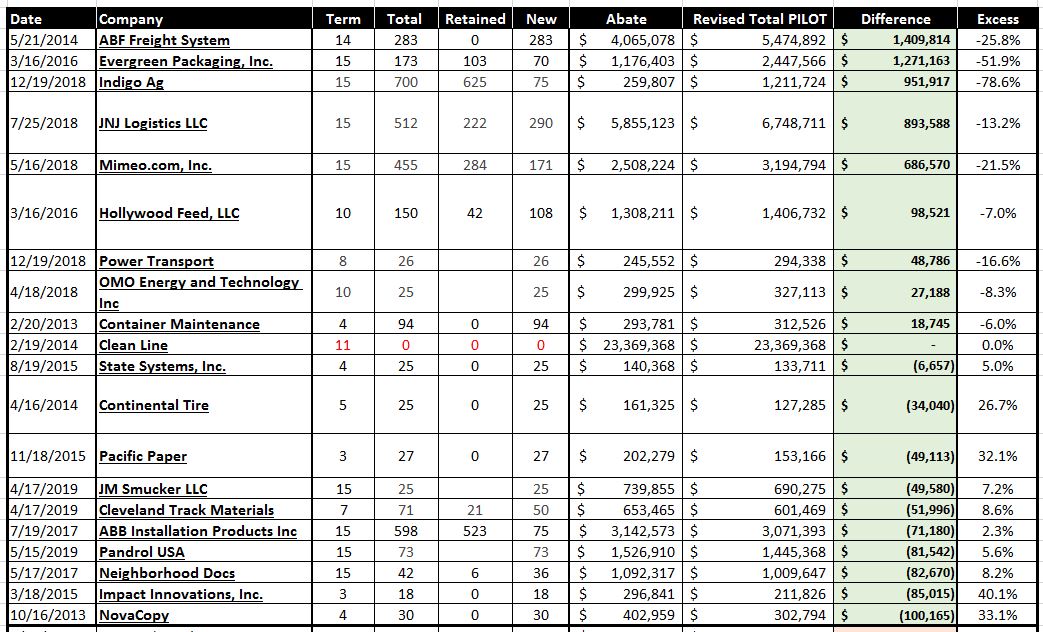

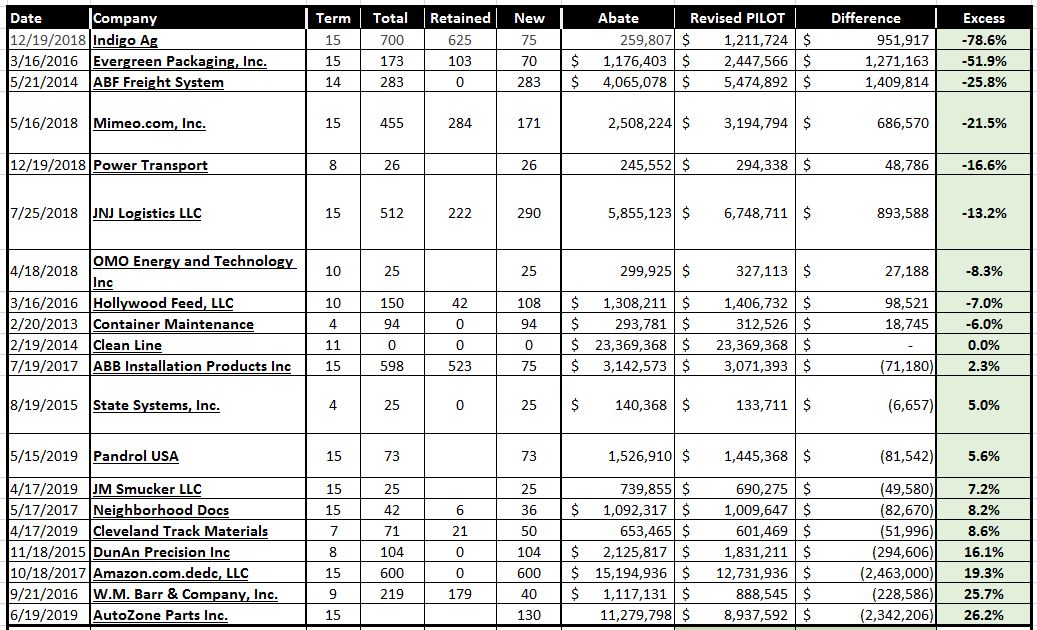

Given this institutional gap and lack of check in the Memphis ecosystem, this blog reviews corporate/real estate incentives. The following tables rank the worst and best PILOTs based on a benchmarking standard against Nashville. The discussion on economic development incentives has been wrongly framed by the local press around all or none as opposed to questioning excessiveness. Excessive in the below table is determined by the benchmarking contained in this blog and the application of a formula that would right size PILOTs based on the benchmarking.

The proposed PILOT formula applied is 50% of property taxes abated on new capital investment when current jobs levels are maintained and 1% for total wages for new jobs only while maintaining EDGE capital investment and term requirements. The amount in the “Revised Total PILOT” applies the above formula which in effect makes PILOTs more than twice the actual amount awarded on a per job basis than Nashville and still more than Nashville when Nashville property tax rates are converted to higher Memphis/Shelby tax rates.

Then the “Revised Total PILOT” amount is subtracted from the actual EDGE “Abate” award to arrive at the excess “Difference” amount and “Excess” percentage difference. When this model is applied, all 91 approved EDGE PILOTs are still awarded at a total of $309M down from $529M which quantifies some $220M in excessive incentives. It should be clear for readers of this blog that an end to all tax incentives is NOT being advocated here, but what is being advocated is lower more responsible incentives overall.

TOP 20 WORST PILOTS IN EXCESS AMOUNT TERMS

TOP 20 WORST PILOTS IN PERCENTAGE TERMS

BEST PILOTS IN AMOUNT TERMS (Indigo Ag does not include DMC Parking Incentive)

BEST PILOTS IN PERCENTAGE TERMS (Indigo Ag does not include DMC Parking Incentive)