Commissioner Mick Wright’s recent policy blog is recommended reading for taxpayers. Instructive for all, Wright relates, in layman terms, the County budget to the household budget by clearly defining County property tax revenue as income, the County general fund balance as a savings account and County debt as a credit card.

Through the welcome use of data and focused on spending management, Wright further proposes a conservative approach in addressing Shelby County’s current budget challenge. While admirable and data supported, Wright unfortunately ignores Shelby County Government’s structural revenue problem.

Currently and perhaps unknowingly, both “progressive” and “conservative” Commissioners are following the “government efficiency” policy script of the Memphis Tomorrow public – private complex. The script is that of cutting both public expenditures and tax revenues through excessive and fiscally liberal economic development incentives. Cutting and managing spending works in budget development, but not alone, in the face of a structural revenue problem.

A structural public revenue problem exists when improving economic conditions will not solve the budget problem. In Memphis, solving the budget problem requires a policy restructuring that ignores the script of Memphis Tomorrow.

Commissioner Wright and other Commissioners could perhaps serve their budget review, with a categorical breakout of historical property tax revenues, coming from residential and commercial property taxes. Current or historically published County budget documentation do not break out property tax revenue by category.

In this way, Commissioners could see that promised economic development, following the Memphis Tomorrow “government efficiency” policy script, is not working for resident taxpayers. This concern was recently revealed in Orange Mound, where falling residential property values got the attention of former County Commissioner and now County Assessor Melvin Burgess.

Correcting years of misdirected economic development efforts, requires a policy intervention in support of Shelby County taxpayers, while getting the Memphis Tomorrow elephant out of the room.

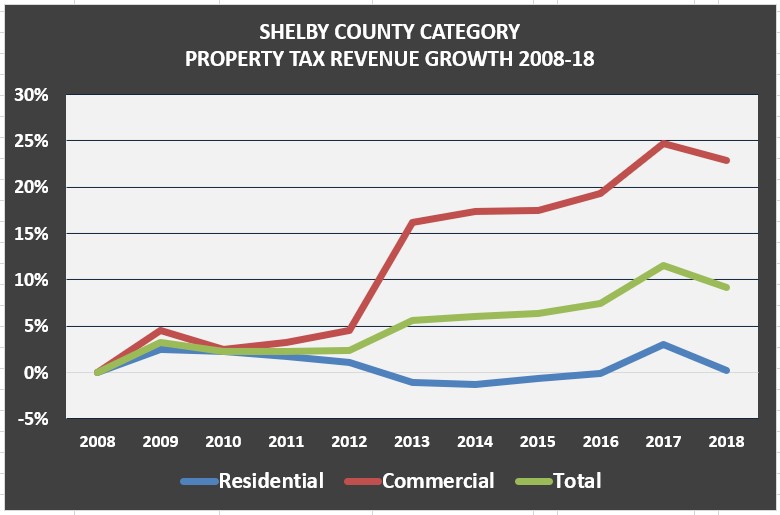

The Structural Revenue Problem Revealed

The above chart breaks out Shelby County property tax revenue growth by residential, commercial and total property tax revenue categories. The data was obtained through a County public information request on June 7, 2019. Only the revenue data in the linked spreadsheet was obtained from the County, with the percentage analysis and combined commercial tax revenue column constructed by MCCLM.

Over a period of 10 years, the above chart reveals, that Shelby County residents are not participating in local economic development, as expressed through increased home values that drive higher property tax revenue. EDGE uses increased residential tax revenue, that occurs from projected wage growth, as part of their justification for abating commercial real estate taxes. But residential property tax revenues are not increasing, while excessive corporate/real estate tax abatements roar for the benefit of the small few.

Consequently, structural revenue problems result from 1) excessive corporate/real estate tax abatements and 2) deficient economic development as evidenced by flat residential property tax revenue.

Based on an analysis using requested Shelby County public information, Downtown Memphis Commission (DMC) and EDGE data referenced in previous blogs, the following conclusions result:

Residential property tax revenues grew annually at .02% and .2% over 10 years

Commercial property tax revenues grew annually at 2.29% and 22.9% over 10 years

Total property tax revenue grew annually at .92% and 9.2% over 10 years

EDGE/IDB revenue projections includes an estimated $165M increase in County residential property tax revenue or approximately $16.5M per year. This would equate to roughly a 4.0% increase in annual County residential property tax revenues as compared to .02% that was achieved per year and 82K per year.

EDGE and DMC tax abatements, when benchmarked against research and other cities, are $25M per year in excess for County government alone, resulting in an accrued public County policy debt of approximately $300M.

Excessive abatements and economic development, that did not materialize, result in a structural Shelby County revenue problem/shortfall in excess of $50M per year when considering all tax revenue sources beyond just property taxes. The above conclusion is further informed by lagging and below average wage growth and employment growth that stem from disconnected workforce development efforts.

In the end, County budget solutions will need to solve both spending management and structural revenue problems through improved economic development.

Policy and Practice Solutions

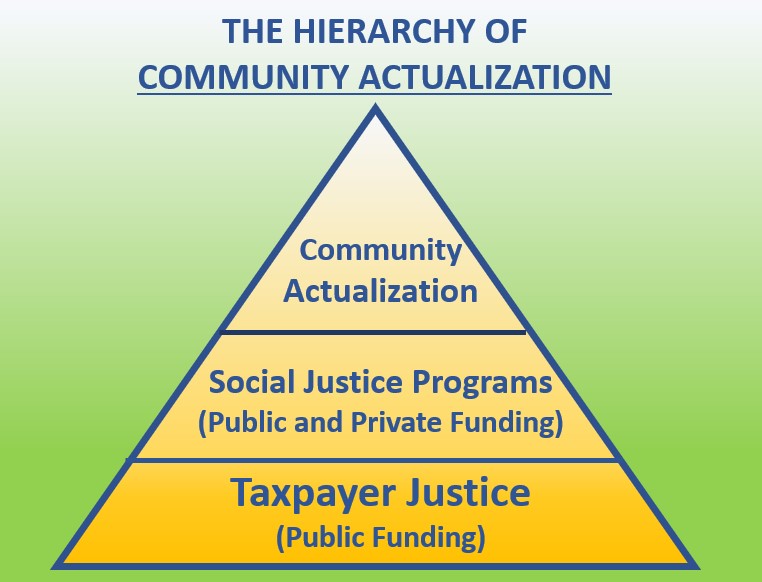

After acknowledging both spending and structural revenue challenges, convergent policy and practice solutions, for both progressives and conservatives, are as follows:

Smart budget cuts

Increase the property tax rate to fill the budget gap from years of excessive incentives and deficient economic development outcomes

Reform incentives in accordance with research while benchmarking against other cities and implementing the TIFNI measurement platform

Practice oversight of the public-private complex to insure publicly funded economic development work occurs for the benefit of taxpayers

Both progressives and conservatives have their roles to play in the current County budget process. There is plenty of work to go around…..