Per Evanoff, Electrolux may only be a bump in the road. Electrolux is only a bump in the road when compared to the cultural restraints of the closed FedEx/Memphis Tomorrow governed economic development complex that has successfully stifled economic growth for years. The closed system even culturally permeates local legislative bodies where, now, public proceedings regarding workforce development (Workforce Ad Hoc) have apparently been taken off the public calendar while morphing into “workgroups” that are not publicly promoted on the County Calendar.

This blog will examine the following:

- Cultural roots that result in a closed economic development system

- Examples of 1 sided corporate / real estate deals that sacrifice economic progress

- Data results of a closed economic development system

Rigged System

Electrolux is just the tip of the iceberg in a long list of overused and excessive 1 sided corporate/real estate deals to the disfavor of the Memphis/Shelby taxpayer. Supported by the rhetorical mantra of “economic opportunity for all’ corporate/real estate interests of the FedEx/Memphis Tomorrow complex choke off growth and vitality for a Memphis community in need.

From the top, the Memphis ecosystem is designed to decline through the implementation of 1 sided corporate/real estate deals as true economic development efforts that benefit all in public transit, workforce, small business and site development are dismissed in favor of excessive corporate/real estate incentives for the small few. Connected workforce development efforts have been obstructed over four years by the FedEx/Memphis Tomorrow economic development complex on the back of a foreign contract award at an estimated recurring annual taxpayer shortfall of $10-15M.

While the unfortunate Electrolux outcome gets the headlines, the big untold story is the systemic design of ecosystem decline by the FedEx/Memphis Tomorrow complex that dismisses entire population segments for the benefit of the small few. Both technical and cultural underpinnings of the economic development system, result in a closed rigged Crump system of the 1940’s that does not course correct for community benefit while using federal, state and local tax dollars.

The founders of both FedEx and Memphis Tomorrow were raised during the times of the closed Crump Machine. A closed rigged culture still persists in Memphis which smothers economic progress. The lack of course correction, non-reporting press and legislative oversight underwrite the rigged condition – as the Crump Machine like Memphis Corporate Community Leadership complex that consists of FedEx/Memphis Tomorrow, Chamber and EDGE goes largely unchecked in the work of economic development.

The lack of course correction by the corporate elite in favor of decline is what proves a rigged state of affairs in Memphis while preserving at all cost the same social construct of economic development players. At the same time, if 1 sided corporate/real estate deals worked for the benefit of the Memphis ecosystem, it would show up in the data. The following sections will discuss 1 sided corporate/real estate deals, dismissed economic development work to the detriment of all and the outcome data associated with those choices.

One Sided Deals

The following are bi-products of the FedEx/Memphis Tomorrow system and serve as an inexhaustive example listing of 1 sided corporate/real estate deals and dismissed economic development work for a Memphis community in need:

Electrolux deal resulted in $188M in total incentives and $100M in local incentives that did not protect the taxpayer.

EDGE retention PILOT program that went unchecked over 8 years abating taxes 20 local operations while using incomplete bogus accounting to justify excessive incentives against the existing tax base. EDGE realizes existing revenue as a $600M gain while abating taxes against existing revenue. In reality, abating taxes against existing revenue results in an estimated $200M taxpayer loss when complete accounting is applied. The Beacon Report of Tennessee also provides a reference regarding this bogus practice that goes unreported by the local press and unchecked by local legislative bodies.

Epicenter nonprofit request of a $20M investment of local government pension funds as FedEx invests $10M. Given the size of FedEx’s $24B pension fund, the appropriate FedEx investment would be $144M. This is an example of a 1 sided corporate deal that threatened to raise the risk profile of government retirement fund by an inordinate amount compared to raising the risk profile of the FedEx retirement pension fund. The FedEx/Memphis Tomorrow complex has traditionally supported a web of nonprofits while the local business culture does not support transacting with small business. The Epicenter ask comes before even a simple ad campaign that would advocate for local small business support.

Residential PILOTS that are only permitted in Shelby County in all of the State of Tennessee, when locally implemented by EDGE, allowed developers to benefit nearly twice as much as Memphis/Shelby taxpayers from residential PILOTs while walking away with $19M in abatements. That is $19M more than developers would have received in any of the other 94 counties in the State of Tennessee. At any rate, it seems Memphis/Shelby taxpayers should have benefitted as much as the developers.

Poplar TIF – Awarded tax increment financing to the most affluent area of the City on the baseless claim that it would create 7,000 jobs.

Mark Anthony EDGE PILOT, approved in November 2018, that abates $2M in existing taxes resulting in a $500K taxpayer loss as EDGE rewards themselves with $51K in fees. This shows that EDGE is incented to conduct transactions for the company while not representing the taxpayer. Close examination of the project summary reveals that the EDGE Board did not follow their own rules by applying the “Tax Incentive Eligibility Analysis” which would have resulted in the $2.3M total abatement being reduced by $1.2M.

One sided corporate/real estate deals are a hallmark of the closed FedEx/Memphis Tomorrow economic development complex which leave Memphis further behind in a global economy that is largely cradled in Memphis, Tennessee.

True Economic Development Dismissed

The deficient Memphis Corporate Community Leadership complex dismisses entire Memphis population segments by neglecting the following core areas of economic development which hurts the overall business community to include small business.

Disconnected workforce development efforts through a lack of course correction and on the back of a foreign contract award that under-served 60,000 learners over a 4 year period. This results in a recurring estimated Memphis/Shelby taxpayer loss of $10-15M

Lack of advocated Memphis Corporate Community Leadership funding solution for adequate transit, 2 years following the release of the Transit Study that identified lack of funding as the primary obstacle to adequate public transit.

Lack of site development activity handcuffs industry recruitment

Dismissed taxpayer funded economic development work when accompanied by 1 sided corporate/real estate deals is a design for decline.

Outcome Data

If 1 sided corporate/real estate deals and the dismission of entire population segments through neglected economic development worked, then it would show up in the outcome data. The following shows the impact of deficient economic development policy and work on a Memphis community in need.

The Memphis Tomorrow CEO organization is down in all of their chosen categories of public safety, workforce and economic development while their initiatives use federal, state and local tax dollars. The Memphis/Shelby tax revenue shortfall is estimated to be $124M in recurring Memphis/Shelby tax revenue shortfalls

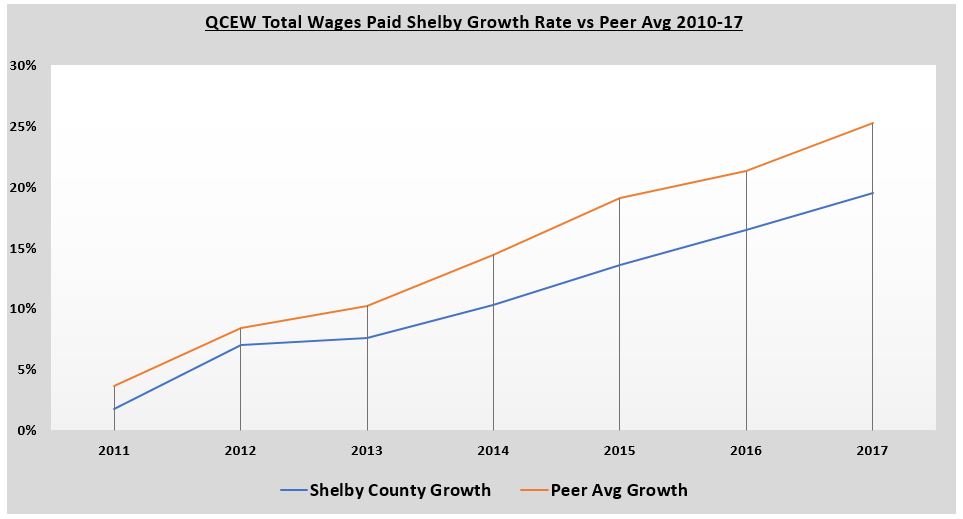

The below chart shows Memphis/Shelby percentage total wage growth compared to the average of Shelby County peers. Shelby County total wages paid growth rate trails the average of its peers by approximately 7% with 21.15% total wage growth since 2010-17. Shelby County peers had an average growth rate of 28.18%. Had Shelby County had average growth of 28.18% total wages paid would have been $1.57B higher annually in Shelby County with Memphis and Shelby County tax revenue being approximately $47M higher on a recurring annual basis than it is today. The tax shortfall is derived by using calculations informed by EDGE. The graph below shows the gap between Shelby County’s total wage growth rate and the average of its peers accelerating at a rate of 1% which equates to approximately $250M in total wage deficiency and $7.5M in additional tax revenue shortfalls per year. The data is sourced from the Bureau of Labor and Statistics Quarterly Census of Employment Wages.

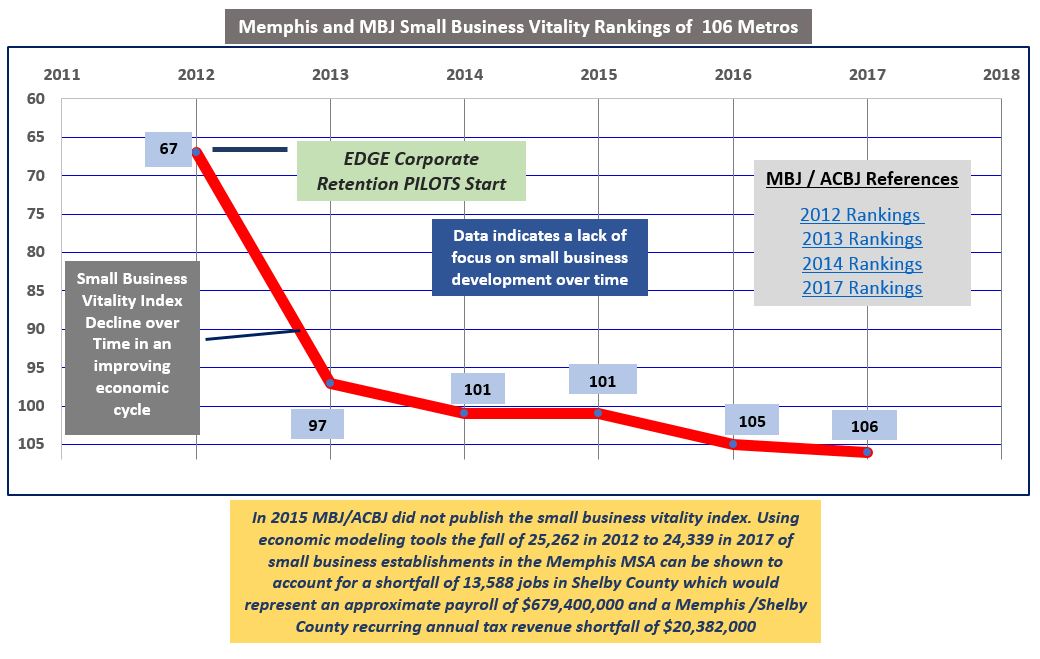

The below graph shows the impact of 1 sided corporate deals and dismissed economic development on the small business sector using the small business vitality index of the American Cities Business Journal who is the parent of the Memphis Business Journal.

A small business vitality index was not published in 2015 so the 101 ranking of 2014 was assumed. This trend line graph is concerning because typically local economic growth comes mostly from small business. Local small business is less likely to demand tax incentives while further diversifying the local economy. In this Good Jobs First – Small Business study, small business believes excessive incentive programs strain the tax base and compromise community wide services that support small business growth. The following ACBJ links provide the data sources for the below graph with the 2016 rankings contained in the 2017 rankings link: 2012 Rankings 2013 Rankings 2014 Rankings 2017 Rankings.

Conclusion

Given the outcome data and in comparison to Memphis/Shelby peers, Electrolux is just a bump in the road when compared to the closed economic development system of Memphis that favors the small few over economic growth for all. Small business and workforce development appear to be the primary challenges which will require culture change from the top to realize the potential of Memphis for the benefit of customer taxpayers.

In the meantime, Memphis/Shelby taxpayers are saddled with the same closed social construct of economic developers that starve out small business, obstruct needed workforce development services and kick members out of the Greater Memphis Chamber without cause while rhetorically championing “economic opportunity for all”. The former occurs as economic development efforts seem to strangely revolve around endless planning efforts, sloganism and pageantry while being divorced from any type of data supported reality.

Sadly, culture change will only occur with the support of activism that questions the status quo. This will not sit well with the FedEx/Memphis Tomorrow complex that, on balance, demands positivity regarding the past, which dodges accountability, while asking taxpayers to trust them with their tax dollars for a better tomorrow while having consistently delivered deficient results….

About This Site – Memphis Corporate Community Leadership (MCCL) Measured

With a special focus on Memphis Tomorrow, MCCL Measured is the first ever and exclusive tool to attempt to measure the effectiveness of Memphis Corporate Community Leadership efforts that use taxpayer money. The site is designed to facilitate financial literacy education regarding taxpayer funded initiatives. Additional videos and resources can be found by browsing the entire site or at http://mcclmeasured.net/resources .