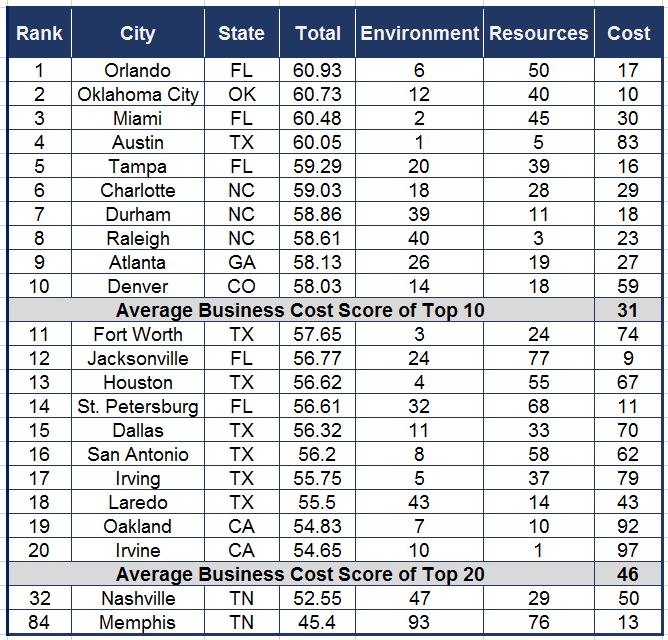

Based on benchmarking analysis, all the PILOTs on this week’s EDGE Board agenda are excessive. The most excessive involves the taxpayer nightmare of the FR8 project that abates $2.04M in taxes in exchange for a claimed revenue of $1.97M over 10 years. Problem is the project summary is claiming $372K in already existing property tax revenue as project revenue while abating $1.1M in existing property taxes.

Upon closer analysis and generously accepting EDGE analysis multipliers, the FR8 project as configured, generates $1.25M (not $1.97M) in tax revenue and abates $2.04M in taxes resulting in a $790K project deficit when more complete accounting is applied.

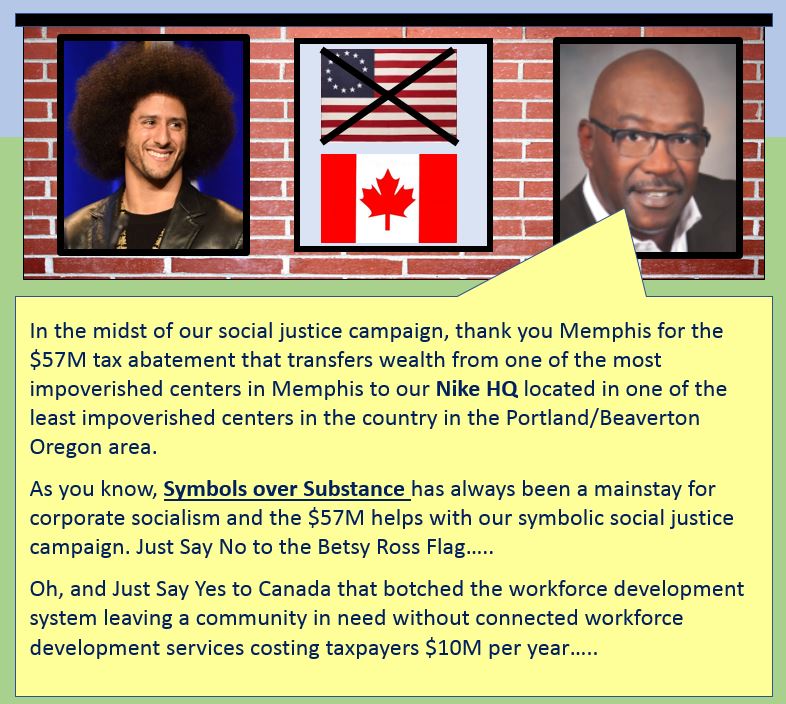

The question here with this abatement are taxpayers better off investing $1.1M in existing property taxes in other economic development activities like workforce or in another real estate deal to get low wage FR8 jobs ? Workforce development is the pain point in Shelby County not another real estate deal.

Right Sizing EDGE Abatements

Based on the previous benchmarking study that right sizes PILOTs while abating 50% taxes for new capital investment and 1 % wages for new jobs, the following revisions would occur:

FR8 – $750,000 down from $2,040,000 ($1,290,000 excessive abatement)

Patterson – $2,593,178 down $3,753,798 ($1,160,620 excessive abatement)

Grove Highland – $527,892 down from $763,200 ($235,308 excessive abatement)

Grove Southern – $294,106 down from $423,630 ($129,524 excessive abatement)

Conclusion

While collecting fee revenue for maximum abatement awards, total EDGE excessive abatement for the July 2019 meeting is $2,815,352. These excesses are not about economic development in an already low business cost operation environment when filling jobs trough improved workforce development is the #1 economic development challenge.